As a seasoned crypto investor with a keen interest in the behavior of Bitcoin and Ethereum, I’ve closely monitored their recent price movements and market trends. The current state of these two leading cryptocurrencies reveals distinct differences in their volatility levels, with Ethereum displaying sustained uncertainty compared to Bitcoin’s newfound stability.

As a researcher studying the cryptocurrency market, I’ve noticed some intriguing differences between the two leading assets, Bitcoin and Ethereum. While Bitcoin seems to be entering a more stable period, Ethereum’s behavior tells a different story. In particular, Ethereum’s options market is marked by ongoing uncertainty.

The significant disparity between Ethereum’s current price and investor expectations, as indicated by persistent elevated volatility in Ethereum option markets, suggests a hesitant stance towards the cryptocurrency’s potential price fluctuations among traders.

Ethereum Persisting Volatility: A Comparative Analysis

Implied volatility (IV) plays a significant role in the world of options trading, offering valuable insights into the anticipated price swings of an asset during a given timeframe. Essentially, IV represents the market’s collective perception of the asset’s future volatility, providing a temperature check on potential price fluctuations that traders anticipate.

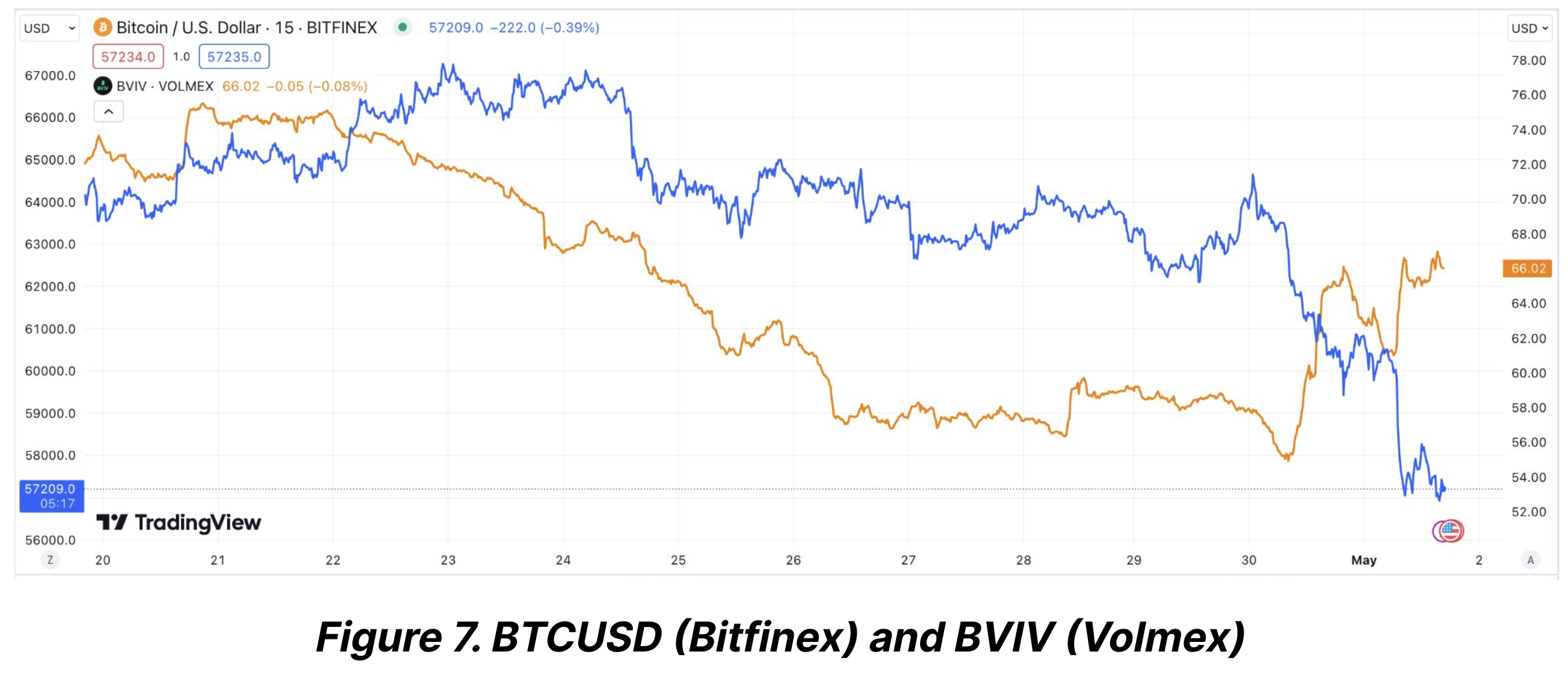

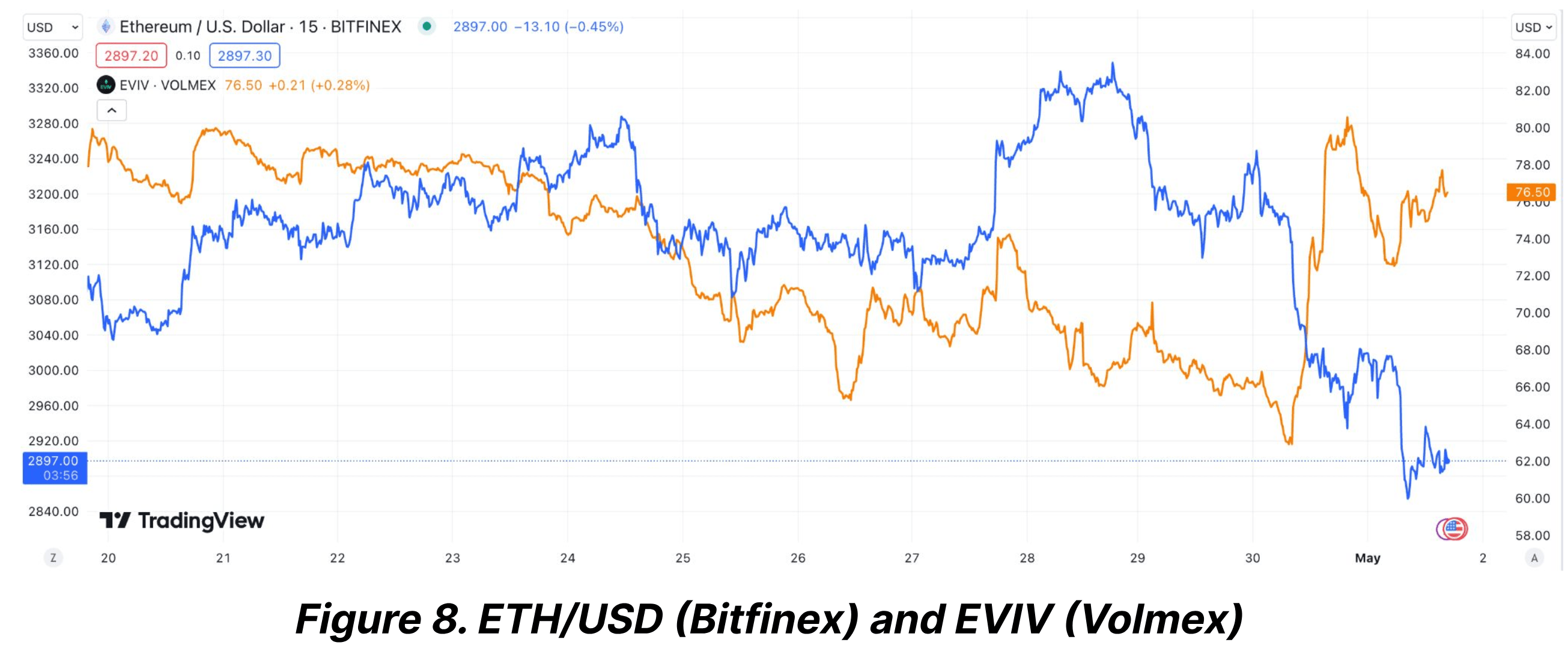

In recent studies, it has been observed that Bitcoin’s volatility, as implied by its volatility index (IV), has noticeably decreased following the halving event. This decrease suggests a more tranquil market for Bitcoin. On the other hand, Ethereum’s volatility index has remained high and unyielding despite the Bitcoin trend. In simpler terms, while Bitcoin’s market has become less volatile after the halving, Ethereum’s remains volatile.

In contrast to Bitcoin’s tranquil market conditions as indicated by a decrease in volatility from 72% post-halving to approximately 55%, Ethereum experiences increased volatility. (Data from Bitfinex Alpha Report)

In contrast, Ethereum experienced a more subdued decrease in its volatility level, going from 76% to 65%, during the same timeframe. The continuous volatility of Ethereum’s market is mainly driven by uncertainties surrounding major regulatory decisions and broader market implications that remain uncertain.

The Ethereum market is on edge as the US Securities and Exchange Commission (SEC) prepares to make a decision on two proposed Ethereum spot ETFs in May 2024.

As an analyst, I view this approaching regulatory development as a pivotal moment that has the potential to significantly impact market trends. It could lead to a surge in activity and price movements, or it might amplify the existing market fluctuations.

The Bitfinex Alpha analysis highlights that Ethereum’s decrease in Volatility Risk Premium (VRP) has been less pronounced than Bitcoin’s due to regulatory uncertainties.

ETH And BTC Show Signs of Recovery Amid Volatility

Over the last week, both Ethereum and Bitcoin have exhibited positive trends in their trading activities. Bitcoin experienced a growth of 4.1%, whereas Ethereum reported a more subtle advancement of 2.4%.

The past 24 hours have seen a minor setback for Ethereum, with a decrease of 0.7%. This serves as a reminder of the market’s instability and the cautious approach adopted by investors.

As a crypto investor, I’ve noticed that Ethereum’s network has been displaying lower activity levels recently, which is evident in the decreased ETH burn rate. This reduction can be largely attributed to the drop in transaction fees.

As a cautious Ethereum investor, I’m keeping a close eye on this technical aspect that could significantly impact our market. The potential for shifts is high, but it all depends on external regulatory actions. So, we need to stay informed and prepared for any potential developments.

In spite of the present volatile market conditions, some analysts like Ashcrypto are optimistic. They believe that this volatility could pave the way for a robust recovery in Ethereum’s price during the third quarter of this year. Looking to past trends, it’s plausible that Ethereum’s speculative value could reach the $4,000 threshold if market circumstances remain beneficial.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

2024-05-07 22:16