As a researcher with experience in analyzing cryptocurrency markets, I’ve closely monitored Ethereum’s price action and have formed an opinion based on the latest trends. The recent recovery wave of Ethereum above the $3,120 zone was impressive, but it failed to surpass the $3,220 resistance.

As a crypto investor, I’ve noticed Ethereum‘s price bouncing back and breaking above the $3,120 mark. However, my hopes of seeing Ethereum surpass the $3,220 resistance were dashed as the price has since retreated, shedding some of its recent gains.

-

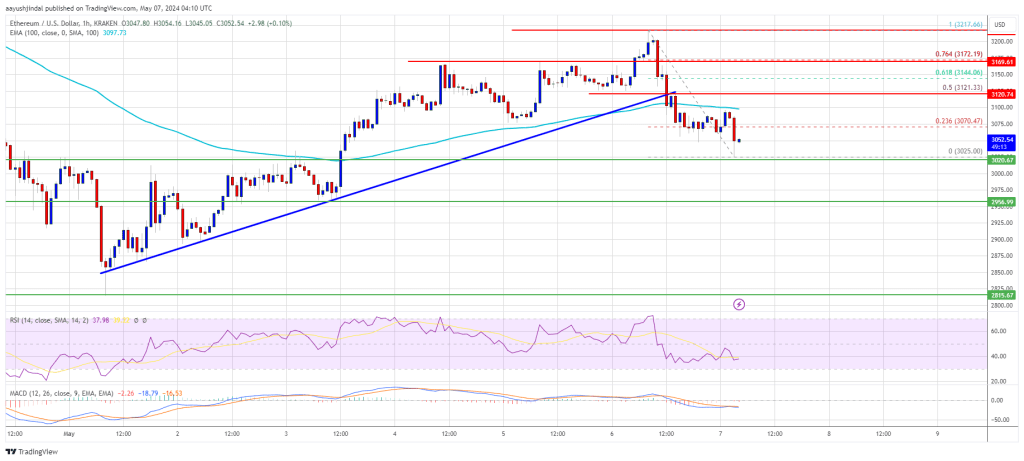

Ethereum climbed further above the $3,150 and $3,200 levels before the bears appeared.

The price is trading below $3,120 and the 100-hourly Simple Moving Average.

There was a break below a major bullish trend line with support at $3,120 on the hourly chart of ETH/USD (data feed via Kraken).

The pair must stay above the $3,020 support to start another increase toward $3,220.

Ethereum Price Dips Again

As an analyst, I’ve observed that Ethereum’s price surged past the $3,150 and $3,200 thresholds, similar to Bitcoin‘s trend. The cryptocurrency reached a peak at $3,217 before encountering resistance in the $3,220 zone, ultimately triggering a correction.

As a researcher studying the ETH/USD market, I observed a significant drop in price below the $3,150 mark. The bears managed to push it down further, breaking through the crucial support level at $3,120 on the hourly chart. Additionally, there was a notable breach of a major bullish trend line that had previously provided support at $3,120. The pair then approached and tested the resistance zone around $3,025.

At a price of $3,025, a low point was reached and the market is currently in the process of regrouping after incurring losses. Ethereum’s value sits beneath $3,120 and falls short of the 100-hour Simple Moving Average. The next level of resistance can be found at around $3,070 or the 23.6% Fibonacci retracement mark of the recent slide from the peak of $3,217 to the trough of $3,025.

As a researcher studying market trends, I’ve identified two significant resistance levels for Bitcoin’s price movement. The initial resistance lies around $3,120 or the 50% Fibonacci retracement mark of the recent downtrend from $3,217 to $3,025. If Bitcoin fails to break through this barrier, it may face further declines. However, if the price manages to surmount this hurdle, the next resistance sits at $3,170. Overcoming this resistance could pave the way for a potential uptrend toward $3,220.

Should the bulls continue to drive up the price past $3,220, there’s a possibility of a gradual progression towards the $3,350 resistance level. Further advancements might propel Ether towards the $3,500 resistance region.

More Losses In ETH?

Should Ethereum be unable to surpass the $3,120 mark of resistance, there’s a risk of another drop. A preliminary cushion from declines can be found around $3,025. The primary support lies in the vicinity of the $3,000 region.

The price is currently being held up by a significant support level around $2,950. If this level gives way and the price falls below it, we could see further declines towards $2,820. Should the price continue to weaken, it may eventually reach the near-term support at $2,650.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 level.

Major Support Level – $3,025

Major Resistance Level – $3,120

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-05-07 07:34