As a researcher with extensive experience in the blockchain and cryptocurrency space, I find Polkadot’s (DOT) impressive progress in Q1 2024 noteworthy. The Messari report underscores substantial growth in market capitalization, XCM activity, and daily active addresses.

As an analyst, I’ve reviewed the Messari report, and I can tell you that Polkadot (DOT) made noteworthy strides during Q1 of this year. The blockchain protocol experienced a substantial growth in market capitalization, revenue generation, and Cross-Consensus Message Format (XCM) activity. Additionally, there was an unprecedented surge in daily active addresses on the network.

DOT’s Market Cap Surges 16% QoQ

As an analyst, I’ve noticed some significant growth in Polkadot’s market capitalization during Q4 2023. It underwent a substantial increase of 111% compared to the previous quarter, reaching a impressive figure of $8.4 billion. This momentum carried over into Q1 2024, where I observed yet another rise of 16%, bringing the circulating market cap up to a remarkable $12.7 billion.

Although DOT has made significant strides, its market capitalization is still only 80% of its previous record-high value of $55.5 billion, which was reached on November 8, 2021.

In the fourth quarter of 2023, Polkadot’s income experienced a remarkable jump of approximately 2,880% compared to the previous quarter. This significant growth translated to around $2.8 million in revenue. According to the report, this notable rise was mainly due to a steep upward trend in extrinsics, which were fueled by Polkadot Inscriptions.

Despite a notable decrease, Q1 2024 revenue figures for us showed a 91% drop in USD terms and a 92% decline in DOT terms compared to the previous quarter. It is important to mention that our revenue typically ranks lower than that of our competitors due to Polkadot’s unique network design.

As a crypto investor, I’ve noticed an impressive surge in Polkadot’s XCM activity during the first quarter of 2024. The number of daily XCM transfers jumped by 89% compared to the previous quarter, reaching approximately 2,700. Moreover, non-asset transfer use cases or “XCM other,” experienced a substantial increase of 214%, averaging around 185 daily transfers.

As a researcher studying the XCM network, I’ve discovered that the daily message volume experienced a significant increase of 94% quarter over quarter (QoQ), reaching a total of 2,800 messages. This growth underscores the network’s vibrant and ever-evolving ecosystem. Furthermore, I noted that the number of active XCM channels expanded by 13% QoQ, amounting to a grand total of 230 channels.

Polkadot’s Parachain Network Soars To New Heights

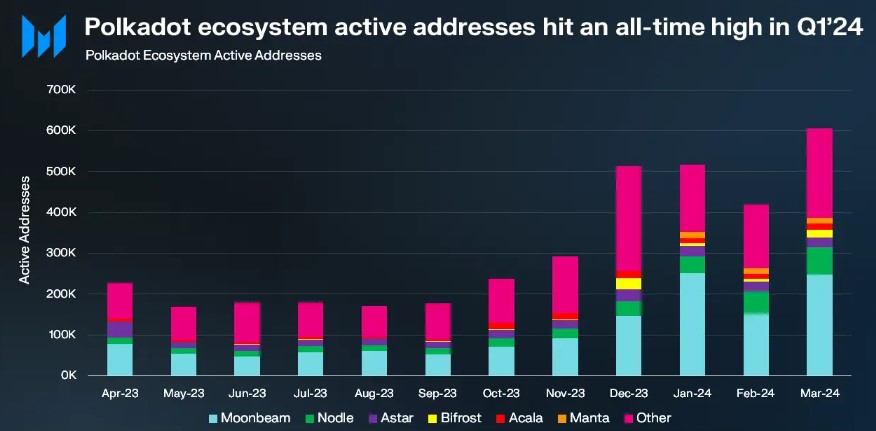

In Q1 2024, Polkadot’s parachains experienced a noteworthy beginning to the year as the number of active addresses hit an all-time record high of 514,000, showing a considerable increase of 48% compared to the previous quarter.

Among all parachains, Moonbeam took the front seat with approximately 217,000 monthly active addresses, marking a substantial 110% rise compared to the previous quarter. Nodle came in second place, boasting around 54,000 monthly active addresses – more than doubling from the preceding period.

On the contrasting side, Astar saw a modest quarter-over-quarter expansion of 8%, bringing its number of active addresses to 26,000. In comparison, Bifrost Finance witnessed a slight increase of 2% QoQ, amounting to 10,000 active addresses. However, Acala underwent a decline, with monthly active addresses dropping to 13,000 – a decrease of 16% QoQ.

In Q1 2024, the Manta Network distinguished itself among other parachains with a remarkable rise in daily active addresses, numbering 15,000. This growth was driven primarily by the successful token generation event (TGE) for MANTA and its subsequent listing on Binance, leading to an elevated Total Value Locked (TVL) of over $440 million for Manta.

Polkadot Price Sees Upside Potential Ahead

From a pricing standpoint, the native token DOT of Polkadot bounced back with renewed buying interest after experiencing a significant decline to $5.8 – a level last seen since February – following its peak price of $11 on March 14th.

As an analyst, I’ve observed that DOT has bounced back and reached the $7.25 mark, representing a 7% increase in value over the last week. However, it’s important to note that the trading volume for DOT has seen a slight decrease of approximately 4.7%, resulting in around $320 million worth of transactions within the past 24 hours based on data from CoinGecko.

As a crypto investor, I’d say: If the bullish trend continues for Polkadot, the first significant hurdle lies at the $7.4 mark. This level has previously acted as a barrier to entry, making it an important resistance point. Should we overcome this obstacle, the next target could be the $8 resistance level.

The past two days this week have seen the price hold steady at the $6.4 support level, indicating its importance as a potential catalyst for further gains in the token’s value.

Read More

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Gold Rate Forecast

- POPCAT PREDICTION. POPCAT cryptocurrency

- Who Is Stephen Miller’s Wife? Katie’s Job & Relationship History

- The Righteous Gemstones Season 4: What Happens Kelvin & Keefe in the Finale?

- Dig to Earth’s CORE Codes (May 2025)

- King God Castle Unit Tier List (November 2024)

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- What Is ‘Mama Dat Burn’ Meme on TikTok? Explained

- FBI Season 7 Episode 20 Release Date, Time, Where to Watch

2024-05-04 06:04