As an experienced analyst, I believe that Bitcoin’s recent price recovery is a promising sign for the cryptocurrency market. The bullish momentum returning after a week-long correction indicates that investors are confident in Bitcoin’s long-term trajectory.

The leading digital currency, Bitcoin (BTC), has recently regained its upward trend, surpassing the significant mark of $61,000 once more.

After a seven-day slide, the price took a hit, falling by 20% to reach $56,000 on Wednesday. With the bulls back in charge, there’s an increasing likelihood that we may see further challenges of resistance levels and a possible regain of lost ground.

Bitcoin Bulls Eye $68,000

Market analyst Justin Bennett posits that surmounting the $61,000 barrier could lead us to explore regions between $67,000 and $68,000. Nevertheless, this mark remains a formidable hurdle at present.

As a researcher studying the latest developments in the Bitcoin market, I believe that the recent price correction was an essential step for the cryptocurrency’s future growth trajectory.

As a researcher studying market trends, I’ve noticed that the price has revisited the significant support level of the 20-week Exponential Moving Average (EMA) at $56,700. Moreover, the return to indicator support zones like the Directional Movement Index suggests a healthy price consolidation, indicating potential stability in the market.

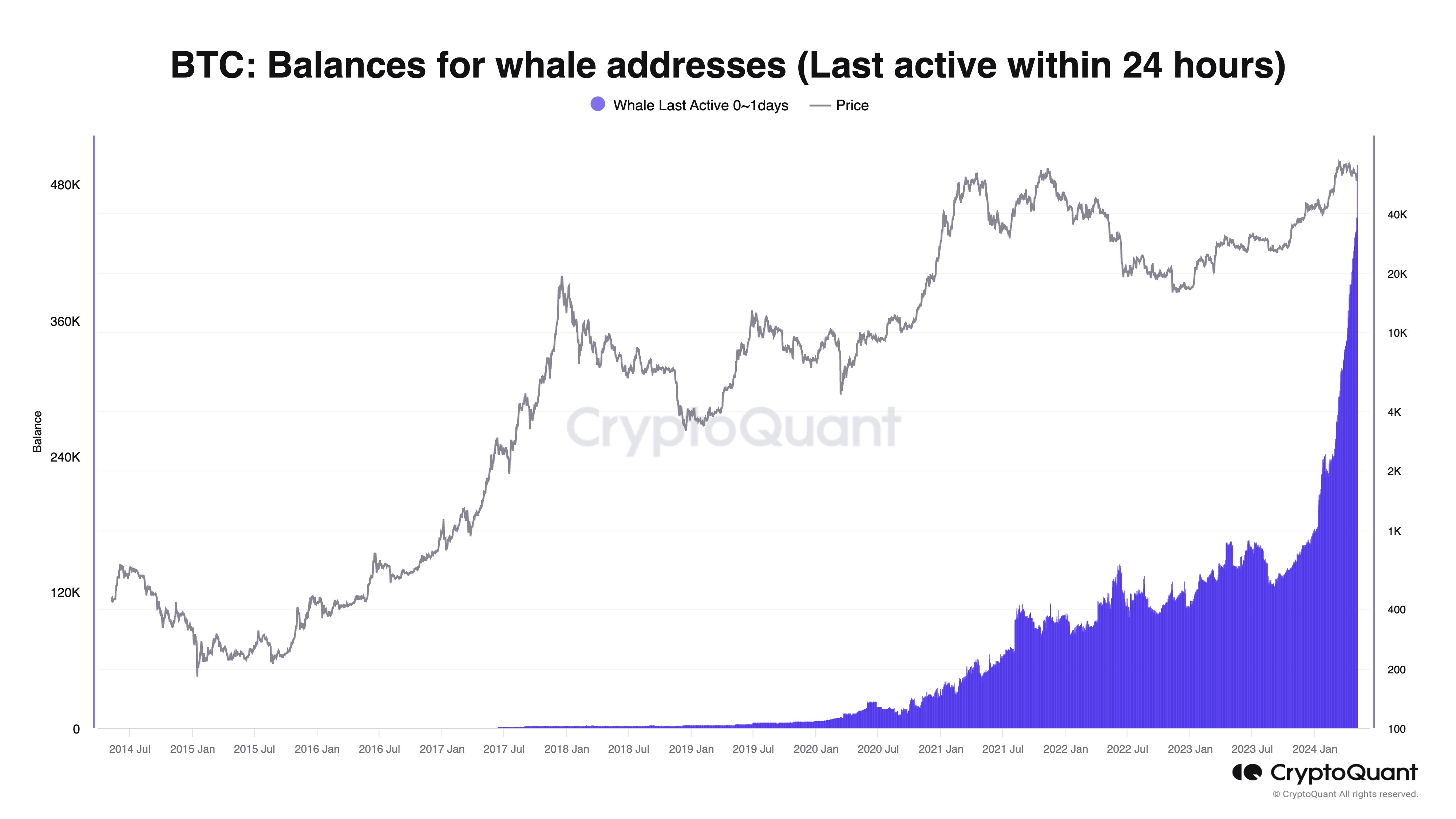

Along with examining technical indicators, the head of CryptoQuant, Ki Young Ju, emphasizes the prevailing optimistic attitude in the crypto market based on their on-chain and market research.

Based on the information they’ve provided, it appears that whales have purchased approximately 47,000 Bitcoins over the last 24 hours. This substantial addition to their holdings from major investors adds credence to the optimistic perspective regarding Bitcoin’s price trend.

Bitcoin Price Poised For Bullish Surge

Expert’s Insight: Crypto prognosticator Titan of Crypto has shared optimistic forecasts regarding Bitcoin’s price. He posits that recent market fluctuations have led to a significant reduction in positions held by investors who had gone long on Bitcoin, creating an opportunity for bullish movements. Furthermore, the Stochastic RSI on the 5-day chart is nearing the threshold for entering bullish territory.

As an analyst, I’ve observed historically that Bitcoin experiencing this occurrence has typically resulted in a price increase, leading us to new highs. This pattern holds the power to rekindle investor confidence and instigate additional purchasing interest.

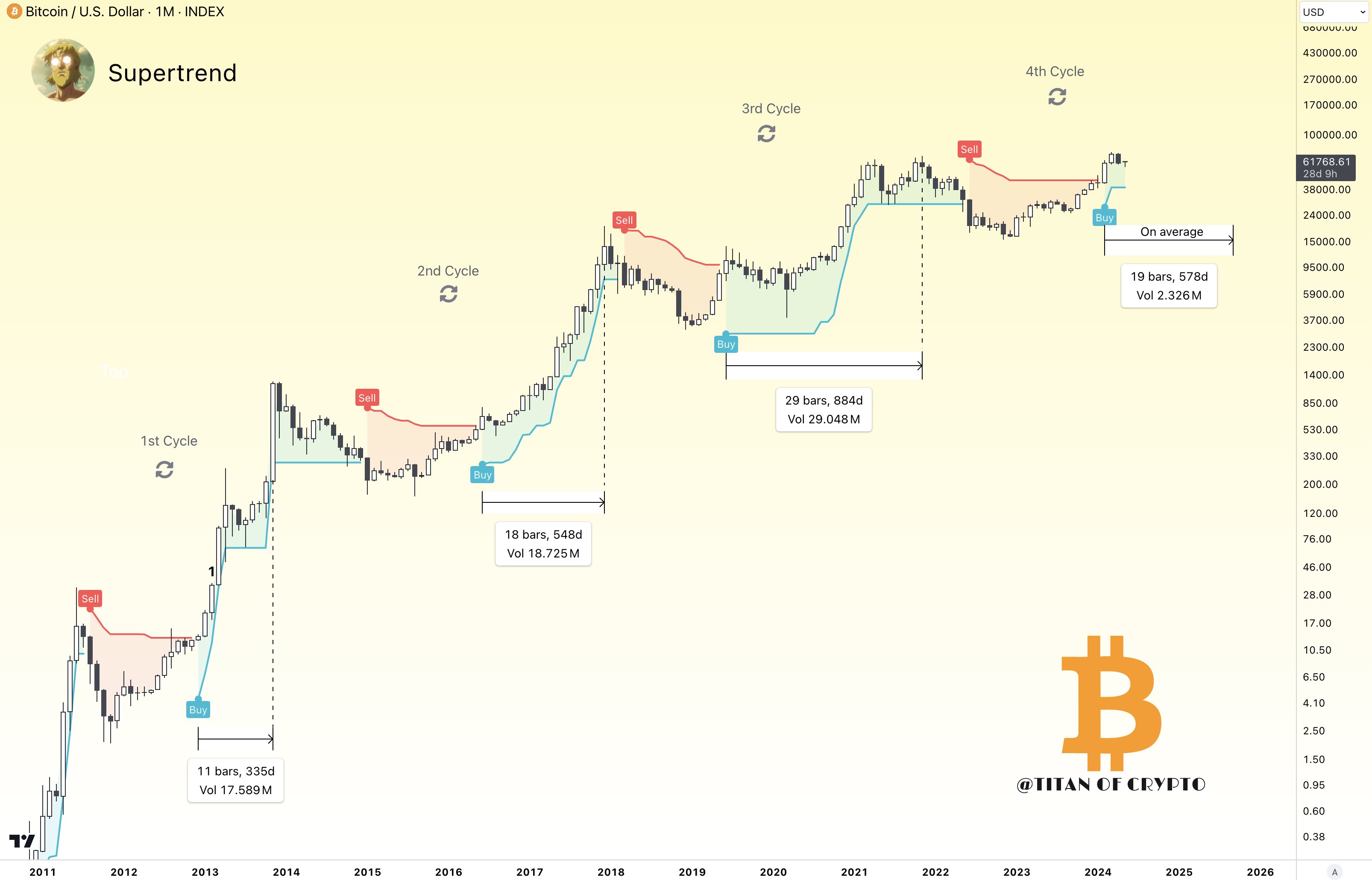

The renowned figure in the crypto sphere, Titan, has brought to light another optimistic indication: the buy signal produced by the Supertrend indicator, depicted in the following diagram. This advanced technical instrument is proficient at discerning trend directions within the price fluctuation of an asset.

As a crypto investor, I’ve been keeping a close eye on Bitcoin’s price movements. Three months ago, I received a buy signal, which means I entered a position in Bitcoin. Based on historical data, I believe there’s still potential for significant growth before we reach the cycle top. According to my analysis of past trends, the average duration from the buy signal to the cycle top is around 19 months. This suggests that we could be in for an extended bull run.

As a researcher studying the cryptocurrency market, I can tell you that Bitcoin is currently priced at $61,600 and has experienced a notable surge of 4.7% within the past 24 hours. However, it’s important to note that Bitcoin must overcome resistance levels in order to continue its upward trend. Additionally, previously tested support levels may be put to the test once again should a potential future downtrend arise.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

2024-05-04 01:16