As a crypto investor with some experience under my belt, I’ve seen my fair share of market ups and downs. Polygon (MATIC) has been a fascinating case study lately, with its growing user base and high daily active addresses. However, this surge in activity comes with its own set of challenges.

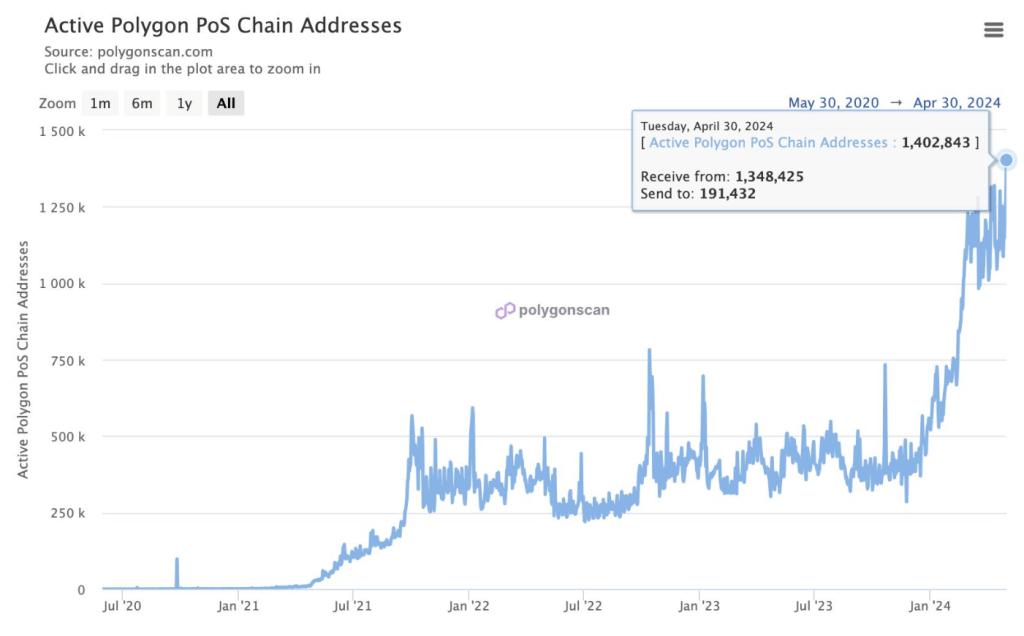

As an analyst, I’ve been closely monitoring the buzz surrounding Polygon (MATIC), the Ethereum scaling solution, which has recently gained significant attention. Notably, the daily active addresses on this network have reached an unprecedented high of over 1.4 million, underscoring its expanding user base. However, this surge in activity brings a dual perspective for MATIC.

Polygon’s Busy Streets: A Sign Of Growth Or Gridlock?

The heavy usage of Polygon’s digital roads is undeniable, as evidenced by the consistent daily presence of over a million active addresses. This indicates a vibrant ecosystem. However, upon closer inspection, there may be a hindrance to its smooth operation. Although the user base has grown exponentially, transaction fees have plummeted. The decrease in fees equates to a reduction in network earnings, sparking worries about Polygon’s financial viability over the long term.

JUST IN:

Polygon PoS has recorded a new all time high in daily active addresses with 1.4M

— Today In Polygon (@TodayInPolygon) May 1, 2024

As an analyst, I’ve observed that the hustle and bustle within Polygon’s Decentralized Finance (DeFi) ecosystem hasn’t resulted in a proportional increase of Total Value Locked (TVL). Despite the network’s vibrant activity, the TVL has taken a dip. This trend could be a reflection of cautious behavior from DeFi whales, who are holding back from fully investing their assets due to the uncertain market conditions.

MATIC Bulls Charge In, Waving Green Flags

In spite of lingering worries, the price of MATIC has significantly risen by over 8% within the last day, now sitting at approximately $0.71. This uptrend might be due to an increase in demand from buyers.

The data indicates a trend of MATIC tokens being withdrawn from exchanges and accumulated by major investors. This movement suggests that these investors have faith in Polygon’s future prospects.

Technical Indicators Flash Bullish, But Caution Remains

Matic’s technical outlook is optimistic based on several indicators. The Chaikin Money Flow (CMF), Money Flow Index (MFI), and Moving Average Convergence Divergence (MACD) all suggest the possibility of an uptrend.

The signals point to significant purchasing interest and market dominance for MATIC. Nevertheless, the Bollinger Bands, which assess price fluctuations, hint that the cryptocurrency may be approaching a phase of reduced price instability.

Although this might indicate stabilization following the market’s previous spike, it raises some doubt due to the volatile nature of cryptocurrencies. Keep in mind that technical signals may sometimes be unreliable.

The Road Ahead: Can Polygon Navigate The Challenges?

At a pivotal point, Polygon faces important decisions. The network’s heightened activity is a promising sign, yet the decrease in fees and DeFi TVL (Total Value Locked) creates cause for worry. The recent price spike and bullish market signals give MATIC investors reason to be optimistic. Nevertheless, investing in cryptocurrencies involves careful consideration due to their volatile nature.

As a researcher studying Polygon’s current situation, I believe addressing the declining fees is essential for the platform to sustain its momentum. I would suggest exploring alternative revenue models or designing fee structures that encourage network usage as possible solutions. Furthermore, attracting innovative decentralized finance (DeFi) protocols and users by fostering a thriving DeFi ecosystem could help rebuild investor confidence and stimulate growth in total value locked (TVL).

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- Who Is Stephen Miller’s Wife? Katie’s Job & Relationship History

- Green County secret bunker location – DayZ

- The Righteous Gemstones Season 4: What Happens Kelvin & Keefe in the Finale?

2024-05-03 11:46