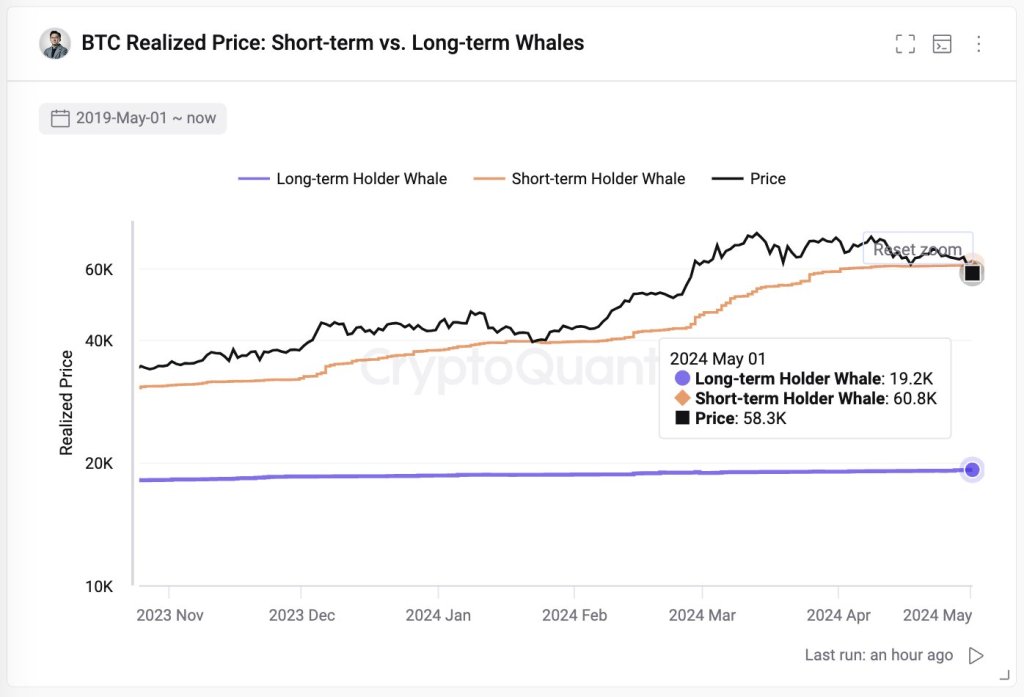

As a crypto investor with some experience under my belt, I find the recent analysis by Ki Young Ju on the current state of Bitcoin both intriguing and concerning. The revelation that all new whales and spot ETF investors are now underwater is a stark reminder of the volatility in the market.

As a crypto investor, I’ve noticed that Bitcoin has taken a downturn recently. But delving into the on-chain data provided by Ki Young Ju, the founder of CryptoQuant, offers a concerning perspective. All newly emerged whales, including those holding spot exchange-traded funds (ETFs), are now underwater. This means they purchased their coins at prices higher than the current market value. It’s a clear sign that confidence in the market may be waning, and it could potentially lead to further price drops.

New Whales And Spot ETF Investors Are In Red

Speaking to X, Jones warned that further losses were imminent, estimating that HODLers would experience “greatest distress” around the price point of $51,000. The decline from current rates is under $10,000, implying that while there are signs of instability, the correction may not extend too far.

As a researcher studying market trends, I acknowledge the value of this comprehensive review, especially given the latest wave of selling activity. However, forecasting precise price bottoms in a dynamic market subject to various influencing factors remains a challenging task.

From my perspective as an analyst, if the current price trend holds, I would advise believers in this cryptocurrency to consider increasing their holdings. The founder’s view is that the present discount offers a chance for astute investors to surpass the returns generated by traditional finance heavyweights, such as US-based institutions holding Bitcoin through spot ETFs.

At present, Bitcoin is experiencing significant selling pressure, causing concern among investors. The market bounce earlier today was unable to prevent a bearish trend, with the cryptocurrency currently trading below key support levels. Specifically, Bitcoin’s price hovers around $60,000 and $61,000 – crucial areas that have previously provided buying opportunities. Additionally, the coin has fallen below its April 2021 high of approximately $64,850.

Inflow To Spot Bitcoin ETFs Decline As Sentiment Deteriorate

The bullish outlook for bulls is evident in this formation, yet the most convenient direction for a decline persists to be southward at present. Bitcoin (BTC) experienced significant growth from October 2023 to March 2024, resulting in remarkable price peaks. Several analysts believe that the recent lull is an unavoidable consequence of the substantial advancements over the past six months.

It came as a surprise that whales were still underwater during the last week of April, given recent events. Yet, an unexpectedly large number of new whales entered the waters, nearly doubling the existing population’s holdings. Analysts interpreted this sudden increase in numbers as evidence of heightened institutional investment interest.

As I analyze the present market trends, it appears that newly emerged large investors, or “whales,” have entered a loss position. Their initial enthusiasm seems to be diminishing.

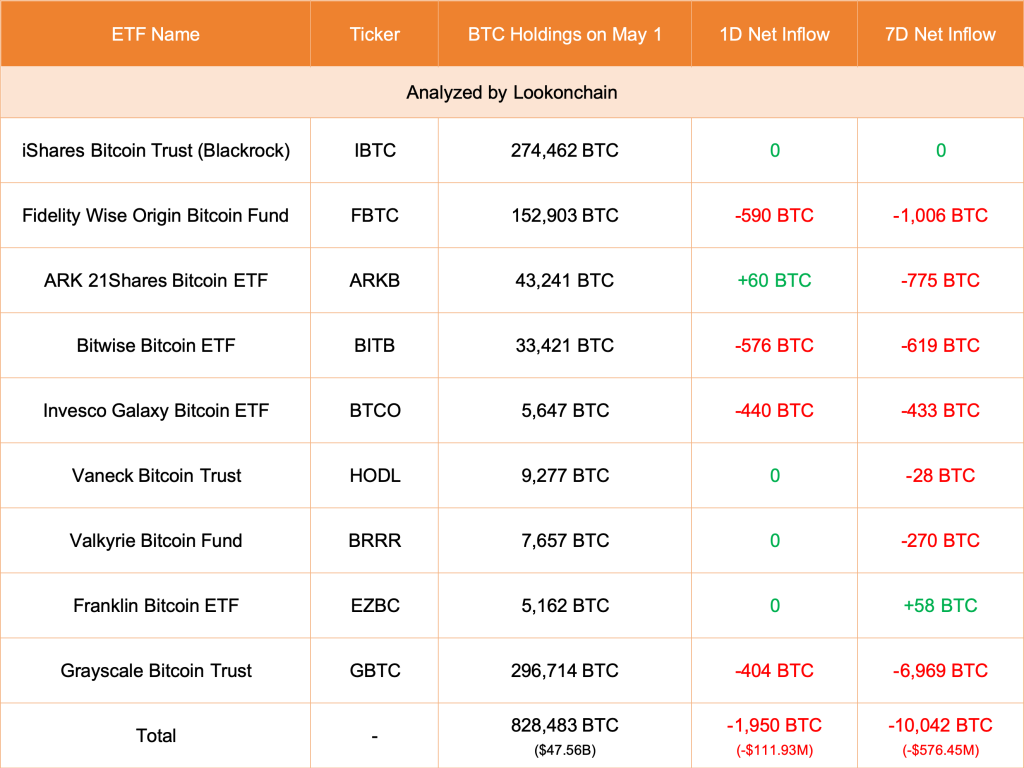

Based on data from Lookonchain, the inflow of Bitcoin into the top eight Bitcoin ETFs, including those managed by BlackRock and Grayscale (GBTC), has come to a halt. On May 1st, all these issuers collectively decreased their holdings by approximately 1,950 Bitcoins. It is worth mentioning that BlackRock’s IBIT has not experienced any inflows for the past five consecutive days.

As a researcher studying the behavior of Bitcoin Exchange-Traded Funds (ETFs), I’ve observed that investor sentiment significantly influences inflows into these funds. The mood of investors hinges on the performance of Bitcoin prices. If Bitcoin manages to break free from its current slump and embarks on an anticipated post-Halving rally, then spot Bitcoin ETF issuers can expect a new wave of investments.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-05-02 22:17