As a seasoned crypto investor with several years of experience under my belt, I’ve seen my fair share of market fluctuations and trends. The recent selloff in Bitcoin, extending its weekly losses to over 10%, has caught my attention once again. While the price drop was initially triggered by the Federal Open Market Committee (FOMC) meeting on May 1, the persistent decline in Bitcoin dominance is a signal that altcoins may soon take center stage.

Bitcoin, the most significant cryptocurrency globally, experienced substantial selling pressure, resulting in over 10% weekly losses. Following the Federal Open Market Committee (FOMC) meeting on May 1, Bitcoin’s price plummeted an additional 5%, reaching a low of $56,500 before partially recovering. Renowned crypto analyst Michaël van de Poppe expressed his perspective that “Bitcoin’s dominance has reached its peak,” paving the way for altcoins to gain prominence. He further noted that “altcoins are beginning to stir in their Bitcoin pairs, indicating the initiation of a rotation.”

In simpler terms, when Bitcoin’s market dominance decreases by approximately 1.75%, it often indicates that a surge in altcoins is imminent. This occurs as investors transfer funds from Bitcoin to other cryptocurrencies. Although Bitcoin has a massive market capitalization and presently holds around 53.9% of the crypto market dominance, this percentage has dropped by 1.75% within the last week. However, Bitcoin’s overall dominance in the wider crypto market has risen by nearly 4.6% since the beginning of 2024.

Multiple market experts have mentioned the recent decrease in Bitcoin’s market supremacy. Trader Matthew Hyland highlighted this trend, signaling a weakening support for Bitcoin’s dominance and intending to observe the upcoming weekly closing for further confirmation on whether it represents a breakthrough or not.

During their analysis on May 1st, IncomeSharks’ trading team noticed a post on X indicating that Bitcoin’s dominance was weakening. This observation implied that altcoins might gain ground if Bitcoin’s price instability continued for an extended period. Additionally, they pointed out the surprising robustness of several altcoins on that day.

The dominance of Bitcoin is decreasing. If its price trend continues to fluctuate for several more months, other cryptocurrencies might seize the opportunity and gain ground. Remarkably, many alternative coins are maintaining their value quite robustly at present.

— IncomeSharks (@IncomeSharks) May 1, 2024

On-chain Data Hints at Weakness in Bitcoin, $50,000 Coming?

I’ve noticed that Bitcoin’s price has taken a hit and dipped below $60,000. The on-chain data reveals a decrease in Bitcoin’s demand growth, which is concerning. Additionally, there’s been an increase in short positions, implying that some investors are betting against Bitcoin’s price rise. These factors suggest that the downside for Bitcoin’s price may not be over yet.

Based on CryptoQuant’s findings, the recent drop in Bitcoin’s price can be explained by several factors. Firstly, there has been a decrease in demand as indicated by a sluggish increase in Bitcoin holdings among long-term investors. Secondly, there appears to be less enthusiasm for spot Bitcoin Exchange Traded Funds (ETFs). Lastly, the number of short positions in the futures market has increased significantly.

According to the data from CryptoQuant, there was a significant decrease of around 50% in the amount of Bitcoin held by long-term investors, or those who consistently buy and don’t sell, during April. Their total holdings dropped from over 200,000 BTC at the end of March to roughly 90,000 BTC.

Photo: CryptoQuant

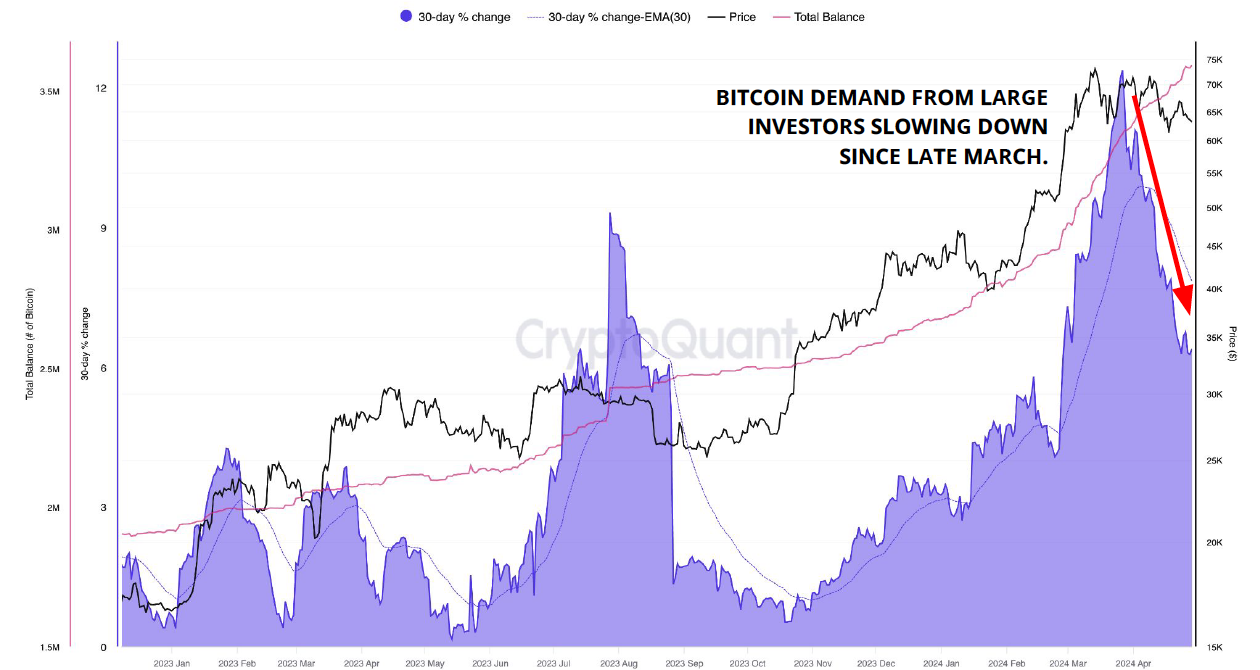

As a crypto investor, I’ve noticed that the appetite of Bitcoin whales, those with large holdings, has been waning since March. According to CryptoQuant, this trend is evident in their data, which shows that the monthly growth rate of Bitcoin whale demand, represented by the purple area in their graphs, peaked at 12% around late March but has since dropped to 6%.

Photo: CryptoQuant

Based on the assessment of recognized market analyst Scott Melker, the Bitcoin price is expected to hold above $52,000 in the near future. Melker pointed out that while there has been a correction, he views it as a normal occurrence during a bull market. Notably, the daily Relative Strength Index (RSI) hasn’t yet fallen into oversold territory.

“He pointed out that this represents just a 23% adjustment, a mild setback for a bull market and in line with previous corrections during this trend. However, we haven’t experienced the more significant downturns of 30-40% that have been typical of past bull markets.”

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Etheria Restart Codes (May 2025)

- Green County map – DayZ

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-05-02 12:07