As an experienced financial analyst, I closely monitor the Bitcoin market and its sentiment indicators. The recent plunge of Bitcoin to the $57,000 level has caused a noticeable shift in investor sentiment, with the Fear & Greed Index moving back into neutral territory. This change is significant, as it marks a departure from the extreme greed that had dominated the market for months.

The feeling towards Bitcoin among the data has shifted from greed to neutrality after its recent drop in value to hit the $57,000 mark.

Bitcoin Fear & Greed Index Has Returned To Neutral Levels

As a crypto investor, I closely monitor the Fear & Greed Index, a unique indicator developed by Alternative. This tool provides insights into the prevailing sentiment among my fellow investors in the Bitcoin and broader cryptocurrency market. By doing so, I can better gauge the current emotional state of the market and make more informed decisions based on fear or greed.

The index measures sentiment based on the analysis of five elements: price instability (volatility), trading activity (volume), social media indicators, market influence (market cap dominance), and search trend popularity (Google Trends).

This metric employs a range from zero to 100 to signify the average sentiment. Sentiments below 46 indicate investor fear, while those above 54 indicate market greed. The area between these thresholds represents a neutral mindset.

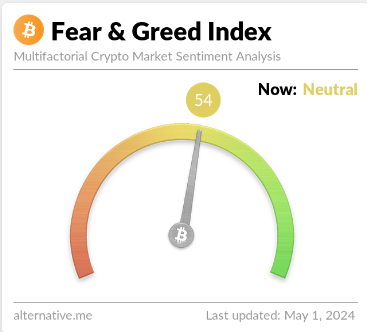

Now, here is what the Bitcoin sentiment looks like right now, according to the Fear & Greed Index:

The Bitcoin Fear & Greed Index, as shown, registers a reading of 54. This figure suggests that investors hold a relatively neutral attitude towards Bitcoin at the moment. Nevertheless, this neutrality is quite delicate, as the index hovers close to the borderline of the greed zone.

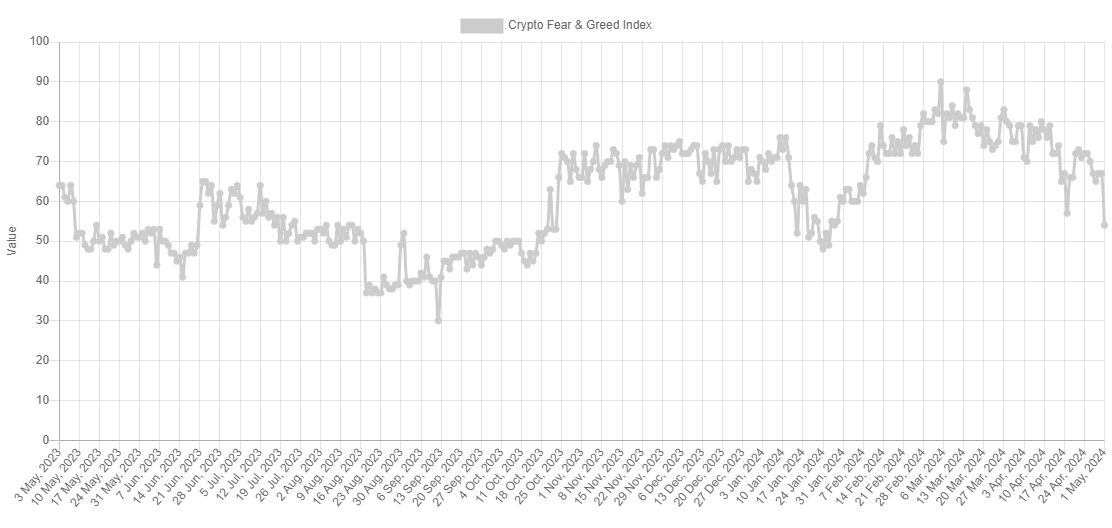

Yesterday’s position held by the indicator was markedly different; have a look at the graph to see how its value has shifted recently.

I’ve analyzed the trend of the Bitcoin Fear & Greed Index, and the graph indicates that it has been decreasing over the past few weeks. For significant portions of February, March, and the initial half of April, this index found itself in or very close to an exceptional zone labeled as “extreme greed.”

In simpler terms, when the market value surpasses 75, it adopts this particular attitude. However, as the asset price experienced some instability lately, the market sentiment shifted away from the extreme optimism and moved towards a more balanced, “greedy” phase. Following the recent Bitcoin crash, the index has witnessed a significant drop, causing it to leave the greed-driven territory altogether.

As a seasoned crypto investor, I’ve learned that the market tends to surprise us with unexpected moves. The more strongly we hold onto our expectations, the greater the chance that the market will go in the opposite direction.

In intense emotional regions, such as those characterized by deep-seated fear or unbridled greed, this anticipation holds significant weight. Consequently, significant market reversals, represented by both major bottoms and tops, have frequently transpired in these areas.

As a financial analyst, I’ve observed that the price of Bitcoin reached its peak, which is currently the highest on record and marks the pinnacle of this recent bull run, coincided with unusually high readings on the Bitcoin Fear & Greed Index.

As the sentiment has calmed down to a neutral level, certain investors might be on the lookout for a potential drop in market confidence. This anticipation arises due to the heightened probability of a market recovery if the current sentiment worsens further.

BTC Price

In Bitcoin’s recent downturn, the value dipped under $57,000 momentarily before rebounding to reach $57,300 once more.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-05-02 05:30