As an experienced financial analyst, I find Tether’s Q1 2024 financial report to be quite impressive. The company’s net profit of $4.52 billion is a testament to the growing demand for stablecoins and the effective management of their reserves.

Tether, a significant figure in the crypto sphere as the creator of the popular USDT stablecoin, has made public their financial report for the initial three months of the year 2024. This disclosure was coupled with an examination carried out by the accounting firm BDO.

The report discloses the financial data beyond that supporting Tether’s stablecoins in their fiat currency form, revealing the company’s earnings for the initial quarter of the year. This period was marked by a significant surge of investment into the market.

Tether Q1 2024 Financials Soar

In the first three months of 2024, Tether experienced significant earnings, totalling approximately $4.52 billion in profits.

The entities that produce stablecoins and oversee their reserves are said to have earned around $1 billion in profits, mostly from the sale of US Treasury securities. The rest of the profit came from the price appreciation of their holdings in Bitcoin (BTC) and gold.

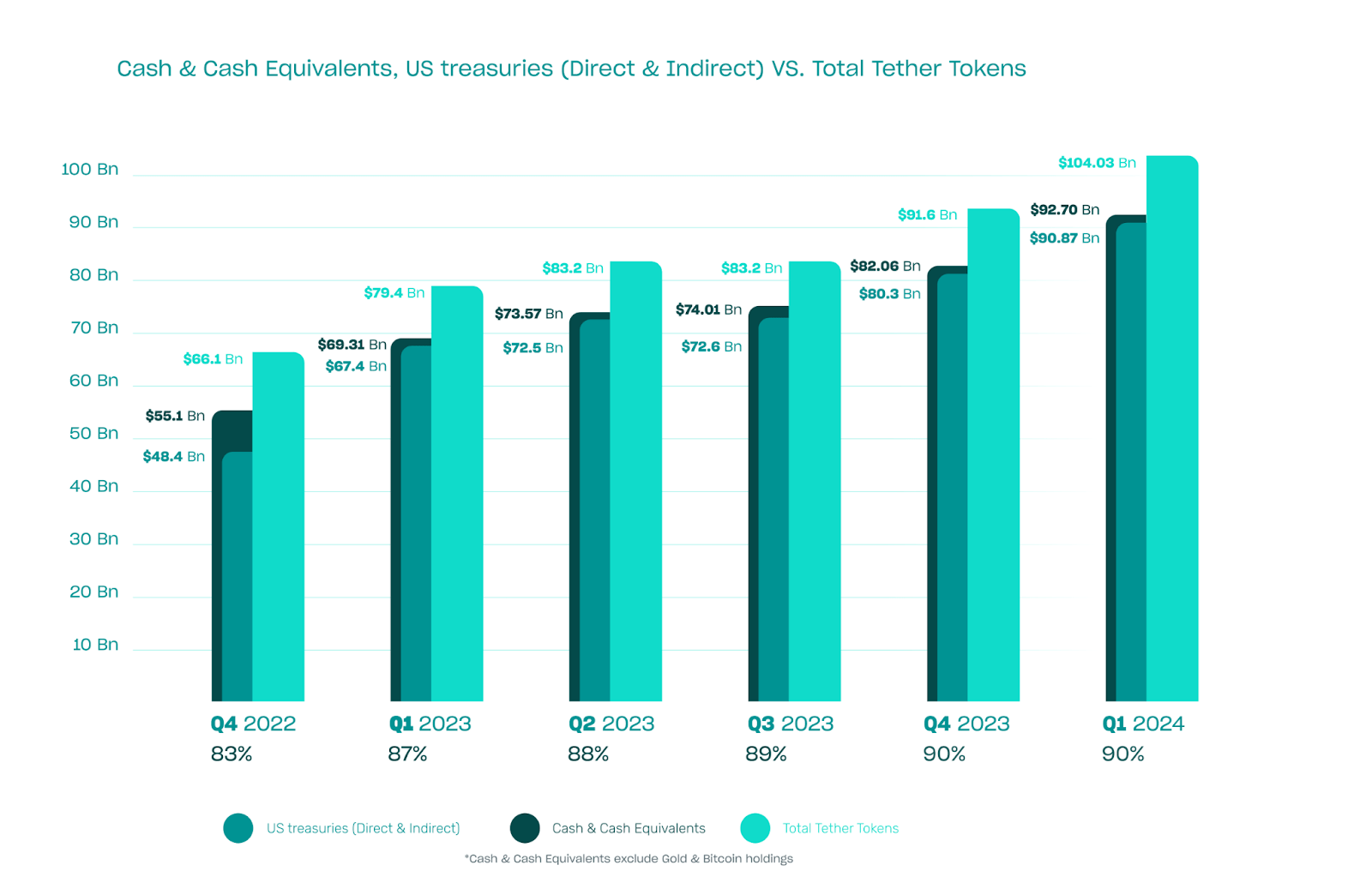

As a researcher, I’ve discovered that Tether has accomplished significant growth in its possession of both direct and indirect US Treasury holdings, surpassing $90 billion. This expansion encompasses indirect exposure, obtained via overnight reverse repurchase agreements secured by US Treasuries, as well as investments in US Treasuries through money market funds.

Tether made a noteworthy disclosure by sharing its net equity for the first time, amounting to $11.37 billion on March 31, 2024 – marking a substantial growth from the reported $7.01 billion in equity as of December 31, 2023.

The report revealed that the company’s excess reserves had grown by an additional $1 billion, bolstering its stablecoin initiatives, amounting to almost $6.3 billion in total.

CEO Emphasizes Transparency And Stability

The BDO audit confirmed that 90% of Tether’s stablecoins are backed by cash and its equivalent. This confirmation reinforces Tether’s commitment to maintaining liquidity within the stablecoin market. In addition, the report disclosed that approximately $12.5 billion USDT were issued during the first quarter.

The investment portfolio of Tether Group encompasses over $5 billion across diverse sectors. These sectors include artificial intelligence (AI) and data, renewable energy, P2P communication, and Bitcoin Mining.

As a dedicated researcher investigating the latest developments in the cryptocurrency industry, I’d like to share how Paolo Ardoino, the CEO of Tether, responded to recent reports. He made it clear that Tether remains committed to upholding transparency, ensuring stability, providing ample liquidity, and practicing responsible risk management.

As a researcher examining Tether’s financial performance, I was struck by their impressive earnings of $4.52 billion – a new record in the crypto sector. Tether has been actively working to enhance transparency and instill trust within the cryptocurrency community, which is commendable. In my analysis, I discovered that they have made significant strides towards achieving these goals.

Tether has once more set a new standard in the cryptocurrency sector by disclosing not only the makeup of its reserves but also its net equity amounting to $11.37 billion, thereby enhancing transparency and fostering trust within the industry.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-05-02 05:21