As an experienced analyst with a deep understanding of Bitcoin’s price movements and on-chain data, I believe that for Bitcoin to surge to a new all-time high (ATH) target of $92,190, it needs to breach the significant resistance barrier at $66,250. This level is currently acting as a major hurdle for BTC, with many loss holders eager to exit at their break-even point.

As a crypto investor, I’ve recently come across an intriguing analysis from a market expert regarding Bitcoin‘s potential journey to reach its next all-time high (ATH) of $92,190. According to this analyst, Bitcoin may need to first retest and potentially hold above the previous ATH at around $64,800 as a confirmation of its bullish trend. If successful, it could then embark on a new leg upwards, possibly experiencing increased volatility along the way. However, it’s essential to remember that past performance is not indicative of future results and investing in cryptocurrencies carries inherent risks.

Bitcoin Needs To Breach This Resistance Barrier To Rise To New ATH

As a crypto investor following the discussions on X, I’ve come across an intriguing new thread from analyst Ali. He’s questioning whether the recent peak in Bitcoin (BTC) prices has already been reached. One indicator he mentioned that could suggest a potential top is the extensive profit-taking activity observed in the market lately.

I’m closely monitoring the market and holding back from making any significant moves until I receive further confirmation that the crypto market has reached its peak. If the top is indeed confirmed, I’ve identified several potential target prices based on the on-chart data I’ve been analyzing.

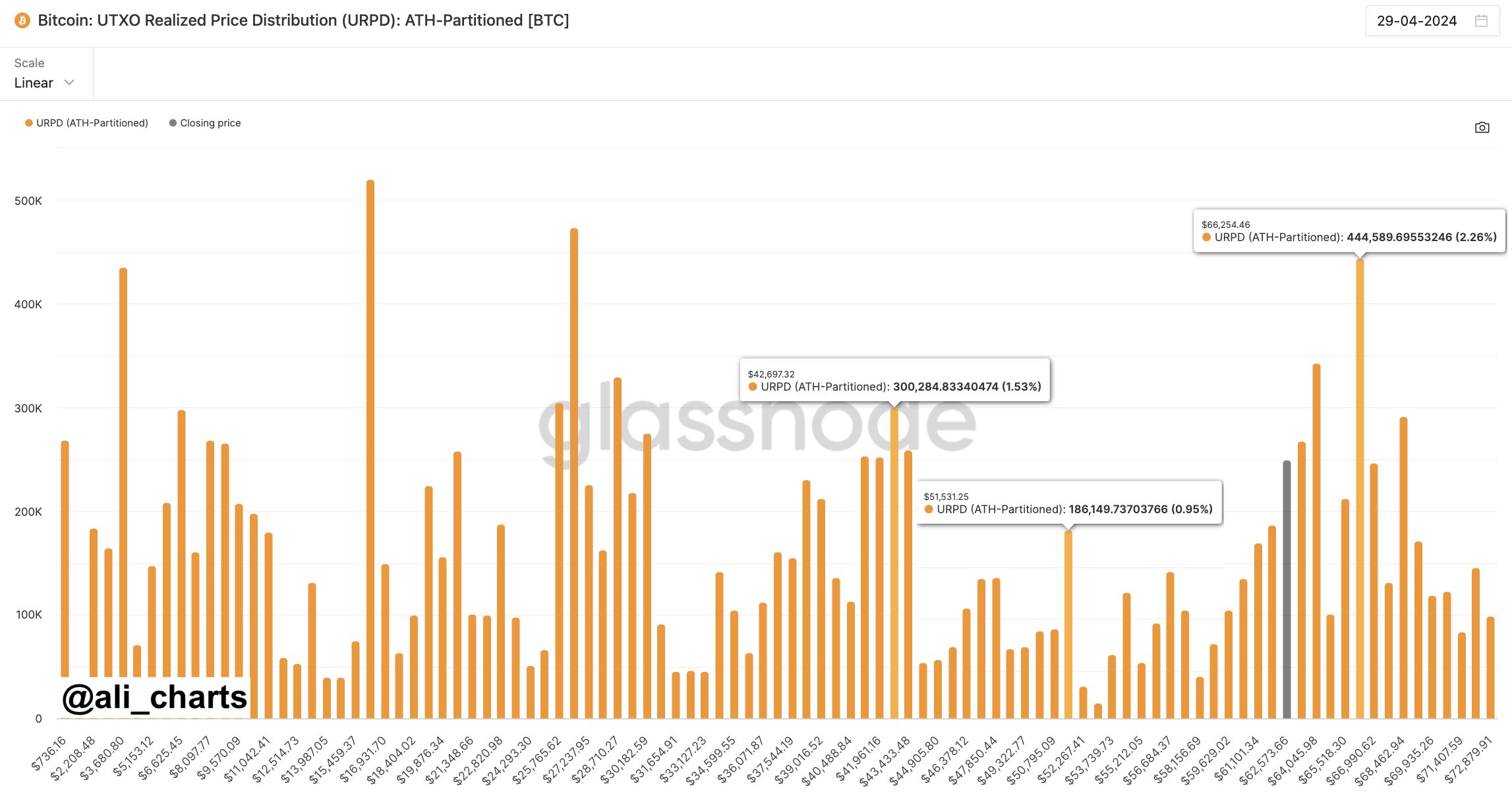

“The graph presented here depicts the UTXO Realized Price Distribution of Bitcoin, as obtained from Glassnode, indicating the number of coins transacted at various purchase prices.”

Investors generally pay close attention to their cost basis, which represents the initial price they paid for a security. A retest of this level can prompt significant reactions from investors. The magnitude of these reactions tends to be greater when a large number of investors hold securities with similar cost bases.

When a retest occurs from a higher position, those holding the asset might choose to buy additional units. They may view the price decrease as a temporary dip and an opportunity to purchase more at a lower cost basis. Consequently, significant cost basis areas beneath the current price can function as strong supports.

According to Ali’s analysis, if the Bitcoin market reaches its peak, there’s a possibility it may decline towards the support levels of $51,530 or even $42,700.

If BTC surpasses the current resistance level of $66,250, as suggested by the analyst, the bearish perspective could be disproved due to the urgency among some investors to sell at their breakeven point.

One method to express this idea in clear and conversational language is: “An on-chain pricing structure may offer some insights into potential market developments once a price rupture occurs.”

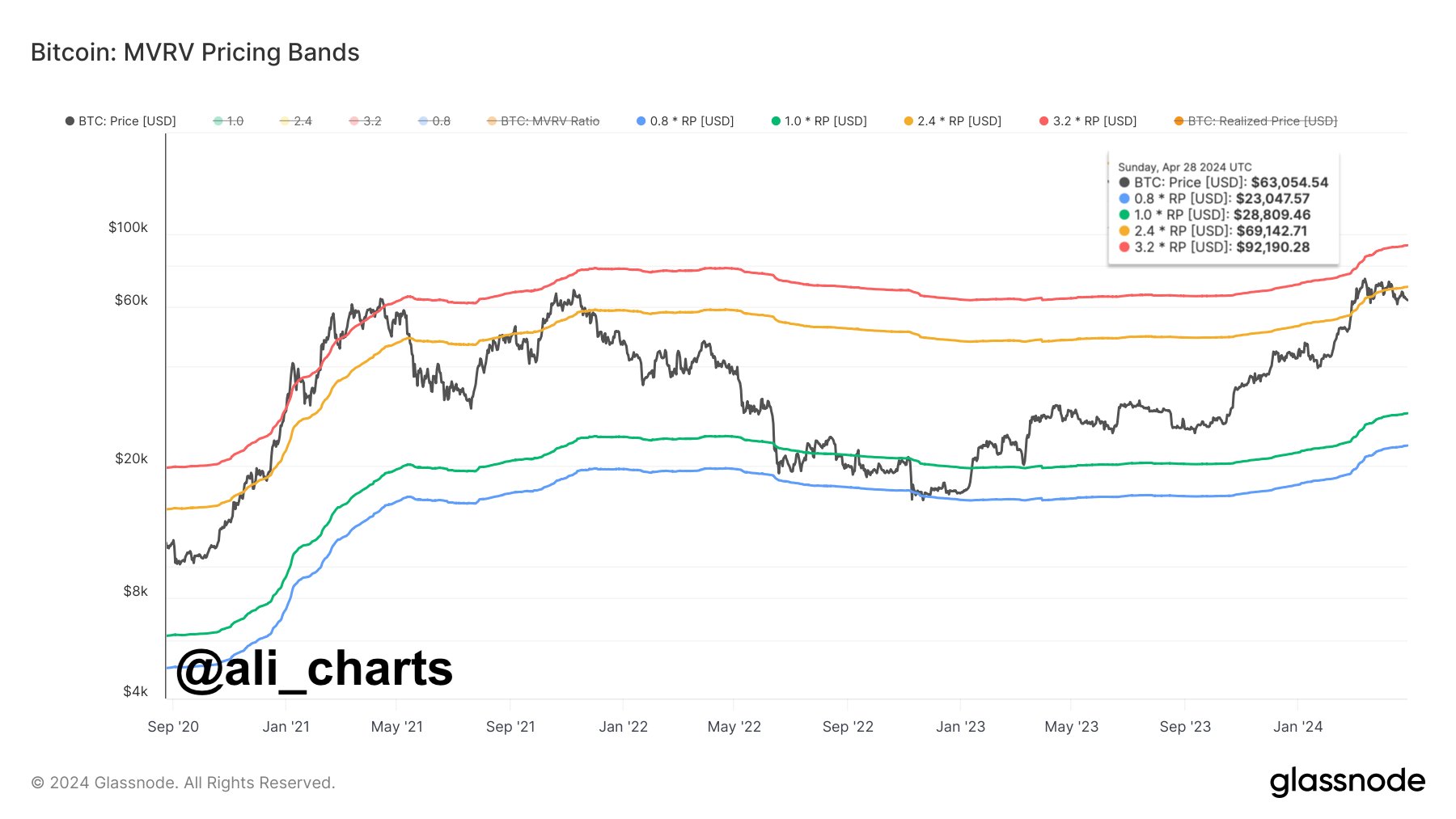

The MVRV Pricing Bands model provides insight into the varying multiples of the average market price relative to the average cost basis for different assets.

The present market cost basis is reflected in the chart at $28,800. Throughout history, three key multiples of this indicator have held significance for the asset: 0.8 times, 2.4 times, and 3.2 times this value.

As a seasoned crypto investor, I’ve noticed that the 0.8x mark often signals potential bottoms in the market, while a price level reaching 3.2x may indicate an impending top. After significant dips, bull rallies have historically emerged once we break through the 2.4x threshold.

Currently, the threshold of 2.4x is set at $69,150. Once Bitcoin surpasses the $66,250 mark, it will have the power to move toward $69,150. If this hurdle is overcome, Bitcoin may continue its progression towards a new record high of $92,190, according to Ali’s analysis.

As a researcher studying the Bitcoin market, I’ve determined that the ATH target for this price trend corresponds to approximately $92,190 based on the current 3.2x multiplier. However, it remains uncertain whether we have reached the peak and if Bitcoin will revisit lower levels or if there is still room for growth within this rally.

BTC Price

At the time of writing, Bitcoin is trading at around $61,100, down more than 7% over the past week.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-04-30 19:35