As a researcher with a background in fintech and stablecoins, I find this development between Tether (USDT) and Circle’s USD Coin (USDC) intriguing. The data from Visa revealing USDC processed a higher transaction volume than Tether last month is a significant shift in the stablecoin landscape.

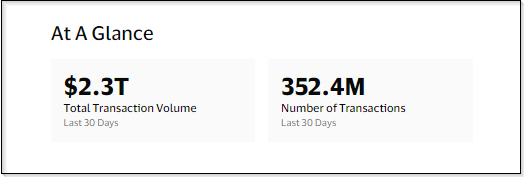

In a surprising turn of events, Circle’s USD Coin (USDC) has surpassed Tether (USDT) as the leader in stablecoin transaction volume, based on data from Visa’s on-chain analytics, in April 2024.

This change signifies a major transformation in the world of stablecoins. Although Tether holds an impressive market value exceeding $110 billion, USDC, with its $33 billion worth, has gained traction as the more frequently exchanged coin.

As a researcher analyzing the latest transaction volumes for stablecoins, I’ve discovered an intriguing difference between USDC and Tether. Last week, USDC processed an astounding $456 billion in transactions – a staggering 400% increase compared to Tether’s $89 billion.

USDC: A Slow And Steady Climb

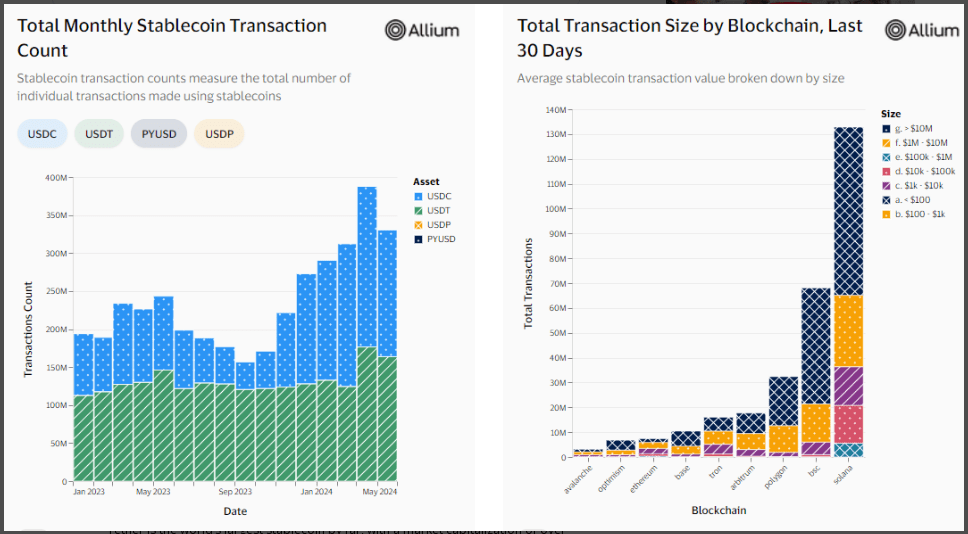

As a researcher studying the cryptocurrency market, I’ve observed that USDC’s ascent to prominence hasn’t been an unexpected or sudden development. Instead, it’s been a gradual process of eroding Tether’s dominance since late 2023. According to Visa’s transaction data, USDC surpassed Tether for the first time in monthly transactions back in December 2023, with a total of 145 million compared to Tether’s 127 million. This trend has continued into April, with USDC recording over 166 million transactions and Tether reporting nearly 164 million.

Several reasons have been identified by experts for the surge in popularity of USDC. The heightened regulatory oversight of Tether’s reserves and lingering doubts about its transparency are potentially pushing users towards USDC, which is viewed as a more transparently regulated and audited stablecoin.

An additional factor that could be contributing to USDC’s growth is its collaboration with Visa. In April, Visa unveiled a stablecoin analytics dashboard, highlighting USDC among other leading stablecoins. The heightened exposure from this dashboard may be drawing new users to the platform.

Tether Still Holds The Crown (For Now)

As a researcher studying the cryptocurrency market, I’ve observed an significant increase in transaction volume for US Dollar Coin (USDC). However, when it comes to market capitalization, Tether (USDT) continues to reign supreme with its impressive $110 billion market value. This figure overshadows USDC’s $33 billion, signifying a considerably larger total value of circulating coins for Tether. This finding suggests that Tether remains the preferred choice for many crypto investors as a store of value, even if they aren’t engaging in frequent trading activities with it.

As a crypto investor, I’ve noticed an intriguing difference between Tether and US Dollar Coin (USDC) based on their user bases. In terms of transaction volume, USDC came out on top in April. However, Tether had the edge when it comes to the number of unique wallets involved. Specifically, over 34 million distinct wallets interacted with Tether last month, whereas USDC only saw activity from around 9.57 million wallets. This observation could suggest that Tether is preferred for larger transactions or by a more diverse group of individuals. Alternatively, USDC might be more popular among active traders.

The Future Of Stablecoins: A Two-Horse Race?

As a researcher studying the crypto market, I’ve noticed an intriguing dynamic between USDC and Tether. USDC has been making significant strides recently, with increasing transaction volumes indicating its expanding influence within the crypto ecosystem. However, Tether, with its large user base and dominant market capitalization, is unlikely to relinquish its position without a fight.

The shifting regulatory environment and growing demand for transparency and security are expected to significantly influence the development of stablecoins moving forward. It is uncertain whether USDC will continue to gain traction and surpass Tether’s market dominance or if Tether can reclaim its lead in transaction volume.

Read More

- CNY RUB PREDICTION

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-04-30 12:05