As a researcher with extensive experience in the cryptocurrency and blockchain industry, I find Forbes’ report on “crypto billion-dollar zombies” both intriguing and concerning. The categorization of certain projects as “zombies” due to their substantial valuations but limited utility beyond speculative trading is a valid observation that warrants further investigation.

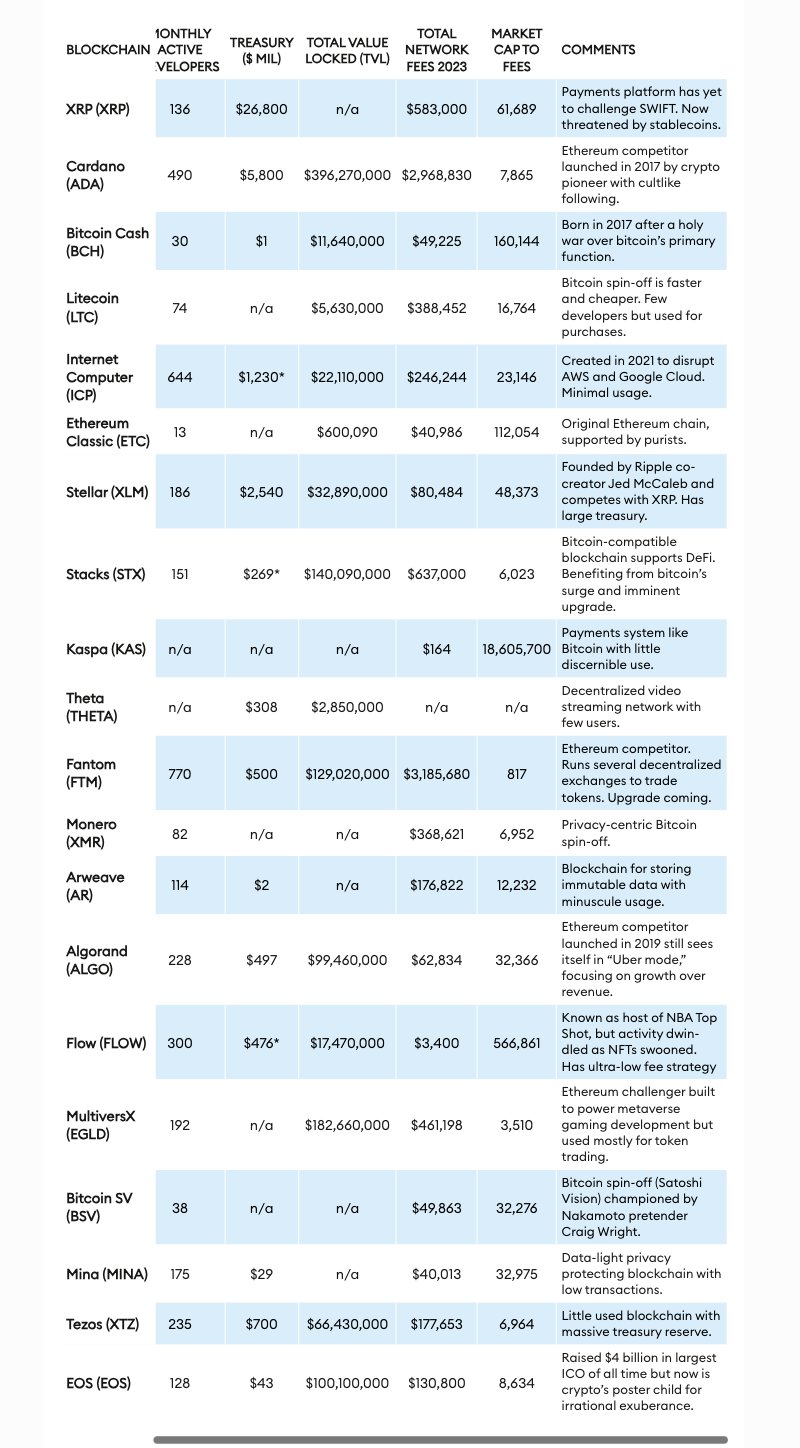

In an provocative publication, Forbes revealed a selection of 20 “crypto assets worth over a billion dollars” categorized as L1 tokens by the magazine. These digital currencies, according to Forbes, possess significant market values but offer only minimal practical uses beyond mere hypothesis and trading speculation.

As a cryptocurrency analyst, I would describe the collection of digital assets and related projects as follows: Ripple is one option, with its native token being XRP. Ethereum Classic, represented by the ticker symbol ETC, is another intriguing project in this space. Tezos (XTZ), Algorand (ALGO), and Cardano (ADA) are additional noteworthy cryptocurrencies that merit attention.

XRP And Ethereum Classic In The Spotlight

XRP, the digital currency developed by Ripple Labs, has been identified as a notable crypto asset exhibiting characteristics similar to “zombie coins.” Although it boasts a substantial daily trading volume of approximately $2 billion according to Forbes, the outlet argues that XRP‘s fundamental role remains speculative in nature and lacks significant utility.

As a researcher investigating the blockchain landscape beyond Bitcoin and Ethereum, I’ve come across an intriguing revelation from Forbes. They have identified no less than 50 blockchains, each with a market value exceeding $1 billion, excluding Bitcoin and Ethereum. Among these, approximately 20 are categorized as “functional zombies.” These 20 blockchains collectively represent a significant market value of around $116 billion. Despite this impressive valuation, they boast relatively small user bases.

Based on Forbes’ report, Ethereum Classic is referred to as a “functional ancestor” in the cryptocurrency world, preserving its identity as the original Ethereum blockchain.

Despite having a market worth of $4.6 billion, Ethereum Classic (ETC) generated fees below $41,000 in 2023. This discrepancy prompts concerns over its effectiveness as a blockchain solution for the news organization.

In the Forbes article, another cryptocurrency initiative that was mentioned is Tezos. They garnered a substantial investment of $230 million during their initial coin offering (ICO), which took place back in 2017.

As a Tezos investor, I’ve noticed that our beloved XTZ token boasts a significant market capitalization, reaching an impressive $1.2 billion as of now. Yet, the blockchain’s fee earnings leave much to be desired. In February 2024, these earnings amounted to a mere $5,640. Over the entire year of 2023, they barely reached $177,653.

Algorand, previously dubbed a potential “rival to Ethereum” for handling up to 7,500 transactions per second, now grapples with comparable issues.

With a market value of $2 billion and over half a billion dollars in reserves, Algorand generated just $63,000 in fees from blockchain transactions last year. This figure raises questions about its widespread usage and practical benefits according to Forbes.

Crypto ‘Zombie’ Blockchains

According to Forbes, zombie blockchains are classified into two main types: those that evolved from existing blockchains like Bitcoin and Ethereum as offshoots, and those that directly challenge their dominance as rivals.

Among the offshoots of the original cryptocurrencies, we find Bitcoin Cash (BCH), Litecoin (LTC), Monero (XMR), Bitcoin SV (BSV), and Ethereum Classic. These currencies emerged from their parent projects through hard forks or other means of separation.

There are a number of blockchains, with a combined value of approximately $23 billion, that allegedly came into being due to disputes among developers over the management and vision of the initial chains.

According to Forbes, when disagreements emerge within a network leading to forks, new blocks chains are formed, preserving the previous transactions history. The market capitalization of these splintered networks frequently surpasses their practical application in the real world.

In essence, the report brings attention to a widening gap between the estimated worths of specific cryptocurrency initiatives and their genuine value in terms of function and application. Subsequently, Forbes labels such projects as “zombie projects.”

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Green County secret bunker location – DayZ

- How to unlock Shifting Earth events – Elden Ring Nightreign

- Green County map – DayZ

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Etheria Restart Codes (May 2025)

- Mario Kart World – Every Playable Character & Unlockable Costume

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

2024-04-27 05:46