As someone who has closely followed the crypto market for several years now, I find the recent trends intriguing. The shift in trader behavior towards Bitcoin, as indicated by negative funding rates and reduced net inflows to US spot Bitcoin ETFs, suggests a more cautious approach among investors.

Lately, the cryptocurrency market has shown a distinct change in trading patterns, most notably amongst investors focusing on Bitcoin.

As an assistant observing this situation, I’d put it as follows: According to my analysis of data from CryptoQuant, I noticed that Bitcoin’s funding rate, which represents the fee paid by traders to maintain long positions in Bitcoin’s perpetual futures contracts on various exchanges, has dipped into negative territory for the first time since October 2023, based on Bloomberg’s latest reports.

this modification indicates a decreased enthusiasm for making bullish wagers on Bitcoin, aligning with the weakening influence of significant market catalysts.

Bitcoin Market Dynamics Post-Halving

I’ve noticed an intriguing connection between the decreasing Bitcoin funding rate and the dwindling net inflows into US Bitcoin Exchange-Traded Funds (ETFs) that used to significantly boost the price of Bitcoin, reaching all-time highs.

The Bitcoin Halving, an occurrence that cuts down the reward for miners adding new blocks and potentially shrinks the number of fresh coins in circulation, was widely expected to significantly influence the price. However, the market response has been relatively subdued instead.

Based on Bloomberg’s report, this muted reaction has intensified the impact of larger economic influences, including geopolitical conflicts and shifting views on monetary policies, causing investors to become more cautious.

After the most recent Bitcoin halving, there hasn’t been the significant price increase that was predicted by many. Instead, Bitcoin has experienced a correction of more than 10% from its record high in March, which currently puts its value around $63,000.

I’ve noticed that according to Julio Moreno, the current Head of Research at CryptoQuant, the decline in Bitcoin’s funding rates dipping into negative territory signifies a reduced enthusiasm among traders to open long positions.

I’ve noticed an intriguing pattern based on recent data. Bloomberg reports that there has been a substantial decrease in daily deposits to US Bitcoin spot exchange-traded funds (ETFs) as observed. Additionally, open interest in Bitcoin futures contracts at the Chicago Mercantile Exchange (CME) has dwindled, suggesting a lessening fervor towards cryptocurrency investments.

[1/4] Bitcoin ETF Flow – 25 April 2024 – UPDATE

— BitMEX Research (@BitMEXResearch) April 25, 2024

I’ve come across a Bloomberg report where analyst Vetle Lunde from K33 Research expressed some intriguing insights. He pointed out that the recent trend of neutral-to-negative funding rates is quite uncommon, implying that the market could be gearing up for a period of price stabilization.

During this time of decreased borrowing and selling activity, Bitcoin’s price might become more steady. However, it leaves us pondering about the short-term possibilities for Bitcoin’s rebound.

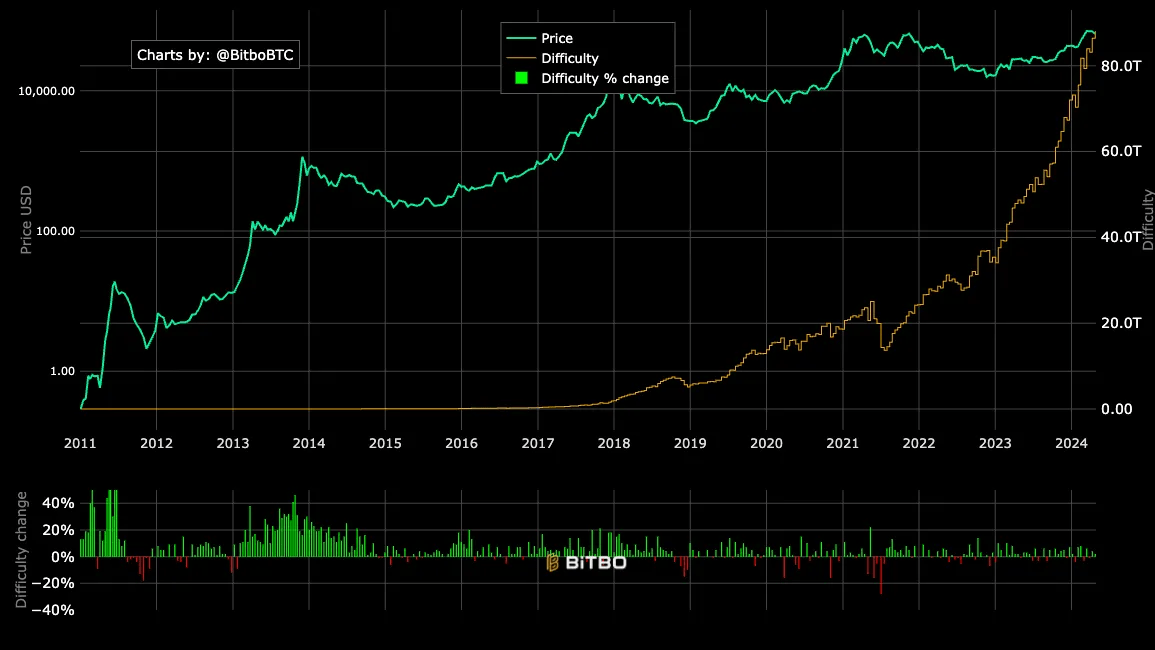

Adjustments In Mining Difficulty And Market Implications

It’s worth noting that as markets undergo changes, Bitcoin’s mining difficulty experienced an initial rise – a first since the fourth halving occurred.

Every 2016 blocks, the mining process becomes slightly more complex as the difficulty adjustment increases by 2%. This latest adjustment brought the level up to an all-time high of 88.1 trillion, based on Bitbo’s data.

In contrast to previous patterns, following a halving event, mining complexity has tended to increase rather than decrease, due to fewer profits forcing less productive miners from the market.

The mining difficulty anomaly indicates that miners continue to be active following the Halving, potentially due to advances in mining technology making processes more efficient or mining companies adopting new strategies.

I’ve noticed that the robustness of mining activities can significantly contribute to maintaining both the security and processing capabilities of the Bitcoin network. However, it’s essential to acknowledge the intricacies involved in forecasting Bitcoin’s market behavior solely using past halving events as a reference point.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Gold Rate Forecast

- Best Japanese BL Dramas to Watch

2024-04-25 19:17