According to on-chain analysis, Bitcoin‘s largest investors (referred to as “whales”) currently hold approximately 25.16% of the total Bitcoin supply. These whales have been actively buying more Bitcoin in recent times, resulting in a growing hoard.

Based on information from the cryptocurrency analysis company Santiment, over 266,000 Bitcoins have been amassed by large Bitcoin holders, or whales, since the beginning of the year. The significant metric to consider here is “Supply Distribution,” which monitors the proportion of the current circulating Bitcoin supply that different wallet categories presently control.

Wallets are categorized into different groups based on the quantity of Bitcoin they hold. For instance, the range of 10 to 100 coins refers to wallets that possess between 10 and 100 Bitcoins.

The Supply Distribution represents the total amount of supply held by a specific investor group and determines their collective proportion of the supply.

In the ongoing conversation, we’re focusing on Bitcoin holders with between 1,000 and 10,000 coins. At present exchange rates, this group holds between $65 million and $650 million worth of Bitcoin.

Large investors in the group hold significant power due to their ability to trade vast quantities of stock. They are often referred to as “whales” because of their capacity to sway the market with their actions. Keeping an eye on their behaviors is therefore important.

In addition to the whales within our group holding more than 10,000 BTC, there are larger whales with even greater holdings. However, at these substantial levels, other types of entities, such as exchanges, become involved, and they don’t function in the same way as regular investors.

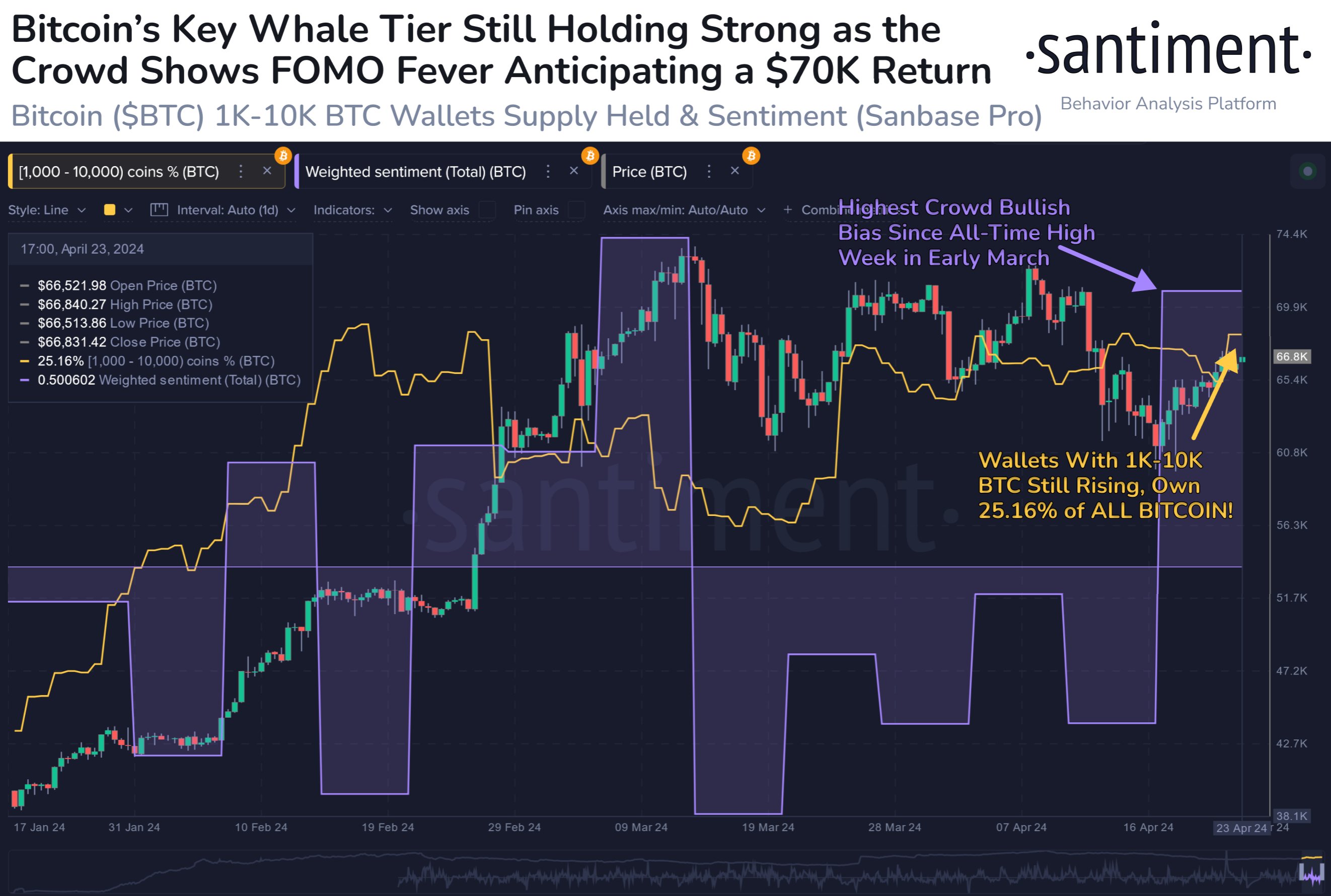

Currently, let me share with you this chart illustrating the development of Bitcoin ownership among those holding between 1,000 and 10,000 coins over the recent past.

In the graph above, we see that the Bitcoin Supply held by major investors, referred to as “whales,” has increased significantly during the year 2024, with these investors purchasing approximately 266,000 Bitcoins worth around $17.2 billion.

Although the buildup hasn’t been steady as shown in the graph, whales sold their holdings during the market surge that later set a new record high, and subsequently repurchased when the downturn ended.

After BTC‘s price stabilization, its supply has also remained fairly steady. However, recent data shows an uptick in this metric, suggesting that large-scale investors may be supporting the ongoing market recovery.

After the recent increase, approximately one fourth (25.16%) of all existing Bitcoins, which is between 1,000 to 10,000 coins, are now controlled by larger investors in their wallets.

When the market is enthusiastic about purchasing whales (large transactions), the mood among investors might not be as optimistic. According to Santiment’s “Weighted Sentiment” data presented in the graph, however, investors seem to experience a fear of missing out (FOMO) regarding this asset.

In the past, Bitcoin has often gone against the conventional wisdom, with fear (FUD) serving as a catalyst for uptrends to begin. Conversely, greed (FOMO) has typically marked the point where market peaks are likely to occur.

BTC Price

At the time of writing, Bitcoin is trading at around $64,700, up more than 7% over the past week.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

2024-04-25 06:04