In a recent post about Bitcoin on X, an expert has identified a significant on-chain indicator that could indicate a robust price surge, reminiscent of the remarkable growth seen in 2017. At present, Bitcoin’s prices are gradually increasing with no major jumps. Yet, unlike many anticipations, the coin did not experience sharp rises prior to the Halving event on April 20th.

Flow Indicator Dips: A Bull Run In The Making?

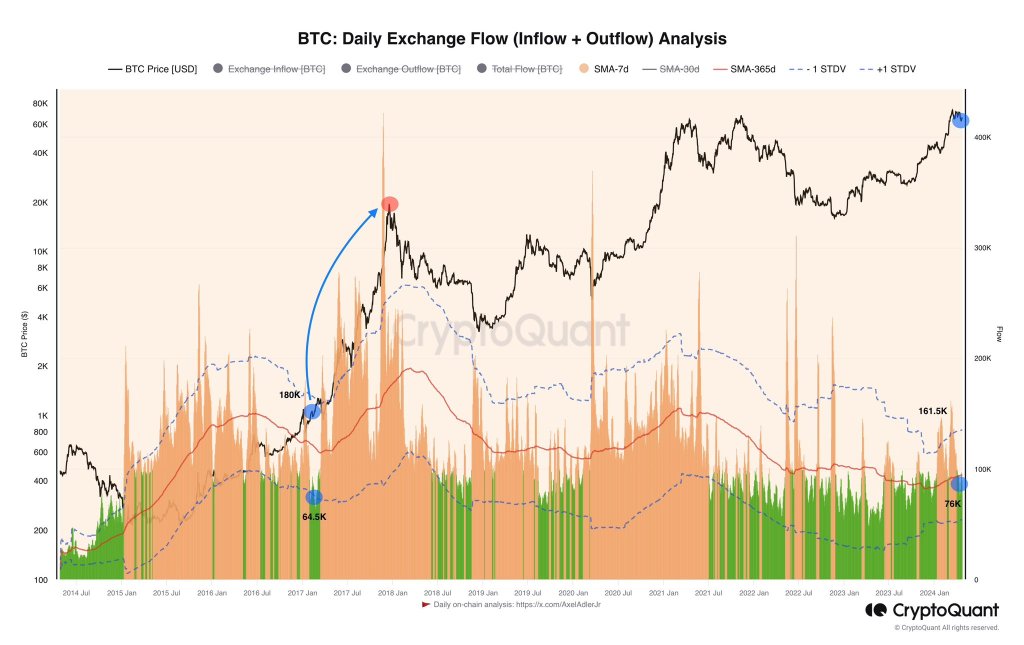

The analyst spoke with X about a significant decrease in the average Bitcoin flow rate observed at major crypto exchanges such as Coinbase and Binance over the past week. This revelation showed that the Bitcoin flow rate had plummeted from approximately 161,000 to around 76,000 BTC, representing nearly a 50% reduction.

Interestingly, a similar pattern emerged in 2017 before Bitcoin embarked on a historic bull run.

Approximately two months prior to the significant rise in Bitcoin prices to roughly $20,000 in December 2017, the Flow indicator, as reported by the analyst, had decreased to approximately 64,500 BTC in volume across exchanges.

Currently, Bitcoin’s future direction remains uncertain. The daily chart shows a bearish formation, with sellers currently having control over the market. Although prices increased after Halving Day on April 20, the April 13 bearish engulfing pattern still influences price action. A break above $68,000 could signal the start of a rally towards $74,000 in the near future.

Bitcoin Supply Rapidly Shrinking

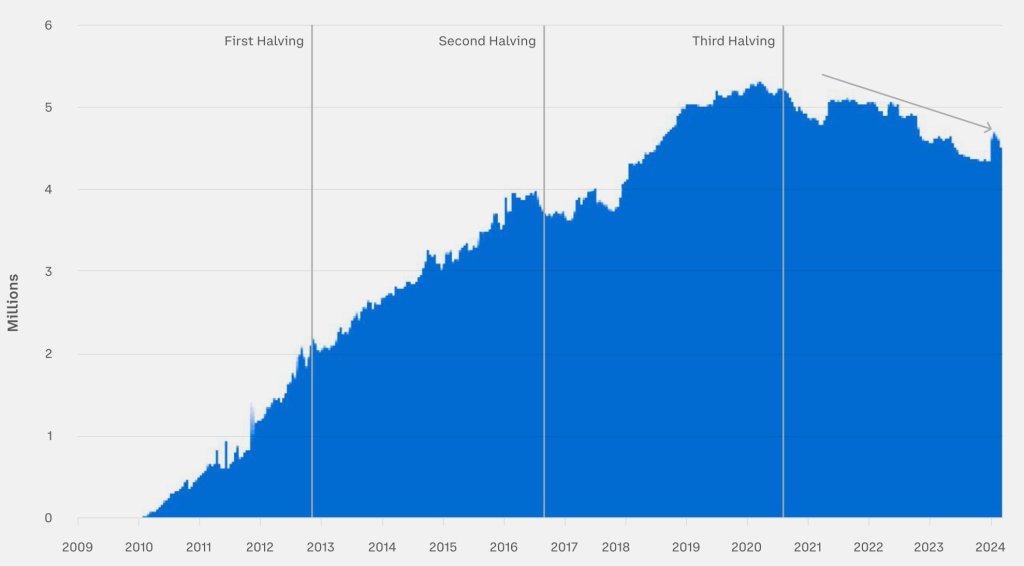

With the Flow indicator suggesting a decrease in Bitcoin circulation across exchanges, an analyst made an intriguing observation on platform X. They mentioned that the total available Bitcoin supply dropped below 4.6 million for the first time since before the April 20 network halving event, which reduced miner rewards.

The reduction in daily bitcoin emissions by half through halving means that if current demand remains constant, supply pressure could cause prices to rise. However, it’s important to note that whether Bitcoin’s price will increase or not depends on how quickly the immediate resistance levels are overcome.

Historically, bitcoin prices typically increase a few months following Halving Day. Yet, recently, there have been significant exceptions to this trend. Notably, prices reached unprecedented peaks prior to Halving Day – an occurrence never seen before.

The SEC gave its green light for the first Bitcoin spot ETFs offered by the United States in January 2024, allowing institutions easy access through share ownership. This development could significantly impact Bitcoin’s price trend during this period and potentially result in unprecedented market behavior.

Read More

- Gold Rate Forecast

- Green County secret bunker location – DayZ

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Green County map – DayZ

- Etheria Restart Codes (May 2025)

- How To Beat Gnoster, Wisdom Of Night In Elden Ring Nightreign

- Mario Kart World – Every Playable Character & Unlockable Costume

2024-04-23 22:16