The Glassnode co-founders’ official account on X (previously Twitter), named Negentropic, has expressed optimistic views regarding the cryptocurrency market.

Glassnode Cofounders: There Would Be A Massive Growth Beyond Recent Corrections

Based on their assessment, the cryptocurrency market, aside from the top 10, referred to as “Others,” is exhibiting robust upward momentum and may continue to increase in value.

After the Bitcoin Halving on April 20, which brought about more instability and unpredictability, the rewards given to miners for adding new blocks to the Bitcoin blockchain were decreased from 6.25 Bitcoins to 3.125 Bitcoins.

The co-founders noticed a fascinating trend in the market’s actions, drawing parallels between the present situation and the “significant downturn” experienced in early 2021, which they classified as the fourth wave in the market rhythm.

The #Crypto Bull Market Continues.

“OTHERS” follows Crypto excl. the largest 10 Cryptos.

In early 2021, we experienced a significant market correction which we think was a wave 4. Currently, we are facing another strong downturn.

More upside is coming. This index and our Fibonacci levels…

— 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) April 22, 2024

According to Glassnode’s co-founders, who rely on the index and Fibonacci benchmarks, there is an estimated potential rise of around threefold from the present market prices.

There’s significant potential for gains ahead, as indicated by this index and our Fibonacci analysis, suggesting approximately a 350% increase from current prices.

In other words, this optimistic forecast highlights their belief in the market’s ability to grow even more, despite some recent setbacks.

Crypto Market Recovery Amid Bitcoin Criticism And Post-Halving Predictions

The Glassnode co-founders have forecasted a large expansion for the cryptocurrency market. However, it’s crucial to remember that the market mood remains optimistic overall. Following a considerable drop the previous week, the worldwide crypto market is exhibiting signs of bouncing back, registering approximately a 3% growth in the last 24 hours.

The rise during this timeframe can be linked back to significant cryptocurrencies, including Bitcoin and Ethereum, achieving increases of 2.7% and 1.7% respectively.

Recently, Bitcoin, the leading digital currency, has been subjected to criticism from notable personalities such as Peter Schiff. He has voiced concerns over its relatively expensive transaction fees and slower processing times.

A single Bitcoin transaction currently costs around $128 and takes approximately thirty minutes to be processed. This issue underscores the fact that Bitcoin fails to operate effectively as a digital currency due to its excessively high usage cost for most transactions.

— Peter Schiff (@PeterSchiff) April 22, 2024

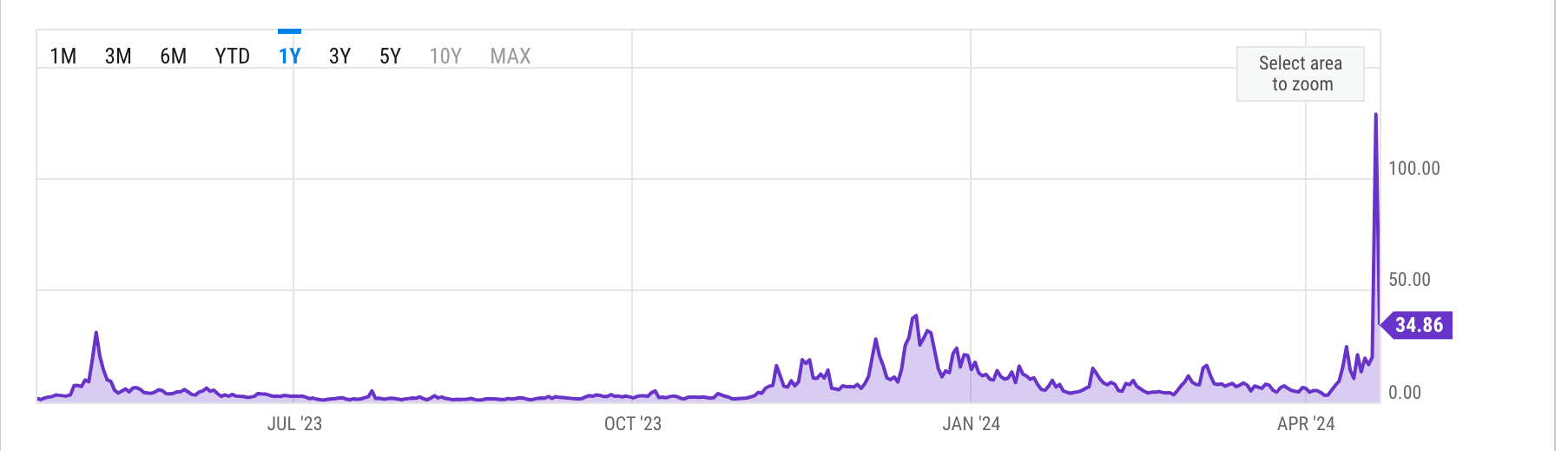

Because of these difficulties, Schiff categorized Bitcoin as a “flop” in the realm of digital currencies. Yet it’s important to mention that the average Bitcoin transaction fee dropped to $34.86 on April 21, marking a substantial decrease from its previous peak of $128.45 the day prior.

Currently, Charles Edwards, an analyst and founder of Capriole Investment fund, has proposed three potential outcomes for Bitcoin following the halving event.

Edwards pointed out that the electrical expense to create a new Bitcoin coin had risen to an astounding $77,400, and the total miner revenue, combining block rewards, fees, and transaction costs, reached an impressive $244,000.

Edwards anticipates that the value of Bitcoin could significantly increase by up to 15%, causing some miners to halt their activities. Alternatively, transaction fees might stay high. Edwards believes that a mix of these possibilities will ensue, resulting in Bitcoin’s price exceeding $100,000.

Read More

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- The First Descendant fans can now sign up to play Season 3 before everyone else

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-04-23 06:04