The chief researcher at CryptoQuant’s on-chain analysis company shares his perspective on why Bitcoin sellers may be decreasing in number.

Bitcoin Short-Term Holder Realized Price Has Risen To $60,000

In his latest blog post on X, CryptoQuant research chief Julio Moreno explains why the selling pressure from Bitcoin owners with short-term holdings might be decreasing. These “short-term holders” are individuals who have possessed Bitcoin for under 155 days.

The STHs refer to active traders in the market who frequently buy and sell cryptocurrencies within short timeframes. Unlike long-term investors (HODLers), they are less inclined to hold onto their coins for extended periods. As a result, they can be quite sensitive to market fluctuations, often selling in haste during market downturns or rallies.

In simple terms, if investors who are making a profit from their cryptocurrency investments are more inclined to sell, then assessing whether large holders (STHs) might join a selling frenzy can be done by looking at their profit or loss ratio.

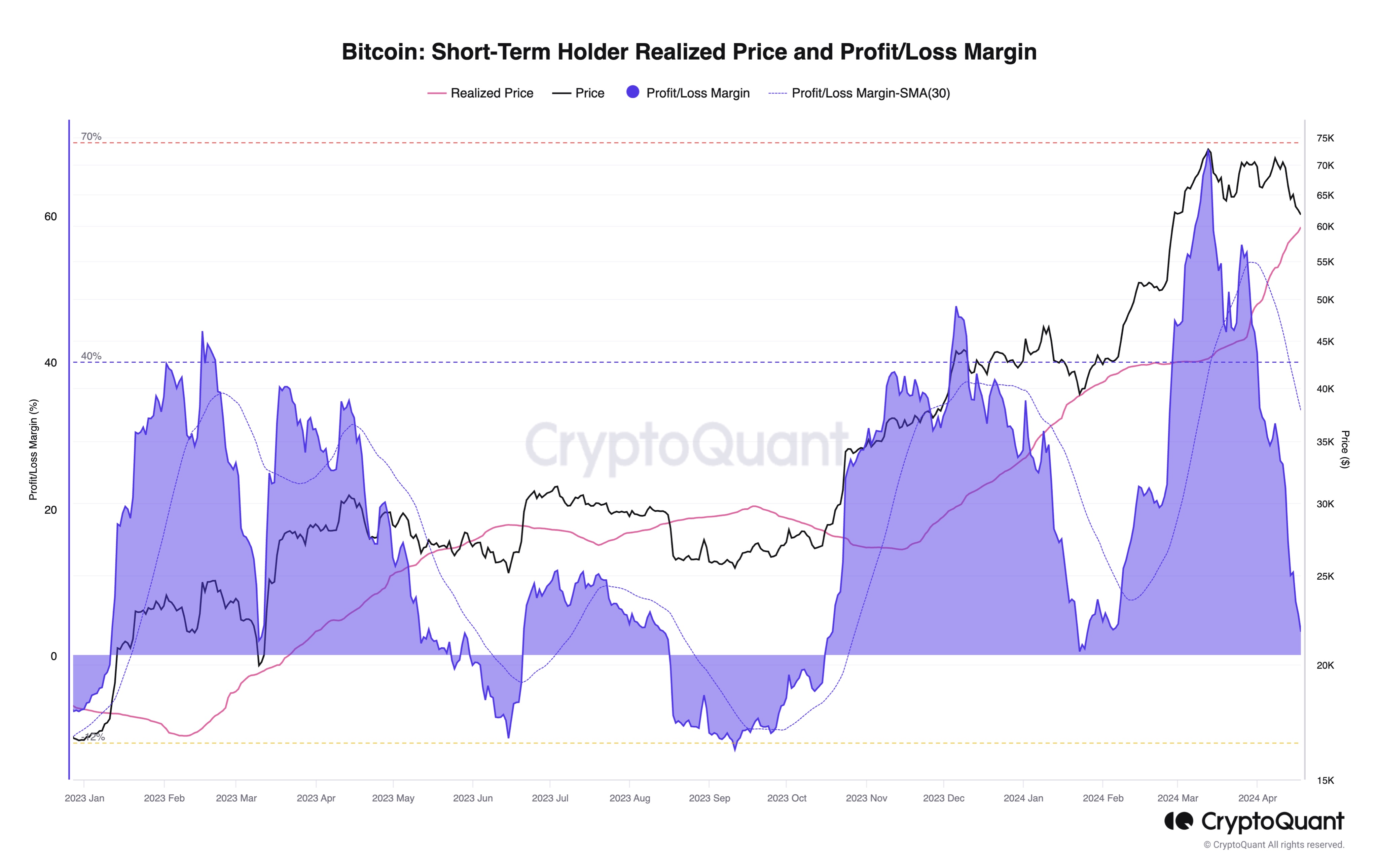

Here, Moreno has cited the profit/loss margin of this cohort based on its realized price.

In simpler terms, the indicated price (marked in pink) for the STH is the typical purchase price for these investors based on their transaction records in the blockchain.

If the current market price of the cryptocurrency is higher than this figure, then its holders collectively have realized gains at present. Conversely, a price level below this indicator suggests that overall losses prevail.

Based on the graph, Bitcoin has exceeded its simple moving average realized price over the past several months. This implies that traders holding Bitcoin have reaped profits during this period.

During bull markets, it’s common for prices to continuously rise, enabling investors to earn profits. However, extended profit-making can increase the likelihood of market peaks occurring. STHs (Smart money, Trend following Traders, or Strong Hands) usually remain in the profitable position during such periods. Yet, the potential for market tops arises when profits become excessively high.

In the graph, you can see that the profit/loss margin reached considerable heights around the same time Bitcoin established its most recent record high, a peak that has remained the highest so far.

In recent times, Bitcoin’s stability between $60,000 and $70,000 has led to a swift increase in the realized price for Strong Hands (STH) investors. Currently, their realized price hovers around $60,000. The reason being, as STHs have been actively trading within this range, their initial purchase costs have been adjusted to these newer, higher prices, consequently elevating the average.

Bitcoin’s price has hovered around this point lately, which could mean that large-scale investors aren’t sitting on significant profits currently. According to CryptoQuant’s analysis, the decrease in selling pressure from traders might be due to the fact that their unrealized gains have almost vanished.

BTC Price

Bitcoin’s price remains stable within its current price bracket, hovering around the $65,200 mark.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- How to unlock Shifting Earth events – Elden Ring Nightreign

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- Who Is Stephen Miller’s Wife? Katie’s Job & Relationship History

- Green County secret bunker location – DayZ

- The Righteous Gemstones Season 4: What Happens Kelvin & Keefe in the Finale?

2024-04-20 02:11