Based on the assessment of experts at Bitfinex, the behavior of Bitcoin on trading platforms resembles the last days of December 2020, implying that a new period of expansion could be underway.

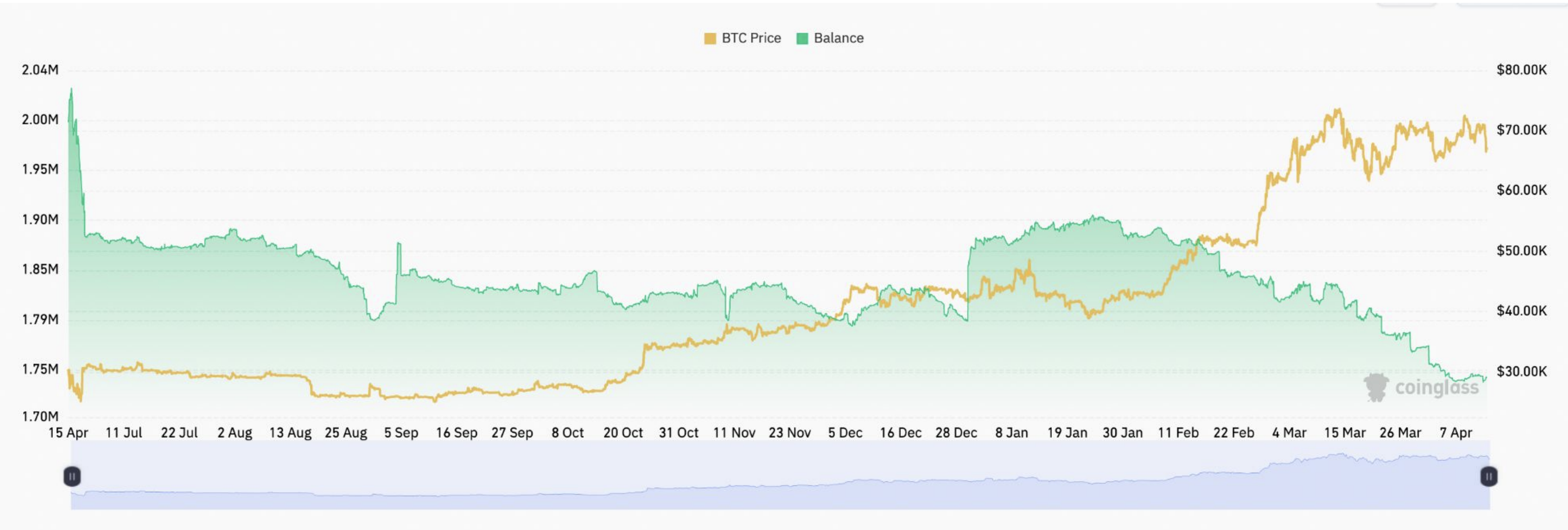

In simpler terms, the newest data from the cryptocurrency exchange reveals a substantial decrease in the amount of Bitcoin owned by long-term investors and kept in centralized platforms, marking the smallest quantity seen in the past 18 months.

According to analysts, this current trend and the upcoming halving event increase the likelihood of additional price increases.

Potential Growth On The Horizon

The Bitfinex Alpha report highlights the decreasing amount of bitcoin that has been inactive for over a year, with a significant portion belonging to long-term holders. This trend suggests that these investors may be selling or moving their bitcoins away from exchanges.

Understanding the price movements of Bitcoin is crucial, and these actions become even more important as the halving event draws near.

As more Bitcoins are moved out of centralized exchanges and the amount of inactive supply decreases, Bitfinex analysts predict “possible price increases” based on past market trends before the major Bitcoin rally in late 2020.

In simpler terms, the data from CryptoQuant aligns with Bitfinex’s finding that there has been a significant decrease in Bitcoin held in exchanges since last year, going from around 2.8 million to 1.94 million currently. This reduction implies that a large amount of Bitcoin is being taken out of exchange wallets and possibly moved to other types of wallets or used for transactions.

Bitcoin Latest Price Action

Recently, Bitcoin’s price has dropped significantly. This downturn started around late last Friday and continued over the weekend. The cryptocurrency that is typically at the top of the market chart fell from approximately $70,000 to a low of around $62,000.

Significantly, the asset has seen a decline over the last 24 hours, dropping by 4.6%, and more than 10% over the past week. Consequently, its current price stands at $62,034.

In the midst of Bitcoin’s price fluctuations, there are indications of fear among traders. Notably, Whale Alert reported a large transaction where 7,690 BTC, equivalent to $483 million, were moved to Coinbase, the leading cryptocurrency exchange in the US.

7,690 #BTC (483,425,557 USD) transferred from unknown wallet to Coinbase Institutional

— Whale Alert (@whale_alert) April 16, 2024

The source of the cryptic address “1Eob1” is unknown, but it’s worth noting that transactions leading to exchanges can indicate an intention to sell. Such activity usually signals a readiness to dispose of assets in the crypto market.

If the entity handling the Bitcoin transfer chooses to sell all their deposited BTC, this could significantly impact the larger Bitcoin market.

Read More

- Sabrina Carpenter’s Response to Critics of Her NSFW Songs Explained

- Dakota Johnson Labels Hollywood a ‘Mess’ & Says Remakes Are Overdone

- Gold Rate Forecast

- Eleven OTT Verdict: How are netizens reacting to Naveen Chandra’s crime thriller?

- What Alter should you create first – The Alters

- ‘Taylor Swift NHL Game’ Trends During Stanley Cup Date With Travis Kelce

- How to get all Archon Shards – Warframe

- All the movies getting released by Dulquer Salmaan’s production house Wayfarer Films in Kerala, full list

- What’s the Latest on Drew Leaving General Hospital? Exit Rumors Explained

- Nagarjuna Akkineni on his first meeting with Lokesh Kanagaraj for Coolie: ‘I made him come back 6-7 times’

2024-04-17 03:04