During the past weekend, the Bitcoin (BTC) market price plummeted to $60,000, causing unease among crypto community members. Some investors grew concerned as they anticipated the upcoming “Halving” event and wondered if this dip signaled potential issues for Bitcoin.

During the recent corrections, Bitcoin skeptic Peter Schiff maintained that his earlier forecasts about Bitcoin spot ETFs (exchange-traded funds) were accurate and hinted at a potential significant decline for Bitcoin.

Peter Schiff’s Doomsday Prediction For Bitcoin

In March, economist Peter Schiff, a well-known critic of Bitcoin, expressed his concerns regarding Bitcoin ETFs. He believed that a major issue with investing in these products was the restriction of liquidity to US trading hours. This means that investors would be unable to sell if the market took a downturn during off-hours.

If Bitcoin begins to decline in value tonight, those who own Bitcoin ETFs are powerless to intervene until the New York Stock Exchange reopens the next morning. Consequently, those holding Bitcoin ETFs will endure a lengthy night filled with anxiety, hoping that the value of Bitcoin doesn’t plummet before they can execute any potential sales.

— Peter Schiff (@PeterSchiff) April 14, 2024

On Sundays afternoon, Schiff predicted that Bitcoin ETF investors would be powerless if Bitcoin began to drop significantly that very night. At the time of his statement, Bitcoin was valued around $63,460, but it rebounded within an hour and traded above the $65,000 threshold.

Previously in the day, Schiff identified a crucial level for Bitcoin’s price at around $60,000. In his expert opinion, if BTC dropped below this point, it might result in a significant trend reversal, forming a “potent triple top.” Consequently, such a development could potentially trigger a sharp decline to the price range of $20,000.

After outlining a grim prediction, Schiff explained that MicroStrategy would face a significant loss of approximately $2.7 billion on their 214,000 Bitcoins, purchased at an average cost of $34,000 each. However, he also speculated that Bitcoin’s price might rise before experiencing a potential decline.

Analysts Unfazed By BTC’s Correction

Multiple experts agreed that the price adjustment was merely a “minor setback” considering the bigger perspective. As per MacroCRG’s assessment, Bitcoin’s graph is “stunning.” The analyst expressed: “Despite launching a major attack, they only managed to touch the lower boundary of the range.”

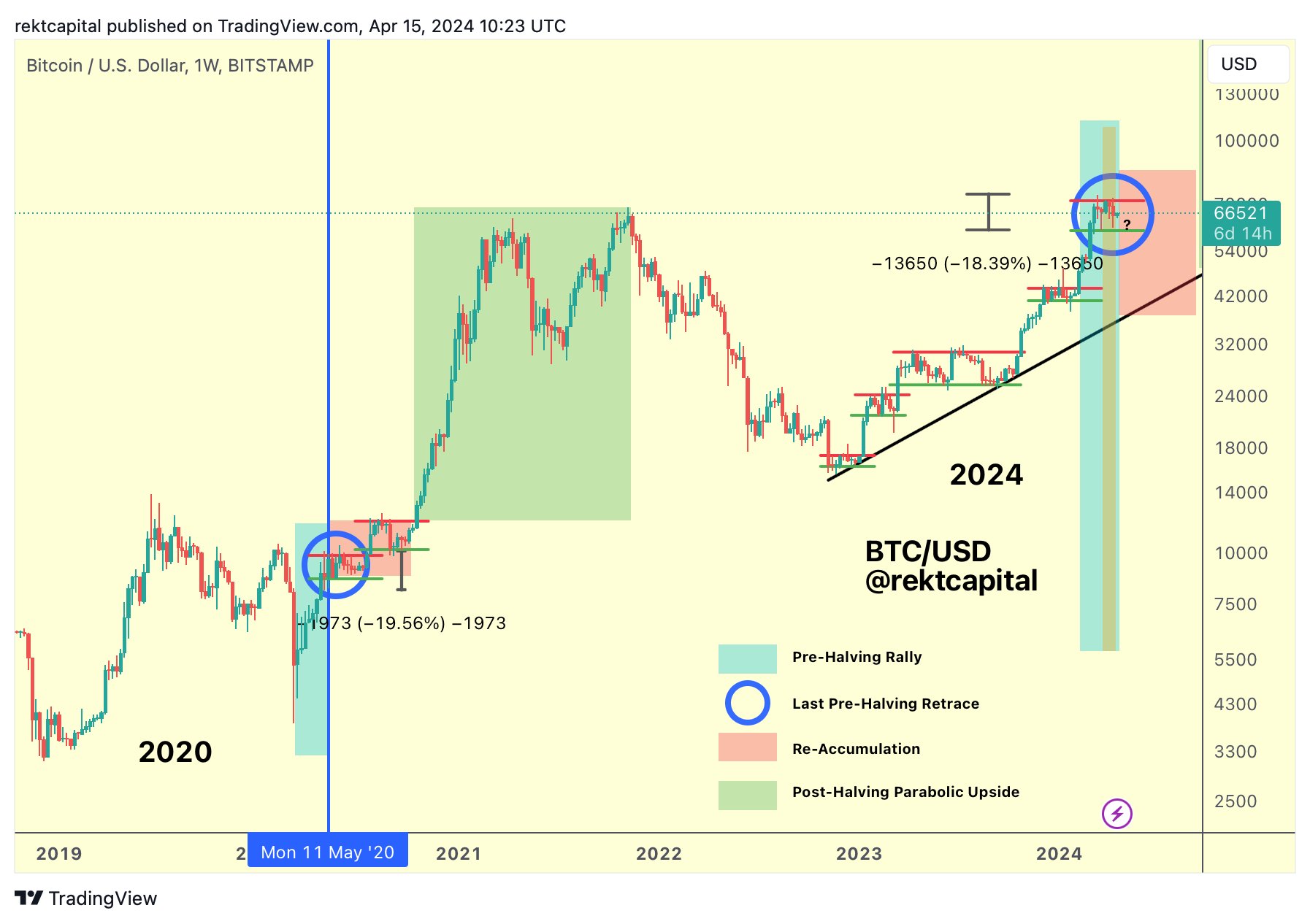

In the same vein, Rekt Capital, a well-known Bitcoin trader and analyst, believes that Bitcoin managed to hold its lower boundary within its consolidation phase during the initial days of the Bitcoin Halving event.

According to the analyst’s analysis, Bitcoin is currently in the “final dip before the halving” during the “pre-halving surge.” If past trends hold true, after April 19, Bitcoin is expected to enter a “reaccumulation period,” following which there may be a “parabolic rise post-halving.”

Additionally, Crypto Jelle advised investors against selling during market fluctuations, believing that Bitcoin is currently stabilizing above its prior peak prices. He remains confident in his projection of Bitcoin reaching $82,000 following the upcoming “Halving” event.

Despite the recent correction, Jelle maintains a more ambitious goal for this bull market, with the bullish megaphone pattern on Bitcoin’s chart suggesting a potential peak of $180,000. The analyst remains confident that the meme pattern may recur.

The correction led to significant losses for BTC over several periods. In the last week and month, BTC experienced drops of 8.4% and 3.1%, respectively. Moreover, there was a notable decrease in market activity within the past day, with a trading volume of $42.56 billion – a 32.1% reduction.

Despite a 3.5% drop in price over the past day, Bitcoin is now priced at $66,275. This represents a significant improvement from its recent low, where it had corrected by 10.3%, resulting in an uptrend to its current value.

Read More

- Is Average Joe Canceled or Renewed for Season 2?

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- All Elemental Progenitors in Warframe

- How to get all Archon Shards – Warframe

- Where was Severide in the Chicago Fire season 13 fall finale? (Is Severide leaving?)

- A Supernatural Serial Killer Returns in Strange Harvest Trailer

- Inside Prabhas’ luxurious Hyderabad farmhouse worth Rs 60 crores which is way more expensive than SRK’s Jannat in Alibaug

- Analyst Says Dogecoin Has Entered Another Bull Cycle, Puts Price Above $20

- Superman’s James Gunn Confirms Batman’s Debut DCU Project

- Mindhunter Season 3 Gets Exciting Update, Could Return Differently Than Expected

2024-04-16 03:04