Over the last several weeks, the surging price of Bitcoin has lost steam, raising doubts about the continuation of its bullish trend. On April 12, there was a sudden market downturn that led Bitcoin’s value to plummet from around $70,000 to below $67,000.

The current drop in Bitcoin’s price serves as a reminder of its difficulty to reach its previous record high of $73,737, achieved in mid-March. According to the analytics company Santiment, there is a specific Bitcoin indicator that could indicate the start of another bull market.

Bitcoin Bull Run May Resume If This Metric Falls

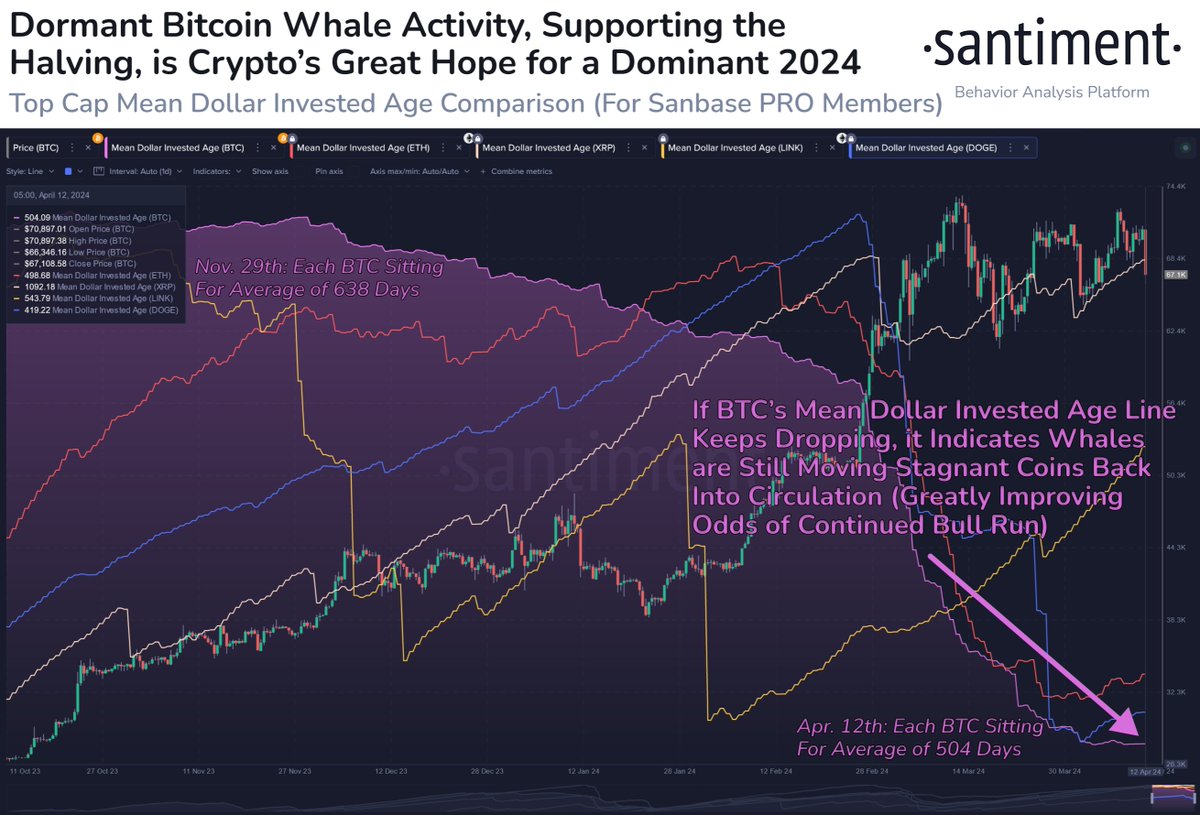

Santiment, a well-known blockchain analytics company, recently shared some intriguing information about Bitcoin’s current cycle and pricing trends in a blog post. They identified the Mean Dollar Invested Age metric as an important factor to keep an eye on while Bitcoin hovers around the sideways trend.

Based on Santiment’s analysis, the Mean Dollar Invested Age metric signifies the typical age of an investment in a specific asset that remains in the same digital wallet. An increasing Mean Dollar Invested Age suggests that investments are becoming less active and older coins are being kept in the same wallets for longer periods.

In other words, when the Mean Dollar Invested Age metric is declining, it means that older investments are being sold and reinvested more frequently. This trend indicates a heightened level of activity within the investment network.

Looking back historically, Bitcoin’s Average Dollar Age (the amount of time each dollar spent in the Bitcoin market) has been declining during past bull markets. Based on Santiment’s analysis, this trend has continued in the ongoing bull run that began in late October 2023.

Over the last few weeks, Bitcoin’s Mean Dollar Invested Age trend on the on-chain analytics platform has remained stable. Surprisingly, this occurs just days before the much-awaited halving event.

The Bitcoin reward for miners will be reduced by half during the halving, from 6.25 BTC to 3.125 BTC. This event is generally viewed positively by investors and is a significant reason for their bullish sentiment towards Bitcoin in the year 2024.

Based on Santiment’s most recent analysis, it could be worthwhile for investors to monitor Bitcoin’s Mean Dollar Invested Age metric. A potential bull market may persist if the BTC‘s Mean Dollar Invested Age trend descends once more, signaling that significant investors (such as whales) are re-entering the market by transferring their coins.

BTC Price At A Glance

At present, Bitcoin is approximatedly priced at $66,548, representing a significant 6% decrease in value over the previous 24-hour period.

Read More

- Ana build, powers, and items – Overwatch 2 Stadium

- Oblivion Remastered—what does it actually change?

- The Hunger Games: Sunrise On the Reaping Finally Reveals Its Cast and Fans Couldn’t Be Happier

- The White Lotus’ Aimee Lou Wood’s ‘Teeth’ Comments Explained

- One Piece Chapter 1140 Spoilers & Manga Plot Leaks

- Florida’s Alex Condon Suffers Ankle Injury vs. Mississippi State

- Black Panther: Damson Idris Jokes About Rejecting T’Challa’s Role & James Bond

- Jade Cargill’s WWE TV Return: Huge Update on Her Creative Plans

- Peaky Blinders Creator Gives Exciting Movie Release Update, Teases Future Projects

- Mei build, powers, and items – Overwatch 2 Stadium

2024-04-13 14:10