Bitcoin is surging towards new all-time highs with prices climbing higher, and one market analyst believes that $150,000 could be a likely post-halving price for Bitcoin based on its historical trends. This optimistic perspective is expressed by the analyst in a recent post, where they outline several key fundamental factors that could potentially push the most valuable cryptocurrency even further up, surpassing current market rates by more than double.

At present, the preferred direction for buyers is north. They have gained confidence following the volatile trading in the previous month, using the strong March 2020 bull trend as a reference point.

April 8 saw Bitcoin’s price surge past the significant selling point of approximately $71,800. Although Bitcoin has since calmed down, its upward trend continues, potentially leading to another price jump over $74,000.

To have bulls in charge and in agreement with the analyst’s perspective, it is essential that the price increase initiated on April 8 continues, preferably accompanied by a rise in trading activity. This may stimulate demand and propel Bitcoin above $74,000 to reach new highs for 2024 before the anticipated Halving event takes place.

Eyes On Bitcoin Halving: A Supply Squeeze In The Making?

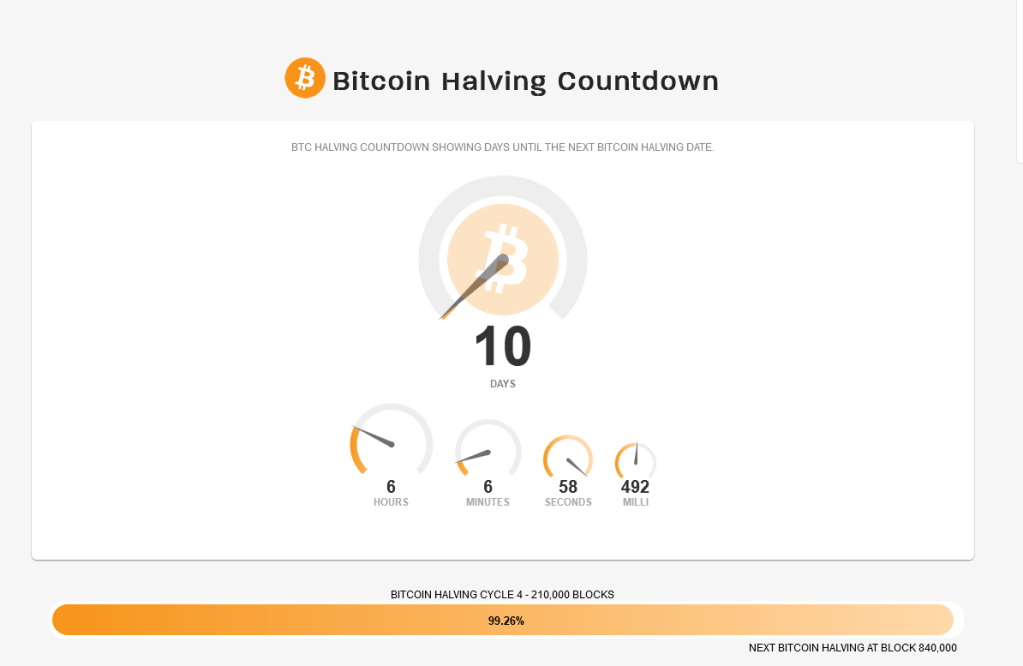

The “Halving” event, which is only a few days away, plays a significant role in the possible price increase of Bitcoin. This is a built-in process that reduces the reward for mining new blocks on the network from 6.25 to 3.125 Bitcoins.

The decrease in supply, along with continuous market interest, could lead to fewer Bitcoins being available, possibly resulting in an increase in its value.

Before Bitcoin’s upcoming halving, analysts have noticed that the amount of Bitcoins held by exchanges is decreasing. For instance, Coinbase currently has the least amount of Bitcoins in its possession over the past six years. This trend isn’t limited to just Coinbase; major exchanges like Binance are also experiencing a decrease in their Bitcoin supply.

Simultaneously, it is reported that OTC Bitcoin desks, responsible for larger, private cryptocurrency deals, are facing a shortage of Bitcoin. This could be an indication of robust institutional interest, potentially leading to a tighter Bitcoin supply situation that may further tighten in the upcoming months.

Impact Of Spot BTC ETFs: London, Hong Kong In The Picture

Currently, Bitcoin ETF issuers have been aggressively purchasing around $300 million worth of Bitcoin daily, as reported by the analyst. This action is being taken on behalf of investors, including retail and institutional ones, leading to a significant influx of capital into the market and a positive impact on prices.

In Q4 2023 through early January, Bitcoin experienced a significant increase, largely due to the expected launch of Bitcoin spot ETFs. The subsequent influx of funds led to improved liquidity and enhanced resilience for BTC in the face of aggressive selling.

The London Stock Exchange intends to introduce Bitcoin-backed exchange-traded notes (ETNs) for trading in the second quarter of 2024. These ETNs function similarly to US spot ETFs, increasing market liquidity and acknowledging Bitcoin as a valuable asset class akin to gold.

In Asia, it’s expected that the Securities and Futures Commission (SFC) of Hong Kong will give their approval to several Bitcoin spot ETFs. Notable applicants for this inclusion are some prominent Chinese asset management firms.

Read More

- Gold Rate Forecast

- ‘iOS 18.5 New Emojis’ Trends as iPhone Users Find New Emotes

- Who Is Stephen Miller’s Wife? Katie’s Job & Relationship History

- Dig to Earth’s CORE Codes (May 2025)

- Love Island USA Season 7 Episode 2 Release Date, Time, Where to Watch

- POPCAT PREDICTION. POPCAT cryptocurrency

- The Righteous Gemstones Season 4: What Happens Kelvin & Keefe in the Finale?

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- [Mastery Moves] ST: Blockade Battlefront (March 2025)

- Green County map – DayZ

2024-04-09 20:10