As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous market cycles and trends. The current Bitcoin rally, reaching new all-time highs, is reminiscent of the late 90’s dotcom bubble for me – a wild ride that ended abruptly but left behind a few gems.

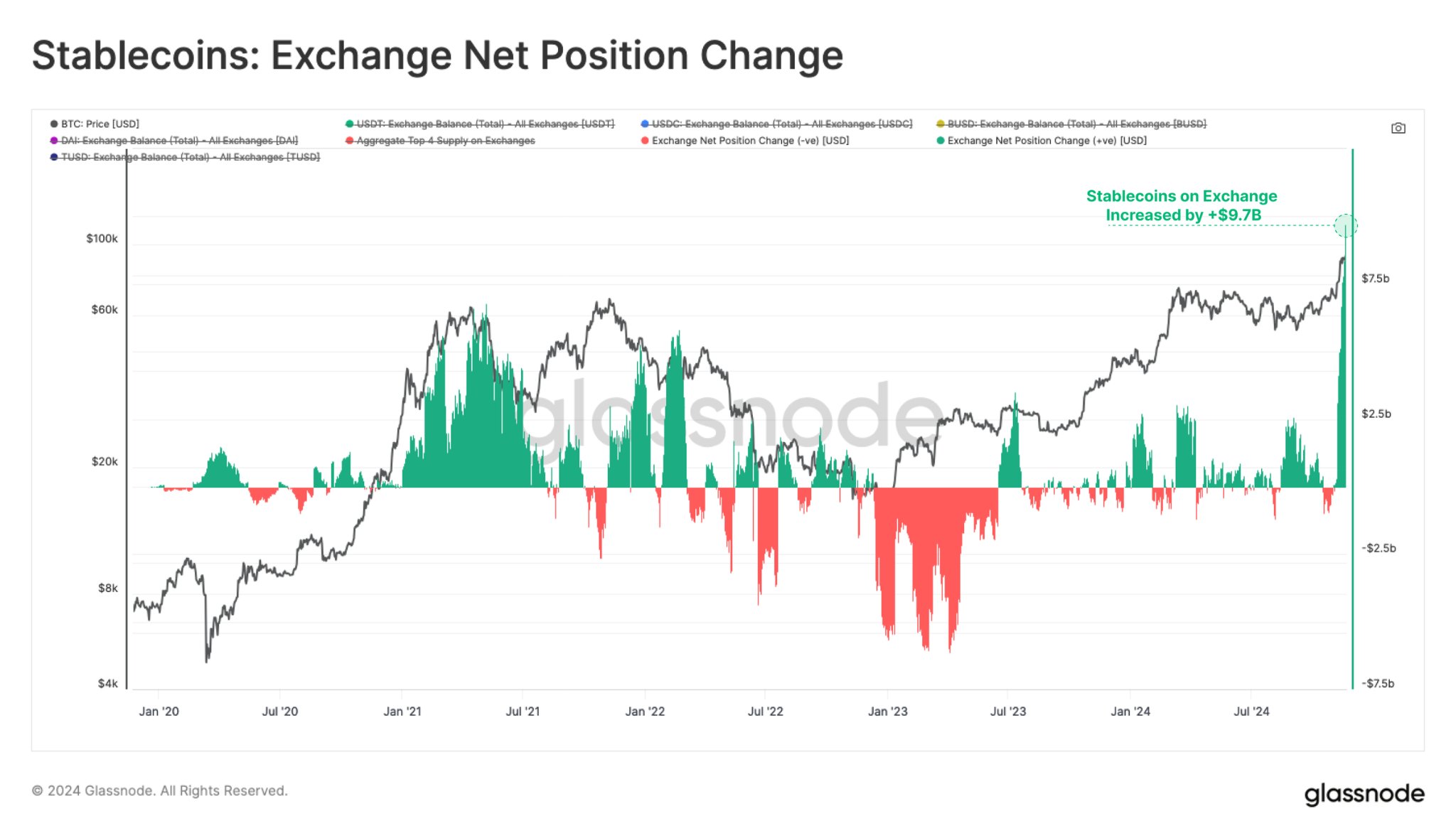

Over the past day, Bitcoin price soared by an additional 5%, reaching a fresh peak of around $97,500. The substantial inflow of $9.7 billion into stablecoins over the last month indicates growing investor enthusiasm for the market, suggesting that the Bitcoin rally may persist.

In the past month, almost $10 billion has flowed into stablecoins, indicating a surge in investor interest, as stated by Leon Waidmann, the head of research at The Onchain Foundation.

In the past month, a record-breaking $9.7 billion of stablecoins have flowed into cryptocurrency exchanges – marking the highest monthly influx ever observed! This surge indicates that stablecoin liquidity has returned, and the demand for speculative investment remains at an all-time high!

Courtesy: Leon Waidmann

An increase in steady flows of stablecoins into cryptocurrency platforms could signal impending buying pressure and an expanding interest from investors. This is because stablecoins function as the main entry point for exchanging traditional (fiat) money into digital currencies.

Based on the significant surge in stablecoin inflows, there’s a strong possibility that the price of Bitcoin may breach the $100,000 threshold imminently. According to crypto market analyst Ali Martinez, this milestone could be reached as early as today, given Bitcoin’s breakout from the bull flag in the hourly chart.

Today, there’s speculation that Bitcoin ($BTC) might soar up to $100,000, given its apparent breakout from a bullish pattern known as a “bull flag” on lower timeframes.

— Ali (@ali_charts) November 21, 2024

Bitcoin Price Going to $135,000 with Stablecoin Support?

Based on today’s market trends, crypto analysts are becoming optimistic about Bitcoin, suggesting the upward trend may persist even more. Analyst Ali Martinez has found similarities in Bitcoin’s current market dynamics and its behavior in December 2020, particularly pointing out that the Relative Strength Index (RSI) is remarkably similar to that period. If past trends continue, Martinez foresees Bitcoin potentially reaching $108,000, then dipping to $99,000 before climbing back up to $135,000.

Courtesy: Ali Charts

Other financial experts, such as Peter Brandt, have observed that Bitcoin’s price trend following the US election results on November 5th. Over the past fortnight, Bitcoin has experienced a sharp surge from approximately $65,000 to its current level. After briefly stabilizing around $90,000, Bitcoin has made a powerful breakaway, which could potentially push it towards $125,000 and beyond.

Courtesy: Peter Brandt

Conversely, Bitcoin exchange-traded funds (ETFs) in the U.S., such as BlackRock’s IBIT, are contributing significantly to Bitcoin’s price surge. Yesterday, November 20, these ETFs recorded approximately $773 million in net investments, with BlackRock’s IBIT alone attracting $662 million. The introduction of options for BlackRock’s IBIT the day prior sparked substantial trading activity on its debut, indicating robust interest in this product.

For six consecutive weeks, U.S. Bitcoin Exchange-Traded Funds (ETFs) have seen a net increase in investments, amassing over $1.67 billion during the trading period from November 11th to November 15th.

According to data from CoinGlass, the Bitcoin futures open interest (OI) on the Chicago Mercantile Exchange (CME) hit a new peak of 218,000 BTC ($21.3 billion), reflecting a rise of more than 30% since before the November 5 election. This substantial increase suggests strong optimistic feelings about Bitcoin’s price direction.

Read More

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Brody Jenner Denies Getting Money From Kardashian Family

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- Connections Help, Hints & Clues for Today, June 17

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

2024-11-21 15:36