As an experienced observer of the cryptocurrency market, I find Santiment’s analysis intriguing. The MVRV ratio model they use is a valuable tool for assessing the potential profitability or loss-making status of altcoins, providing insights into investor sentiment and market conditions.

According to the on-chain analysis firm Santiment, approximately 85% of all altcoins presently fall into the historically favorable investment range.

MVRV Would Suggest Most Altcoins Are Ready For A Bounce

As a researcher studying the cryptocurrency market, I’d like to bring your attention to a recent post by Santiment on platform X. In this post, they delved into the current state of the altcoin market using their MVRV ratio model. The “Market Value to Realized Value (MVRV) ratio” is an essential on-chain metric that provides insight into the relationship between a coin’s market capitalization and its realized capitalization for Bitcoin.

The market capitalization refers to the total value of an asset’s circulating supply, calculated based on its current market price. On the other hand, on-chain capitalization is a model that calculates an asset’s value by using the last transaction price on the blockchain as an estimation of the coin’s true worth in circulation.

In simpler terms, the price of a coin during its last transaction serves as its current purchase price. Therefore, the total value representing the purchase prices of all tokens in circulation is referred to as the realized capital.

One perspective on the model is that it represents the entire investment made by investors in the asset. On the other hand, market capitalization signifies the current worth held by the asset’s owners.

The MVRV (Money-Weighted Average Value) ratio serves as an indicator by comparing the current value of bitcoin investments with their original purchase price. A higher MVRV ratio signifies that investors have realized greater returns, surpassing their initial investment amount. Conversely, a lower MVRV ratio implies that investors presently hold fewer gains than their initial outlay.

From an analytical perspective, I’ve observed historically that periods of substantial gains for investors may signal the approach of potential tops. This is because heightened profit-taking can significantly increase risk, leading markets to become vulnerable to price reversals. Conversely, prolonged periods of losses might indicate impending bottom formations as market selling pressure begins to wane.

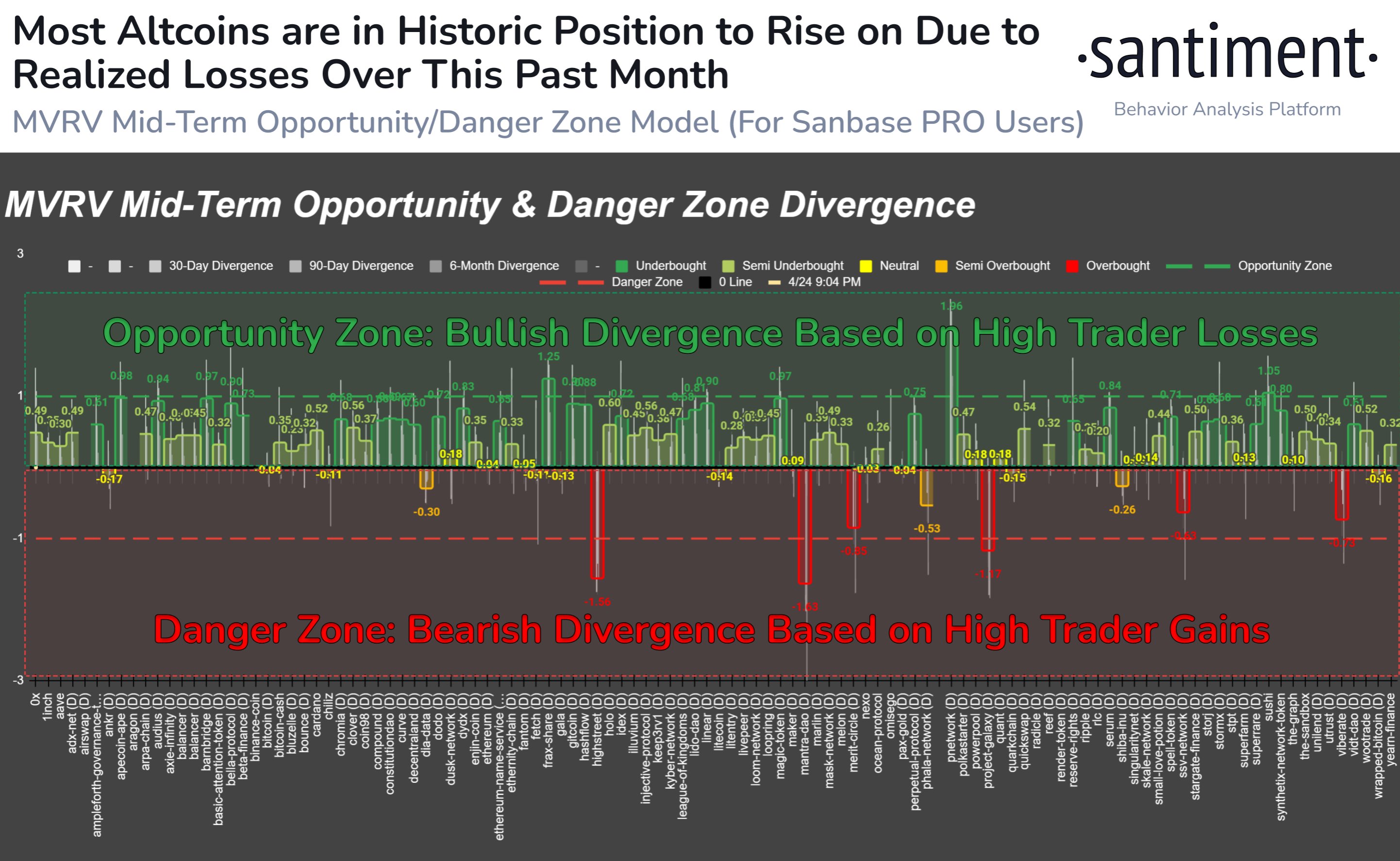

According to Santiment’s analysis, there is a designated “opportunity” and “risk” area for altcoins based on the given data. The following chart illustrates the current market status using their Multi-VDG Ratio Value (MVRV) model.

From an analyst’s perspective, I would interpret this model as follows: When the MVRV divergence for a specific asset exceeds 1 on a given timeframe, I consider it a bullish sign and potentially a good buying opportunity. Conversely, if the MVRV divergence is below -1, it indicates a bearish trend and may suggest selling or avoiding that asset.

A significant portion of the market, according to the chart’s data, currently falls into the profitable range for the MVRV (Moving Average Realized Value) divergence indicator. This means that many assets are presenting opportunities for potential gains based on this specific technical analysis metric.

Approximately 85% of the tracked assets in our system exhibit historical potential for significant price appreciation when assessing the Market Value to Realized Value (MVRV) ratio of wallets’ returns over short-term periods such as 1 month, 3 months, and 6 months.

Thus, if the model is to go by, now may be the time to go around altcoin shopping.

ETH Price

The largest cryptocurrency besides Bitcoin, Ethereum, has experienced a 3% increase in value during the last week, reaching a new price point of $3,150.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Justin Bieber ‘Anger Issues’ Confession Explained

- All Elemental Progenitors in Warframe

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- Superman’s James Gunn Confirms Batman’s Debut DCU Project

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

2024-04-26 06:25