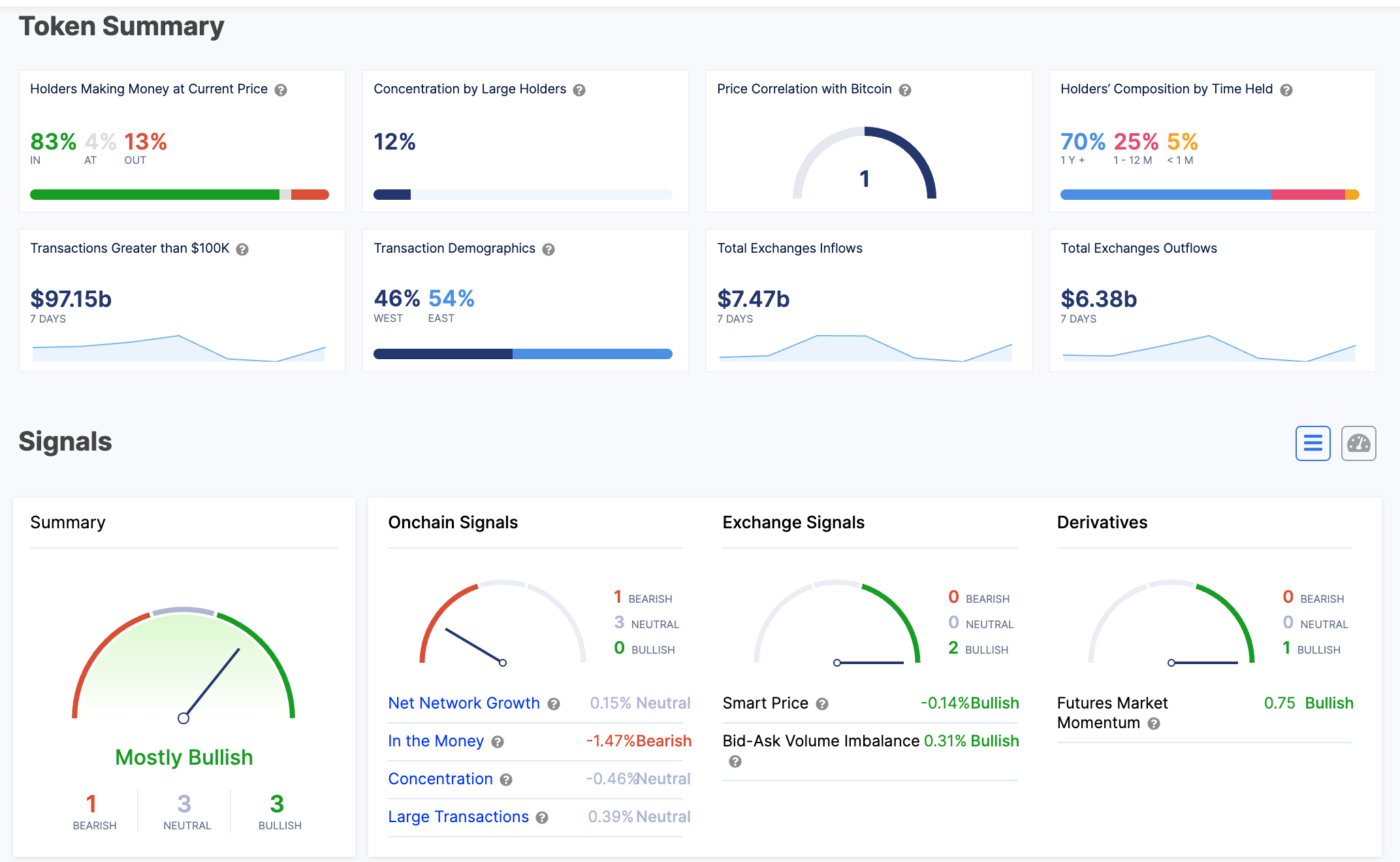

As a researcher with experience in the cryptocurrency market, I find it fascinating to see how Bitcoin holders have managed to maintain significant gains despite recent price drops. According to data from IntoTheBlock, approximately 83% of Bitcoin investors are currently in profit, which is a remarkable figure given the latest price drop below $60,000.

Over the past weekend, I observed a significant dip in Bitcoin‘s price, which fell below the $60,000 mark. This decline was driven by aggressive selling from prominent Bitcoin holders like the German and U.S. governments. The downward trend resulted in one of the most substantial drops for Bitcoin within the last two years, causing a massive financial loss for the market, approaching billions of dollars. Yet, amid this market turmoil, Bitcoin investors continue to experience considerable gains. A vast majority of them are currently in profit, even following the recent market crash.

Bitcoin Holders Enjoy Massive Gains

Based on information from the on-chain monitor IntoTheBlock, approximately 53.57 million individuals own Bitcoin globally. Among these owners, around 83% continue to experience a profit with Bitcoin’s current price hovering slightly above $56,000, having dipped below $60,000.

Approximately 83% of Bitcoin (BTC) holders are currently experiencing a profit, while roughly 17% are still underwater with their investments. Of this 17%, about 13% have incurred losses by purchasing their coins when the price was higher than the present value. The remaining 4% of holders find themselves at the breakeven point, as they bought their BTC around the current market price.

Approximately 44.61 million Bitcoin investors continue to experience gains on their investments, while approximately 6.8 million investors are currently facing losses, and about 2.16 million investors find themselves neither making a profit nor incurring losses.

It’s intriguing to note that most investors currently in a profitable position with Bitcoin purchased it for less than $50,000. Consequently, even if there is another 10% decrease from the current price, nearly all Bitcoin investors would still be enjoying profits on their holdings.

BTC Long-Term Holders At Risk Of Losses

As a researcher studying Bitcoin investment trends, I’ve observed that the overwhelming majority of investors continue to experience profits. However, a noteworthy development has emerged, specifically impacting those who have held Bitcoin for extended periods. Based on recent sentiment data from a comprehensive report, the average returns for long-term Bitcoin holders are at risk of dipping into negative territory for the first time in over a year.

Although the current price drop causes average long-term returns for Bitcoin (BTC) holders to turn negative, this isn’t a cause for concern based on past market behavior. According to Santiment, such situations often present opportunities to buy, particularly when Bitcoin’s 30-day and one-year MVRV (Maker’s Cost Basis Model Ratio of Market Price to Realized Price) are in the red. The analysis tool explains that these conditions indicate “buying relative to other traders’ pain,” which could potentially lead to profitable purchases.

In simpler terms, if you had purchased Bitcoin when both indicators showed negative readings in the past, your profit would currently be around 132%. Such occurrences may signal the potential end of a downtrend and an opportune moment for investment.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- The First Descendant fans can now sign up to play Season 3 before everyone else

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-07-10 05:10