As a seasoned researcher with years of experience in the crypto sphere, I find Patric H.’s analysis compelling and well-supported by the current market trends. His bullish outlook for Bitcoin this week resonates with my own observations and insights.

As a researcher exploring Bitcoin‘s price dynamics, I find myself in agreement with Patric H. from CryptelligenceX who recently presented an analysis on X. He has outlined seven compelling reasons that suggest a positive outlook for Bitcoin’s price this week. In light of the recent developments, it seems almost unfounded to maintain a bearish stance toward BTC.

#1 Mt. Gox Bitcoin Repayment Deadline Extension

The bankrupt cryptocurrency exchange Mt. Gox has successfully requested a court-approved extension for its repayment deadline, moving it from October 2024 to October 31, 2025. This means that creditors will now have an additional year to receive their refunds. This postponement helps alleviate the immediate concern of a massive Bitcoin sell-off, as approximately 44,905 BTC (approximately $2.9 billion) previously expected to enter the market over the next year has been delayed.

#2 China’s Economic Stimulus

As an analyst, I’m observing two significant developments:

#3 Declining Bitcoin Exchange Reserves

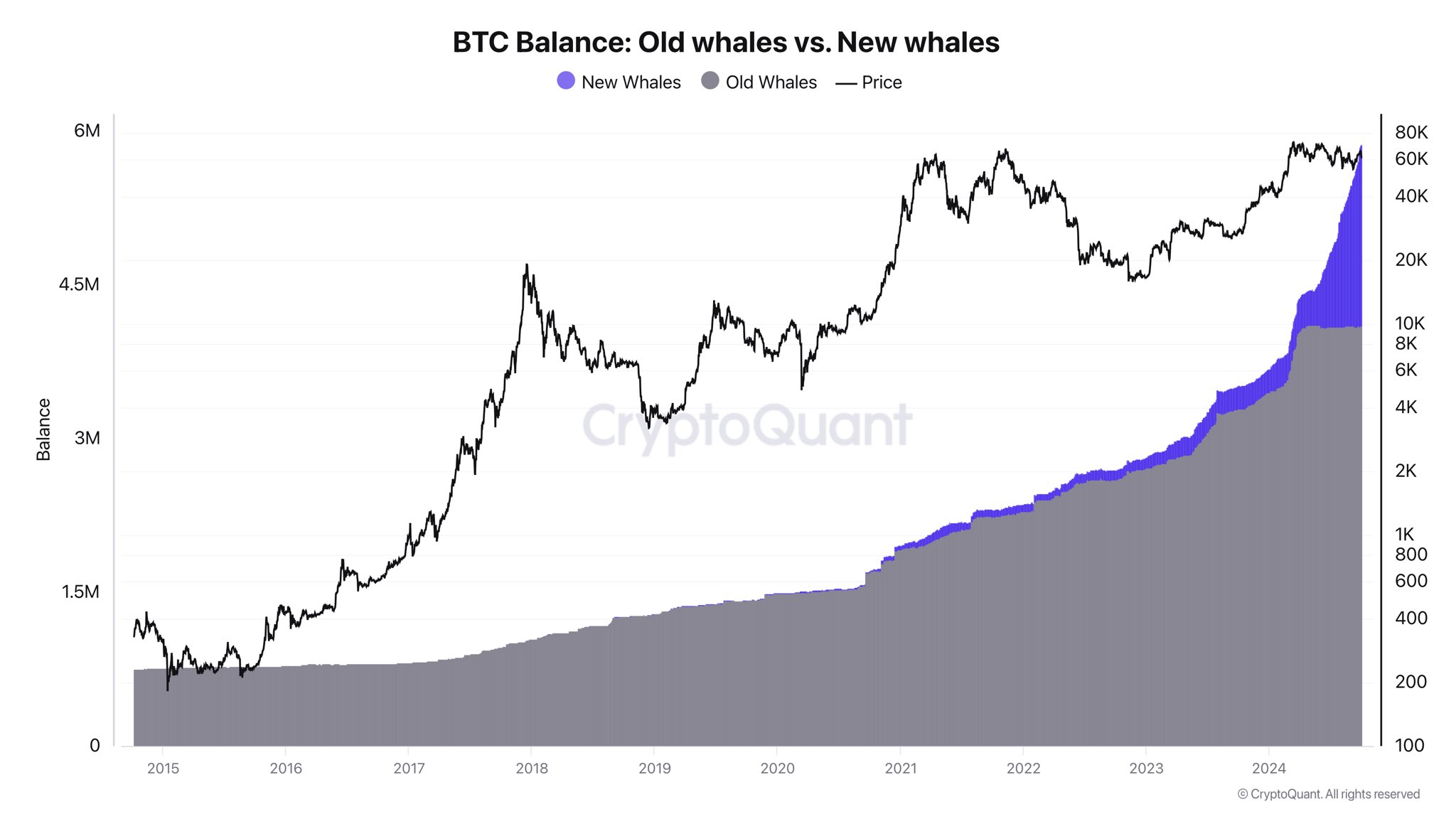

The amount of Bitcoin held by exchanges is decreasing rapidly as major investors and influential figures (often referred to as whales) amass the digital currency at record levels. This pattern suggests that there may be a lack of supply on these platforms, which combined with growing demand, could trigger a sudden shortage or “supply shock.” According to experts, this scarcity could eventually drive up prices over time.

Recent on-chain analysis shows an unprecedented accumulation of Bitcoin by new large investors, often referred to as “whales.” Ki Young Ju, CEO and founder of CryptoQuant, explained that the current market fluctuations are primarily due to activity in the futures market. However, it’s important to note that true whales influence the market through spot trading and over-the-counter (OTC) transactions. Consequently, data from on-chain activities is vital in understanding the real state of the market.

He pointed out that it’s unlikely these freshly arrived ‘Bitcoin whales’ will offload their holdings until a significant amount of liquidity from individual investors (retail) floods into the market. Interestingly, the minimal connection between these accumulations and U.S. spot ETF inflows hints at strategic buying by institutional investors.

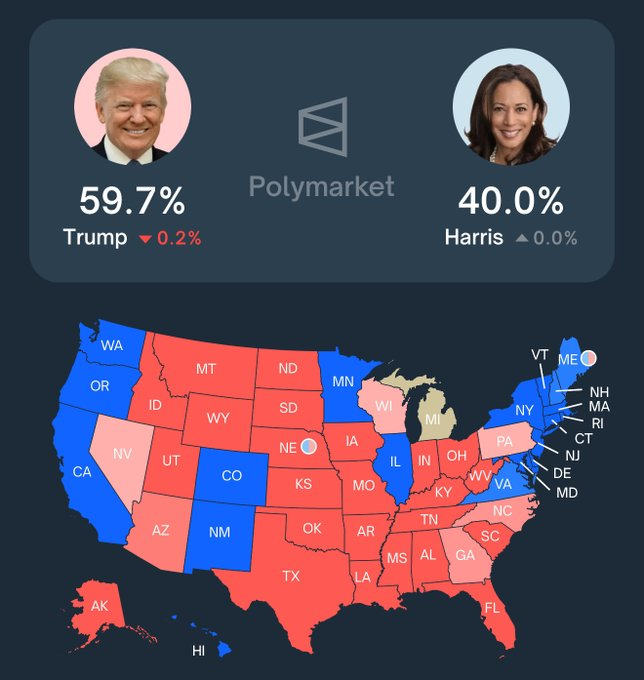

As a researcher delving into political trends, I’ve noticed an intriguing development: Recent forecasts suggest that Donald Trump may regain traction in key swing states prior to the upcoming elections. Remarkably, according to Polymarket’s latest data, Trump is predicted to secure victories across all seven of these decisive states. Moreover, it’s interesting to note Patric H.’s assertion that Trump’s pro-cryptocurrency stance could potentially lead to Elon Musk leading the Department of Government Efficiency (DOGE) if these trends continue.

In simple terms, when the S&P 500 index hits a record high, it’s typically a good sign for Bitcoin and other cryptocurrencies as well. As Patric H. explains, “Historically, there hasn’t been a moment in history where the crypto market didn’t follow the lead of the S&P 500.” He acknowledges the common argument that “this time is different,” but counters with a hint of sarcasm, “Well, sure, this time is definitely unique.” The connection between traditional stock markets and cryptocurrencies suggests that if equities are performing well, that positive trend might extend to Bitcoin and other digital currencies.

historically, the final three months of the year (Q4) have seen Bitcoin performing exceptionally well, particularly during halving years. According to experts, this is a period when Bitcoin and the overall cryptocurrency market typically show remarkable growth compared to other asset classes.

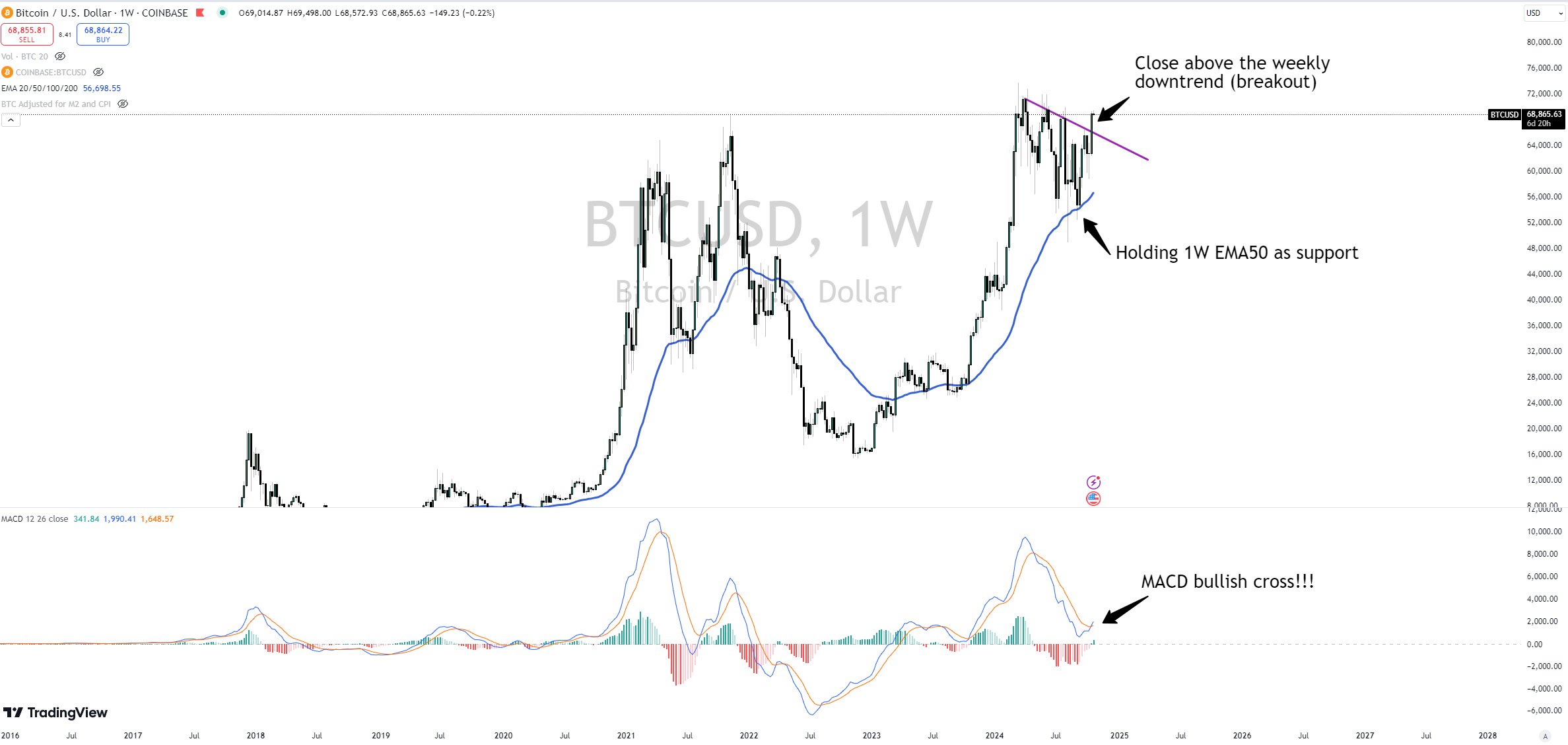

Based on these key factors, technical analysis suggests an optimistic outlook for Bitcoin. Patric H. points out that Bitcoin has surpassed its weekly downtrend line, indicating a possible shift from negative to positive trends. Furthermore, Bitcoin is maintaining a strong position above the 50-week Exponential Moving Average (EMA), which serves as a crucial support point. Additionally, the Moving Average Convergence Divergence (MACD) indicator has recently made a bullish movement for the first time since April, generally interpreted as a signal to buy.

Absolutely, we can expect occasional setbacks, but moving forward, it’s better to view these as opportunities to buy since the overall trend of the market has changed from a decline to an upward trajectory, according to Patric.

At press time, BTC traded at $68,397.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

2024-10-21 15:04