Data from the blockchain indicates that approximately 69% of PEPE investors are currently making a profit, following a recent drop of around 26% for the meme coin over the last seven days.

69% Of All PEPE Addresses Are Carrying Some Gains Right Now

On X’s latest update from market intelligence platform IntoTheBlock, they share insights into the present financial situation of PEPE investors.

An analytics company measures if an investor is earning a profit or not by examining their wallet’s historical transactions on the blockchain. By determining when the investor bought the coins, the metric calculates their average purchase price using the asset’s market value at that specific time.

If the present value of a cryptocurrency at a specific address is greater than its average purchase price, then that investor holds a profit in that particular transaction. According to IntoTheBlock, such profitable addresses are labeled as “profitable” or “in the money.”

In simpler terms, if an investor’s initial investment cost is greater than the current market price, they are said to be “underwater” or “in the red.” On the other hand, when an investor’s cost basis matches the current market price, they neither made a profit nor incurred a loss – they’re just breaking even or at the “breakeven point.”

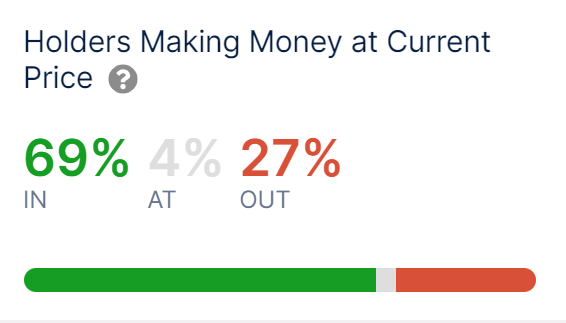

Currently, the analytics firm has provided us with the following data on the distribution of investors in PEPE:

Approximately two-thirds (69%) of all PEPE address holders have purchased the coin at a price higher than its current market value, whereas around one-third (31%) are currently experiencing losses. A small group of investors (4%) neither have gains nor losses as they are holding onto their coins without incurring or realizing any profits or losses yet.

The profitability ratio for this investment isn’t impressive, as indicated by data from IntoTheBlock which shows that only 89% of Bitcoin investors are currently earning a profit. However, the memecoin’s lower profits can be attributed to its price experiencing a significant decline in recent times.

In historical context, properties with green labels have tended to be sold in order to realize profits. Consequently, when market earnings significantly outweigh losses, a large-scale selling spree may ensue.

In simpler terms, as more investors make profits, the likelihood of a market top increases. On the other hand, when only a small number of investors are profitable, it could lead to the formation of market bottoms as profit-taking reaches its limit at those price levels.

Currently, the PEPE market doesn’t have a clear majority of green (buyers) or red (sellers). Yet, during market uptrends, or bull runs, prices tend to stay elevated. Consequently, any dip or correction could potentially lead to a price recovery.

In simpler terms, if the memecoin’s investor profits have reached approximately 69%, this could indicate that a market bottom is approaching and the bullish trend may persist further.

PEPE Price

PEPE’s price has dropped back down to $0.0000050913, representing a nearly 27% decrease over the last week as depicted in the following chart illustrating its progression during the past month.

Read More

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Superman’s James Gunn Confirms Batman’s Debut DCU Project

- All Elemental Progenitors in Warframe

- General Hospital: Lucky Actor Discloses Reasons for his Exit

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- KPop Demon Hunters 2: Co-Director on if Sequel Could Happen

2024-04-17 21:40