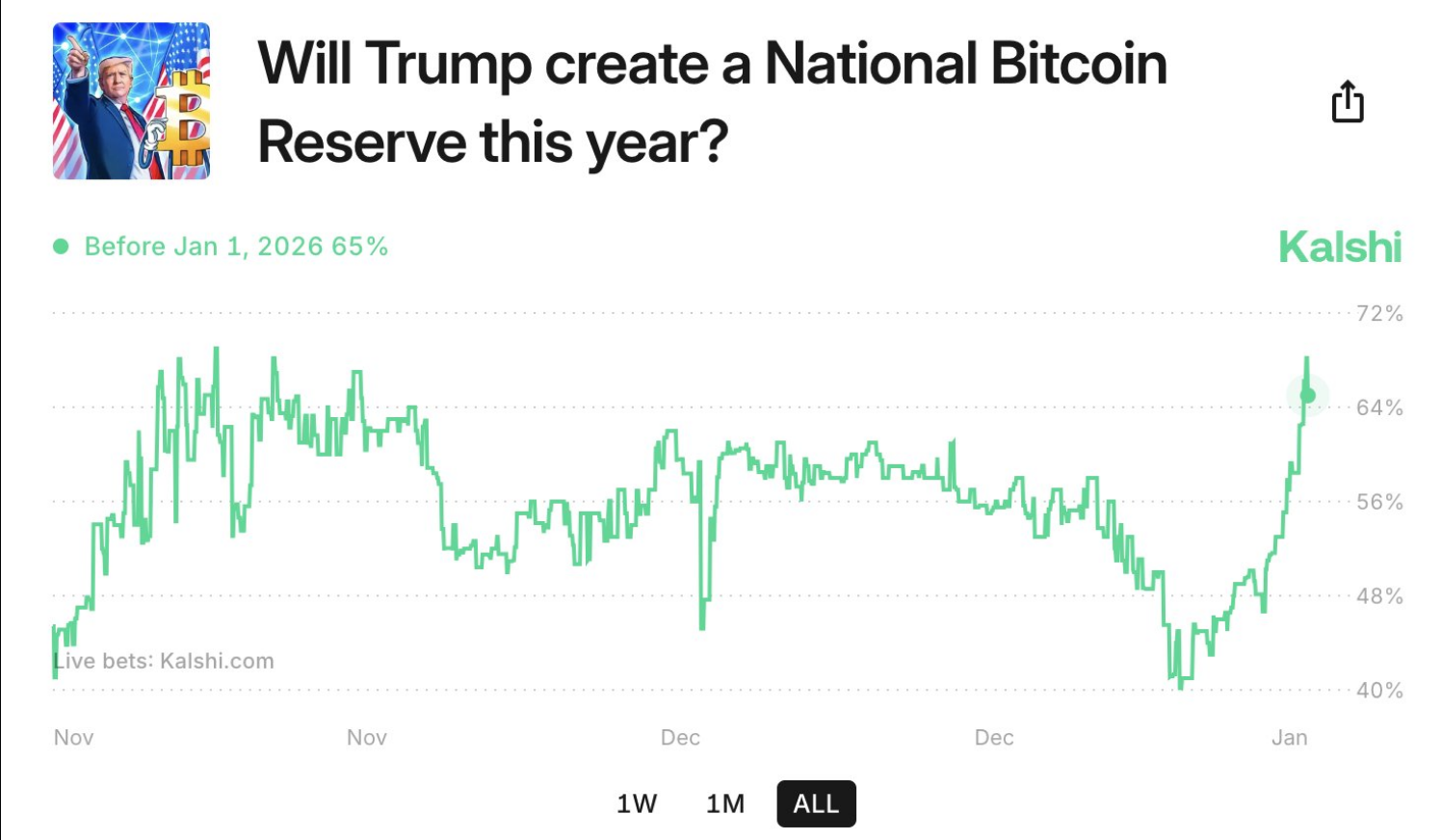

Given a 65% probability, there’s been a significant increase in expectations that a Strategic Bitcoin Reserve might be established within the United States. This surge stems largely from President-elect Donald Trump’s vocal support for cryptocurrencies and the proposed Bitcoin Act.

Supporters argue that this plan could significantly shift American perception towards Bitcoin, aligning it with strategic national security objectives. Crafting a cryptocurrency policy may prove crucial over the next few months.

According to Anthony Pompliano, the head of Professional Capital Management, he recently made a presentation to the public about a potential development. On the platform Kalshi, an online prediction tool, he noticed that the probability of establishing a Strategic Bitcoin Reserve in the U.S. this year increased to approximately 65%.

Trump Vision For Crypto Becoming Popular

As an analyst, one key factor contributing to the heightened likelihood I’m observing is Trump’s favorable standpoint towards cryptocurrencies. At the heart of this shift lies the proposed Bitcoin Act, which outlines the creation of a reserve containing approximately 1 million digital currency units over a five-year span.

Supporters of this plan believe it will boost creativity and financial stability. The fact that Trump is open to using blockchain technology has renewed hope among cryptocurrency supporters, who view his presidency as a chance to incorporate digital currencies into government plans.

The odds that a strategic bitcoin reserve will be created this year is now at 65% on Kalshi.

That is a 50% increase in the odds over the last few weeks.

— Anthony Pompliano (@APompliano) January 17, 2025

Lobbying Intensifies For Executive Action

Stakeholders involved with cryptocurrencies do not expect the legal process to be resolved quickly. Instead, they have intensified their efforts to lobby the new administration, aiming for an immediate executive order on the matter.

Supporters argue that establishing such a reserve would not just bolster economic security, but also serve as a symbol of global dominance in the digital currency sector. They propose that a presidential decree could streamline administrative procedures, thereby speeding up the process of clarifying America’s position within the crypto marketplace.

Strategic And Financial Motives

1) The necessity for an SBR (Single Business Resolution) is motivated by both strategic and monetary factors. Advocates of Bitcoin highlight its potential role as a safeguard against the unstable nature of conventional finance systems.

Additionally, there’s a concern that the U.S. might fall behind other nations who are integrating cryptocurrencies into their domestic strategies. Proponents suggest establishing a Bitcoin reserve isn’t just about keeping pace with global competitors, but also about ensuring our future security.

A Critical Year For Crypto Policy

In the course of 2025, U.S. decision-makers will encounter crucial choices that could reshape the landscape of digital currencies. The fate of the Bitcoin Act and related initiatives hinges on their willingness to foster innovation.

The opportunity for establishing a U.S. Strategic Bitcoin Reserves has reached an all-time high. This could be realized through legislative changes or executive orders, a decision that might solidify Bitcoin’s role in our economy and bolster the nation’s long-term financial strategies.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Overwatch 2 Season 17 start date and time

2025-01-18 21:40