As a seasoned researcher with a decade of experience in the cryptocurrency market, I find these recent transactions by the Ethereum Foundation quite intriguing. The consistent selling pattern, particularly during this volatile market environment, has certainly piqued my interest.

Recently, I’ve found myself closely following discussions surrounding the Ethereum Foundation and their planned liquidation strategy. This strategy involves selling portions of their Ethereum (ETH) reserves.

Based on data from Lookonchain, a wallet associated with the foundation transferred approximately 2,500 ETH, worth around $6 million, to the exchange Bitstamp on October 8, 2024. This action is consistent with a growing pattern where significant investors, often referred to as “whales,” are offloading their assets in response to the turbulent market conditions.

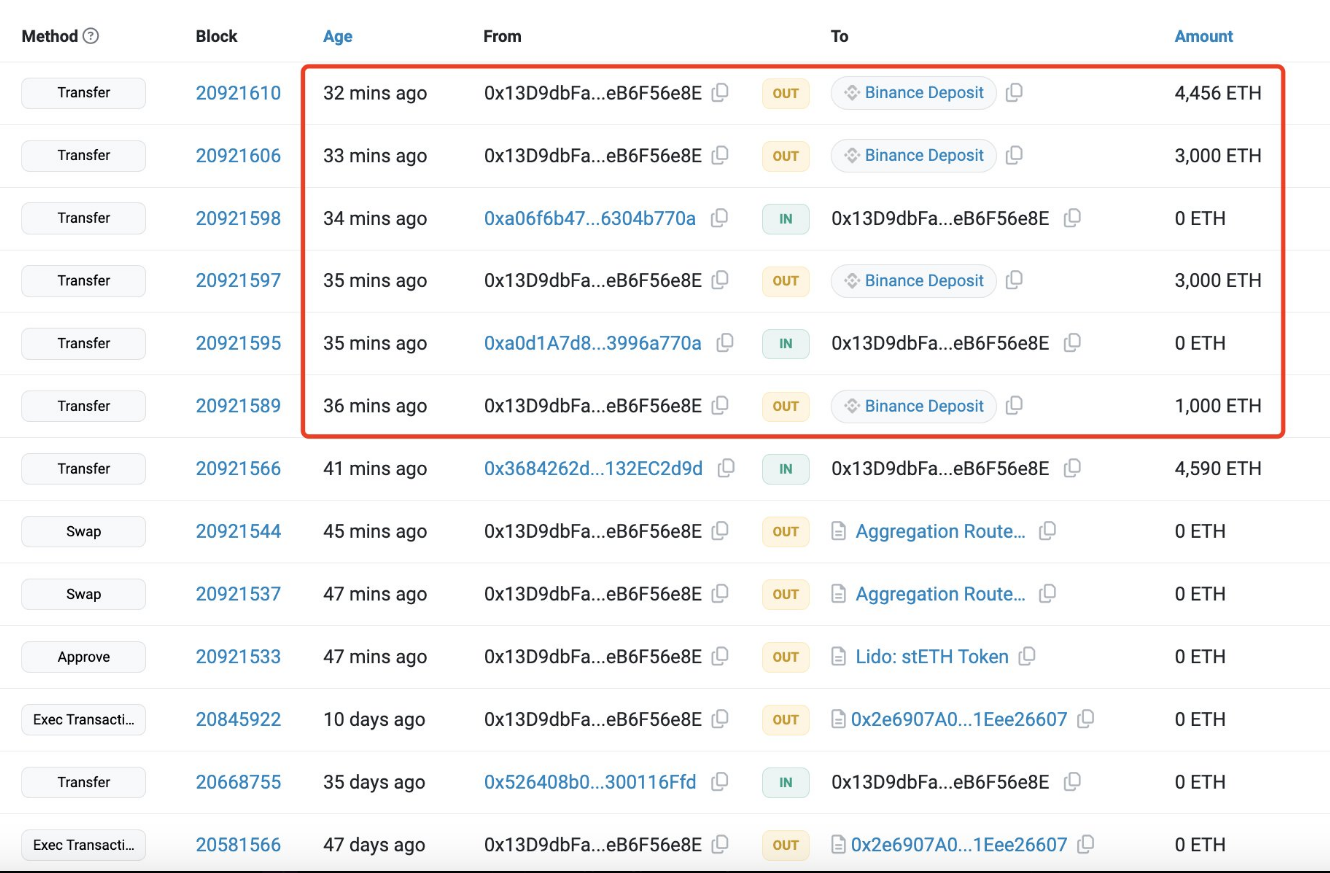

A whale deposited 11,456 $ETH($27.8M) to #Binance in the past 40 minutes!

— Lookonchain (@lookonchain) October 8, 2024

Significant Transactions Uncovered

According to Lookonchain, this foundation has been involved in more than one recent transaction. In the year 2024, they sold a total of 3,766 ETH, which equates to approximately $10.46 million. Specifically, they sold 950 ETH in September, equivalent to about $2.27 million. They seem to sell ETH quite frequently, approximately every 11 days, with each transaction averaging around 151 ETH. Currently, the foundation holds a substantial amount of ETH: approximately 271,274 ETH, or roughly $655 million.

Market Reactions And Jitters

Concerns are rising within the crypto community due to the persistent selling of Ethereum. Many investors are concerned that this massive sell-off could exert a negative influence on Ethereum’s prices. Over the past two weeks, the value of Ethereum has decreased by approximately 8%.

Some analysts are musing that these selling instances could be influencing factors in the downturn of the Ethereum market. Members of the community are showing mixed feelings about the past wallet activity by the foundation and its potential impact on market trends, as revealed by Lookonchain.

Future Financial Planning

According to Aya Miyaguchi, an executive director at the Ethereum Foundation, these sales are a deliberate financial move aimed at funding operational expenses and supporting ongoing projects. The estimated total annual budget is approximately $100 million, with certain costs – including salaries and grants – needing fiat currency. Consequently, converting a portion of the ETH reserves into stablecoins like DAI has become common practice.

As the Ethereum Foundation navigates its ongoing financial challenges amid market volatility, it remains unclear how future sales will impact both ETH‘s value and the overall strength of the Ethereum network. Given that significant funds are still under the foundation’s control, many investors are closely watching for indicators like price fluctuations or potential upheavals in the market.

Read More

- Odin Valhalla Rising Codes (April 2025)

- King God Castle Unit Tier List (November 2024)

- Pixel Heroes Character Tier List (May 2025): All Units, Ranked

- POPCAT PREDICTION. POPCAT cryptocurrency

- Vesper’s Host guide – Destiny 2

- Pet Simulator 99 VIP Private Server Links And How To Use Them

- Sarah’s Shocking Hospital Emergency—What Really Happened on Days of Our Lives?

- Incarnon weapon tier list – Warframe

- Cape Fear Cast: Patrick Wilson Eyed to Star in Apple TV+ Show

- Pokémon and Crocs Release “Charizard vs. Blastoise” Versus Clog

2024-10-09 17:10