As a seasoned researcher with years of experience in the cryptocurrency market, I find myself constantly intrigued by the ebb and flow of Bitcoin and Ethereum prices, particularly during options expiry days. Today, we have a significant event unfolding with over $4.5 billion worth of Bitcoin options set to expire, and another $1.01 billion for Ethereum.

Following a dip in Bitcoin‘s value to around $65,500 earlier this week due to selling pressure, the price is now partially rebounding to approximately $68,000 today, just before Friday’s options expiration. Data from the derivatives platform Deribit indicates that a staggering $4.5 billion in Bitcoin options will become void today.

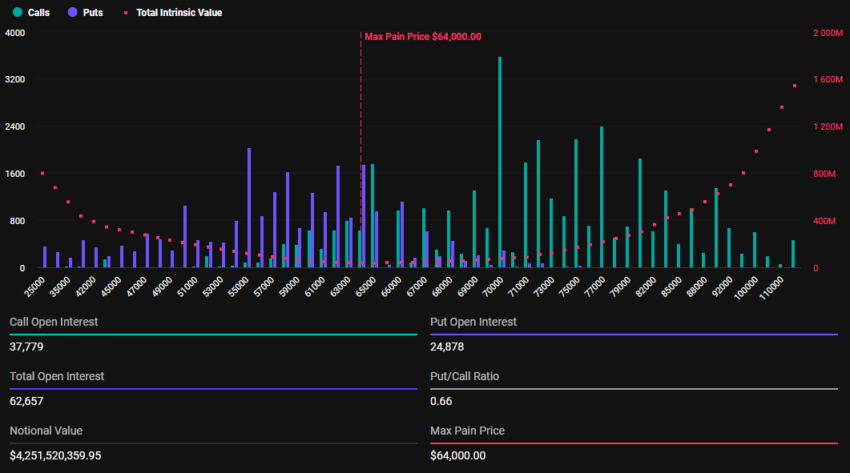

Today, October 25th, approximately 62,657 Bitcoin options contracts are set to expire. The highest potential price for these contracts is capped at $64,000, and the number of put options (betting on a decrease in price) is slightly less than call options (betting on an increase in price), with a ratio of 0.66 puts to every call option.

Currently, the price of Bitcoin (BTC) stands at $67,818, and it has shown only minimal volatility over the past 24 hours with a 1.4% fluctuation. This stability is significant as it keeps the Bitcoin market cap above $1.34 trillion. In the last 24 hours, a trading volume of $33.77 billion has been recorded.

It’s noteworthy that the value of Bitcoin option expirations this week has significantly increased to approximately $4.5 billion. Compared to the average for the rest of this month, which was around $1.5 billion, the surge is quite substantial.

Experts at BloFin Academy are observing a substantial change in projected volatility (IV) as the U.S. elections draw near, according to their recent findings.

The rise in implied volatility initially mirrors the effect of the election on anticipated volatility within the cryptocurrency market. This elevation is evident not only in Bitcoin or Ethereum options, but also in those set to expire on November 8th, which have risen substantially above the implied volatility of options with later expiration dates.

The change in implied volatility (IV) is being linked to investor demands for hedging and speculation. Analysts have also observed a significant increase in the “election day option” related to Bitcoin, indicating its responsiveness to major economic events. At present, however, many investors seem hesitant, implying that October’s volatility might not be extensive.

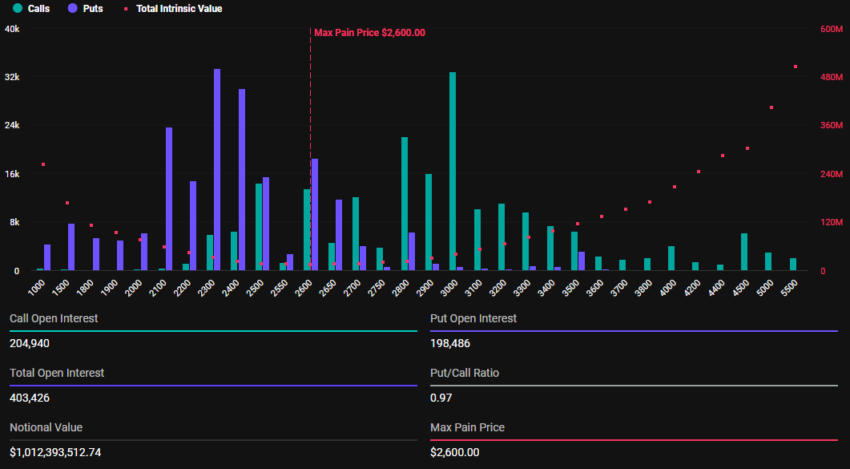

A Look into Ethereum Options Expiry

As an analyst, I’m observing that today marks the expiration of approximately 403,426 Ethereum options contracts with a total value of $1.01 billion. The maximum ‘pain point’ for these contracts is set at $2,600, indicating a significant struggle between potential buyers (bulls) and sellers (bears). Currently, Ethereum is trading around $2,541, with a 24-hour volatility of just 0.7%. With a put-call ratio of 0.97, it seems the market leans slightly towards bearish sentiment, but it’s crucial to keep a close eye on Ethereum’s $305.96 billion market cap and its $17.23 billion 24-hour trading volume for further insights into this intriguing battle between bulls and bears.

For some time now, fluctuations in Ethereum’s price have tested investor’s patience, as Ethereum ETFs have yet to gain traction like their Bitcoin counterparts. At the present moment, Ethereum is trading near $2,515 without a clear signal of its future direction.

It’s possible that the presidency of Donald Trump could spark a surge in the altcoin market, potentially driving prices beyond $3,000.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-10-25 14:02