As an analyst with years of experience navigating the unpredictable crypto market, I find myself both intrigued and cautious regarding the recent Shiba Inu (SHIB) developments. The significant transfer of nearly 400 billion tokens by an early and highly profitable whale serves as a stark reminder of the immense potential for profits in this space, yet it also raises concerns about market manipulation.

A significant Shiba Inu (SHIB) transfer has caught the attention of traders today, December 19, as an early and highly profitable SHIB whale moved nearly 400 billion tokens. On-chain analysis service Spot On Chain (@spotonchain) highlighted that this well-known early buyer deposited 399.99B SHIB (worth $9.69 million) to Gemini, building on a history of substantial gains after initially acquiring 15.2 trillion SHIB in August 2020 for a mere 10 ETH.

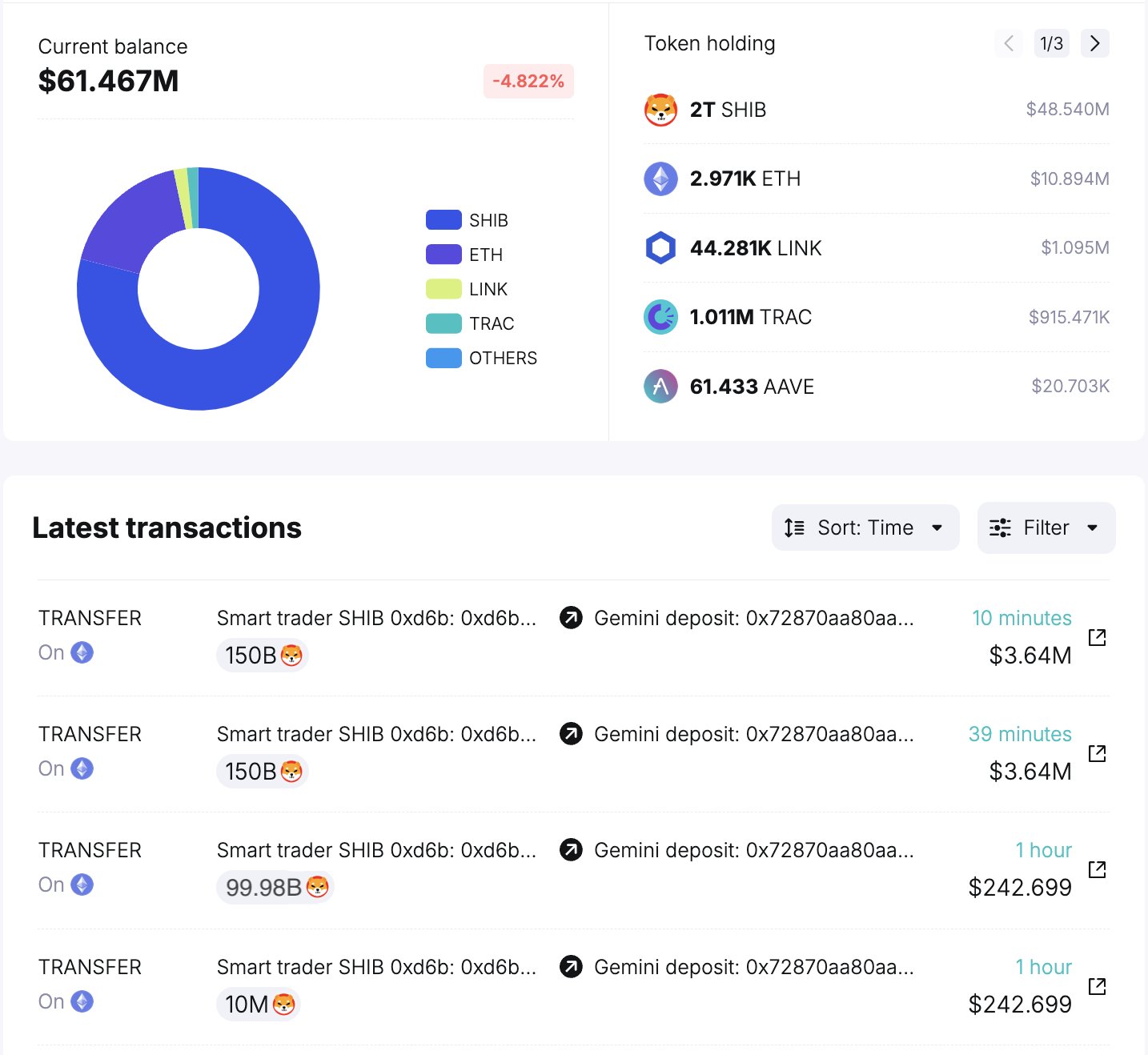

Spot On Chain wrote via X: “This early $SHIB whale with a $108M profit just further deposited 399.99B $SHIB ($9.69M) to Gemini in the past hour. Notably, on Aug 7, 2020, this whale bought 15.2T SHIB for just 10 ETH. Now, the whale still holds 2T SHIB ($48.54M) with an estimated total profit of $107.7M (3.7x return) from SHIB.”

It’s not the first occasion where an unidentified whale has made a profit by selling tokens. In mid-November, as Spot On Chain observed, the same initial buyer with the address “0xd6b” resumed token sales after eight months of inactivity, transferring 100 billion SHIB (equivalent to $2.81 million at that time) to Gemini. Earlier, this whale was active in March, moving 200 billion SHIB to both Gemini and Crypto.com.

Shiba Inu Price Drops

Over the past day, Shiba Inu’s price has decreased by approximately 6.2%, continuing a recent trend of fall that began with a 10% decrease on December 18th.

Significantly, a large portion of this vulnerability mirrors the wider crypto market decline after the Federal Open Market Committee (FOMC) conference. While the predicted 25 basis point rate increase was confirmed, Jerome Powell’s focus on a cautious stance regarding interest rate reductions in 2024 led to a negative market reaction throughout digital assets.

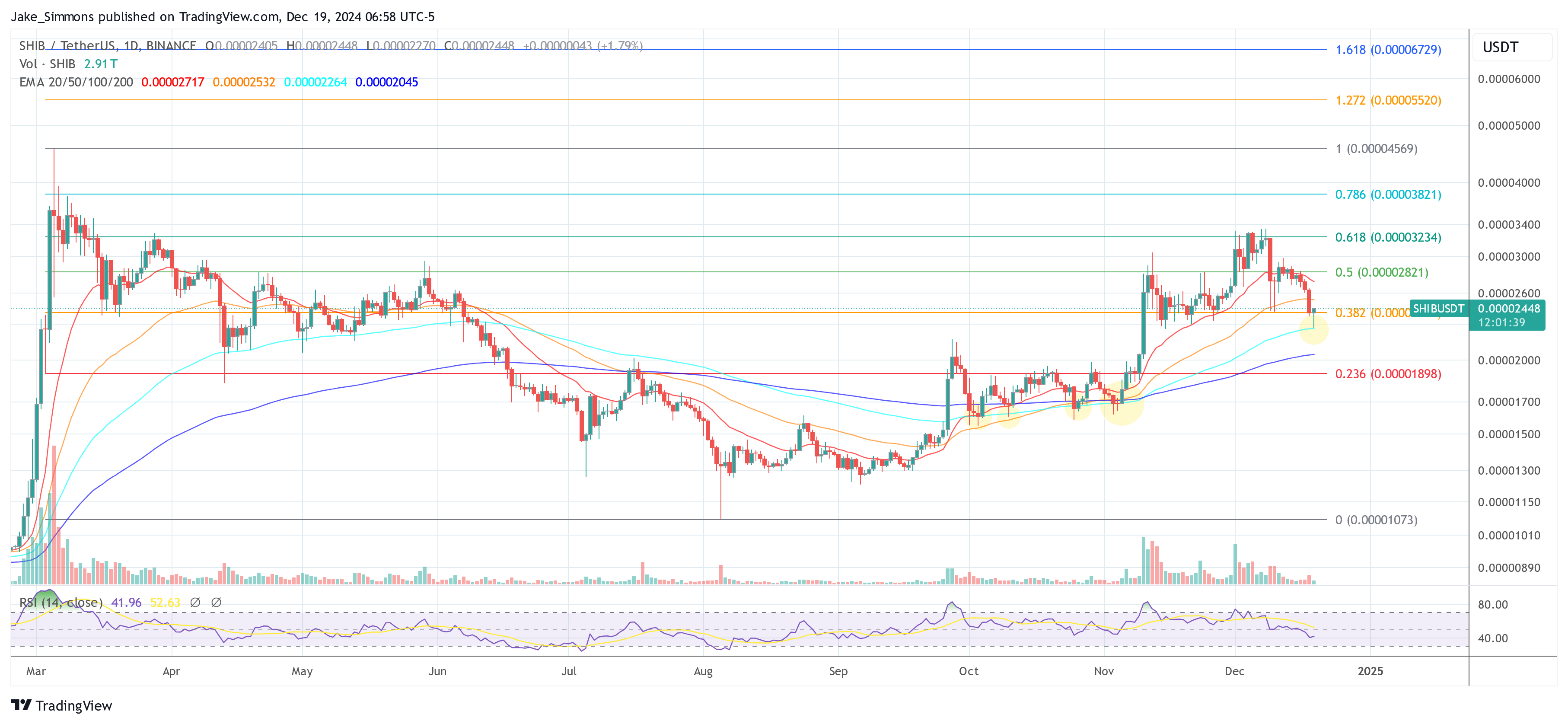

Even with the strong headwinds and significant sell-off by major investors (often referred to as whales), Shiba Inu’s long-term technical analysis shows a fairly steady pattern. On the daily chart, Shiba Inu has managed to hold onto crucial support levels, specifically the 100-day moving average, which has consistently been a strong support for SHIB since it initially surpassed this level in late September.

Marked by the yellow circles on the chart, this EMA has repeatedly served as a crucial pivot point for price action, sustaining support for the fifth time during the observed period. Currently, the 100-day EMA sits at approximately $0.00002264

Moreover, SHIB maintains its position above the 0.382 Fibonacci retracement point, currently at approximately $0.00002409. This level is significant and is under close observation by analysts. The 0.5 Fibonacci level at around $0.00002821 represents a crucial midpoint in the recent price range fluctuations. If SHIB tries to recover, this point could serve as a mental hurdle for traders.

Additionally, if bullish momentum resumes, potential obstacles may arise at the 0.618 Fib level ($0.00003234) and the 0.786 Fib level ($0.00003821), as these could serve as resistance points.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

2024-12-19 23:46