As a seasoned crypto investor with a keen eye for trends and a knack for spotting opportunities, I can confidently say that the $200,000 Bitcoin prediction by Bernstein Research seems like a plausible scenario. My journey in the crypto world began in the early days of Bitcoin, when it was still considered an obscure digital currency. Back then, who would have thought we’d be talking about BTC reaching six figures?

As a crypto investor, I’m excited about the forecast from Bernstein Research, an influential research division under global asset manager AllianceBernstein. They predict that by the end of 2025, the price of Bitcoin could soar to an impressive $200,000. Given that they oversee assets valued at a whopping $791 billion as of August 2024, they label this prediction as “conservative” in their latest comprehensive 160-page report on Bitcoin, titled the “Black Book.

Why BTC Price Will Hit $200,000 In 2025

In this analysis, I’m delving into the various factors driving Bitcoin’s rise, as outlined in Bernstein’s comprehensive report titled “From Coin to Computing: A Guide to Bitcoin Investing.” The report emphasizes the increasing institutional interest, the growing market for Bitcoin Exchange-Traded Funds (ETFs), and the transformative role of Bitcoin miners in both the cryptocurrency and artificial intelligence (AI) industries.

In the viewpoint of Gautam Chhugani, a managing director and senior analyst at Bernstein, if one is skeptical about Bitcoin, they might reconsider its value given the current situation where U.S. debt has reached an all-time high ($35 trillion) and the ongoing concerns about inflation. In fact, if you favor gold as a hedge against economic instability, you may find Bitcoin even more appealing.

The report emphasizes a major change in how institutions are investing, with institutional investors now controlling around $60 billion in Bitcoin and Ethereum ETFs, a fivefold rise from the $12 billion held in September 2022, as stated by Bernstein. They refer to these ETF launches as “the most successful ever” for exchange-traded funds, pointing out that they’ve attracted $18.5 billion since their debut in January, according to inflows recorded so far this year.

According to the report, it’s predicted that by the end of 2024, Wall Street could take over Satoshi’s position as the largest Bitcoin wallet due to logistical difficulties associated with individual custody for regular investors. Bernstein suggests this increase is due to these challenges. Furthermore, the firm emphasizes that Exchange-Traded Funds (ETFs) are serving as a gateway for institutional players to invest heavily in digital assets on a large scale.

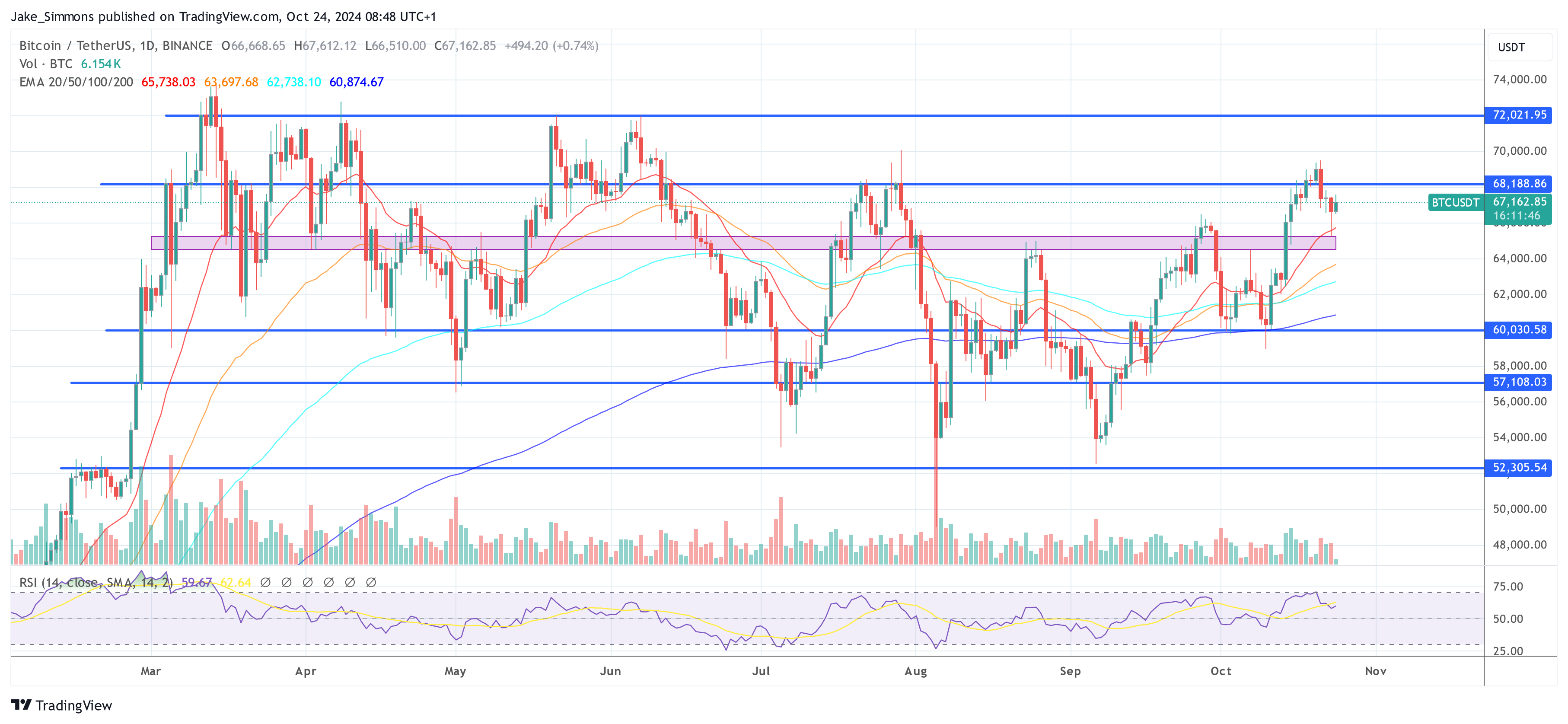

Bernstein’s bullish stance on Bitcoin is underpinned by its analysis of market trends and institutional behavior. BTC price has already appreciated by 120% over the past 12 months, with its market capitalization swelling to $1.3 trillion.

According to their forecast, as more institutions embrace Bitcoin, we predict that its value will nearly triple from its current price point. Bernstein believes that the total market capitalization of Bitcoin could surpass $3 trillion by 2025, largely due to increased investments from wealth management firms, pension funds, and investment advisors.

As the market develops, it’s predicted that significant financial entities will take on a more influential position. Our analysis indicates that this shift towards larger institutions could potentially drive Bitcoin’s price up to $200,000 by the end of 2025. It’s important to note that this projection is considered “conservative” due to the growing trend of institutional investment at present.

Bitcoin Treasury And Mining

A key aspect emphasized in Bernstein’s report is the increasing tendency of corporations to keep Bitcoin as a part of their treasury reserves. The report particularly points out MicroStrategy Incorporated (NASDAQ: MSTR) as an early adopter. This company, under the leadership of CEO Michael Saylor, has invested over 99% of its liquid assets into Bitcoin, making it own around 1.3% of the entire Bitcoin supply.

As a crypto investor, I consider MicroStrategy to be an aggressive Bitcoin investment approach, given its equity nature. Notably, this company’s stocks have delivered better returns than simply owning Bitcoin outright or through ETFs.

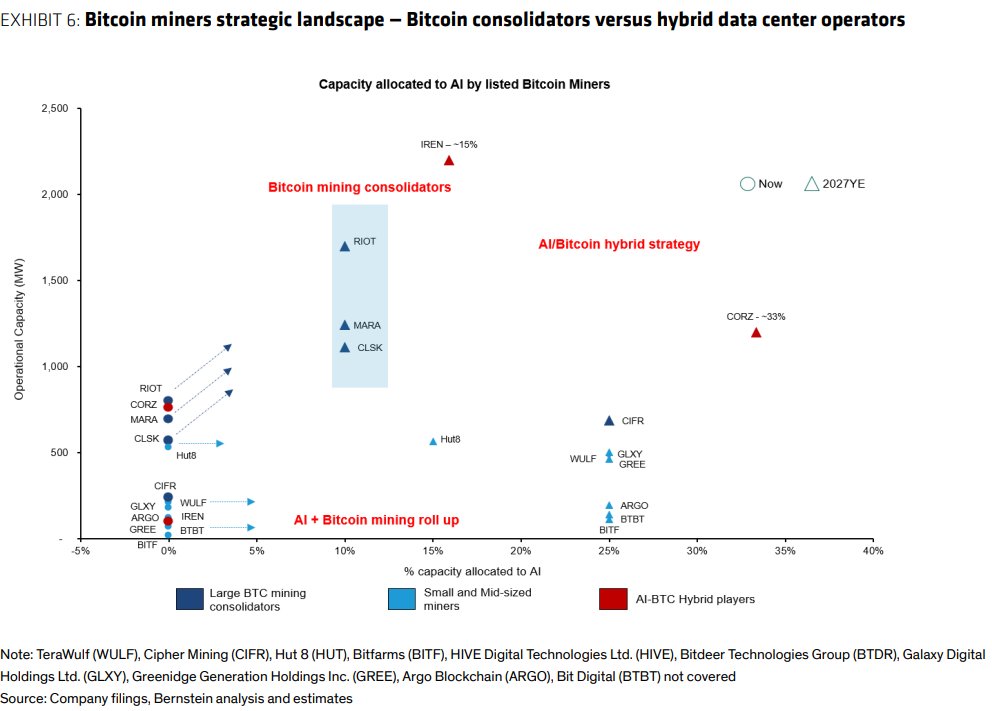

Bernstein’s report offers insights into the consolidation patterns occurring in the Bitcoin mining sector. Key figures such as Riot Blockchain Inc. (NASDAQ: RIOT), CleanSpark Inc. (NASDAQ: CLSK), and Marathon Digital Holdings are buying up smaller miners, resulting in a market predominantly made up of large-scale operations.

According to the report, top Bitcoin miners in the U.S., such as Riot, CleanSpark, and Marathon, are likely to grow their influence and transform into energy infrastructure providers. The report further anticipates that these key players will dominate approximately 30% of the total Bitcoin mining capacity by 2025, based on Bernstein’s predictions.

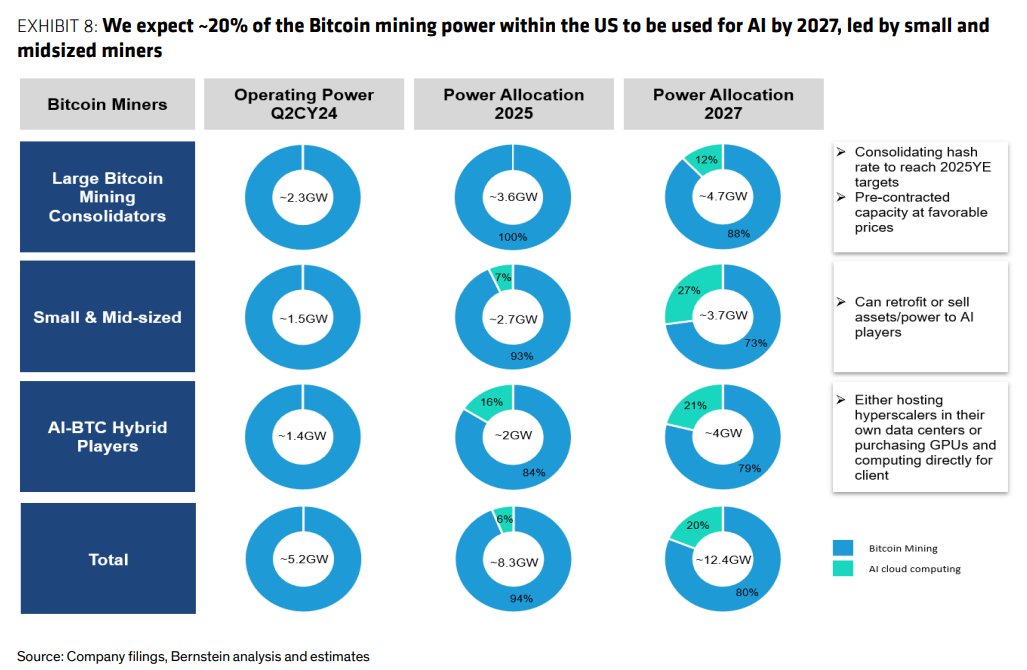

Analysts delve deeper into the connection between Bitcoin mining and artificial intelligence (AI) technology infrastructures. As potential collaborators, Bitcoin miners present an appealing opportunity for cloud service providers specializing in GPUs, due to their vast energy resources at a gigawatt scale and expediting the process of deploying AI data centers by shortening the time required to bring these projects to market.

According to Bernstein, miners offer an energy trading advantage, with costs ranging from $2-$4 million per megawatt, significantly less than the $30-$50 million per megawatt traditional data centers pay. Companies such as Core Scientific and Iris Energy are taking advantage of this disparity by simultaneously building AI data centers and Bitcoin mining facilities.

According to Bernstein, Bitcoin miners are transforming into crucial allies for artificial intelligence (AI) data centers because they take advantage of surplus energy resources and provide effective solutions for heavy computing tasks. This collaboration not only expands income opportunities for miners but also boosts the eco-friendliness and expandability of AI systems.

At press time, BTC traded at $67,162.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-10-24 14:47