As a seasoned analyst with a background in cryptocurrency and blockchain technology, I’ve witnessed the ebb and flow of investor sentiment in the crypto market for years. Based on the latest trends and data, it seems that Bitcoin (BTC) is gearing up for another price rally.

Large-scale investors’ faith in the crypto market seems to be increasing recently, resulting in Bitcoin being a significant recipient of this renewed optimism. Subsequently, these investors have continued to amass Bitcoin, even with its erratic pricing behavior.

As a crypto investor, I’ve observed that Bitcoin’s price failed to close above the $70,000 mark during May, despite briefly reaching that level towards the end of the month. However, recent on-chain data indicates that faith in Bitcoin remains unwavering.

Is BTC Primed For A Price Rally?

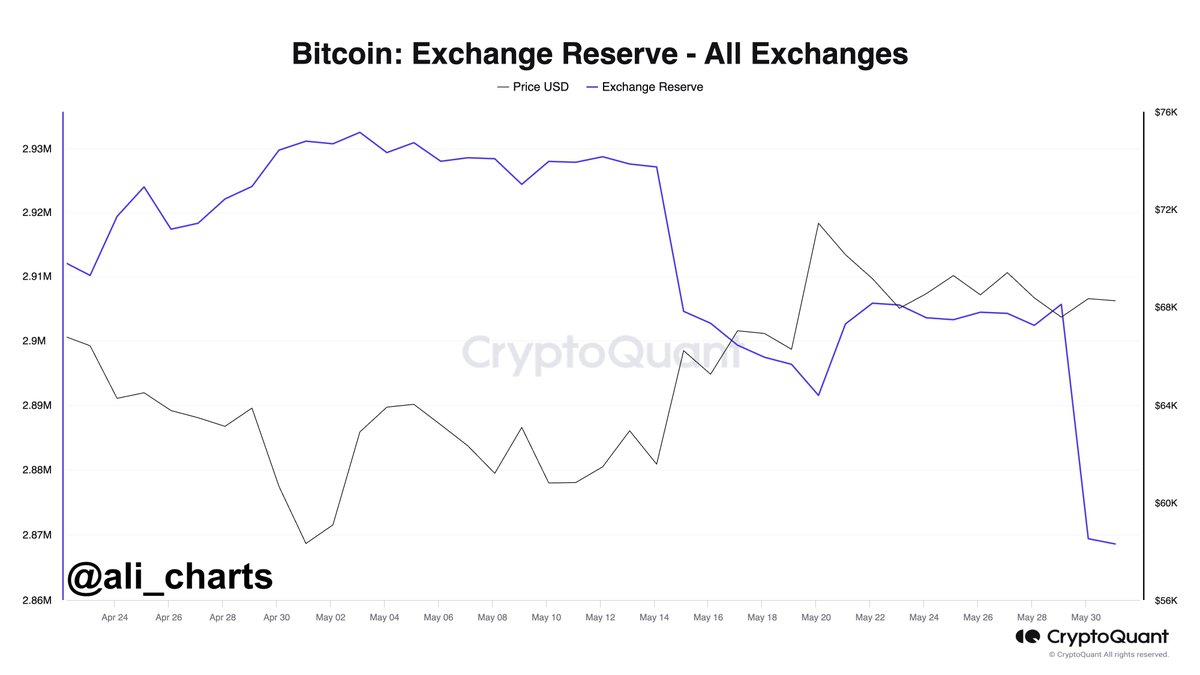

Expert: Ali Martinez, a well-known crypto analyst, recently mentioned on the X platform that a significant quantity of Bitcoin has been transferred from centralized exchanges. This insight is derived from the CryptoQuant Exchange Reserves indicator, which monitors the Bitcoin holdings in all centralized exchange wallets.

When the value of the metric rises, it signifies that investors are depositing more Bitcoin into centralized exchanges than they are withdrawing. Conversely, a decrease in the metric’s value indicates that more Bitcoin is being withdrawn from these exchanges than is being deposited.

Based on Martinez’s recent update, over 37,000 Bitcoins, equivalent to approximately $2.53 billion, have left crypto exchanges within the past three days. This substantial movement of funds suggests a shift in investor sentiment and potentially a longer-term holding approach among Bitcoin investors.

Despite the unclear reasons for the large-scale transfer of funds from cryptocurrency exchanges, the shift in investments from trading platforms hints at a growing sense of trust among investors. This could mean that numerous individuals are becoming more optimistic about Bitcoin’s future potential and choosing to hold their assets in personal wallets as a long-term strategy.

Additionally, the continuous decrease in the amount of Bitcoin held on centralized exchanges might lead to a surge in its market price due to a potential supply shortage.

When the need for a specific resource exceeds the available amount, we refer to this situation as a “supply shortage.” This scarcity leads to an increase in the asset’s value due to high demand.

Bitcoin Price At A Glance

At present, Bitcoin is valued at approximately $67,489, representing a modest 1.5% decrease over the previous 24-hour period. This marginal loss highlights Bitcoin’s recent difficulties, as its value has dipped nearly 2% in the last week based on CoinGecko’s reports.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- How to Update PUBG Mobile on Android, iOS and PC

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

2024-06-01 15:04