As a seasoned crypto investor with over a decade of experience navigating the volatile digital asset landscape, I find myself bracing for the impending storm that is the largest Bitcoin and Ethereum options expiry on record. With $18 billion at stake, I can’t help but feel a mix of anticipation and trepidation, much like a gambler waiting for the roulette wheel to stop spinning.

As we approach the final seven days of 2024, the cryptocurrency market is preparing for the largest Bitcoin options expiration ever recorded, with an estimated $18 billion in both Bitcoin and Ethereum options set to expire today. This significant event occurs against a backdrop of broader market instability and hopes for a traditional year-end “Santa Claus rally.

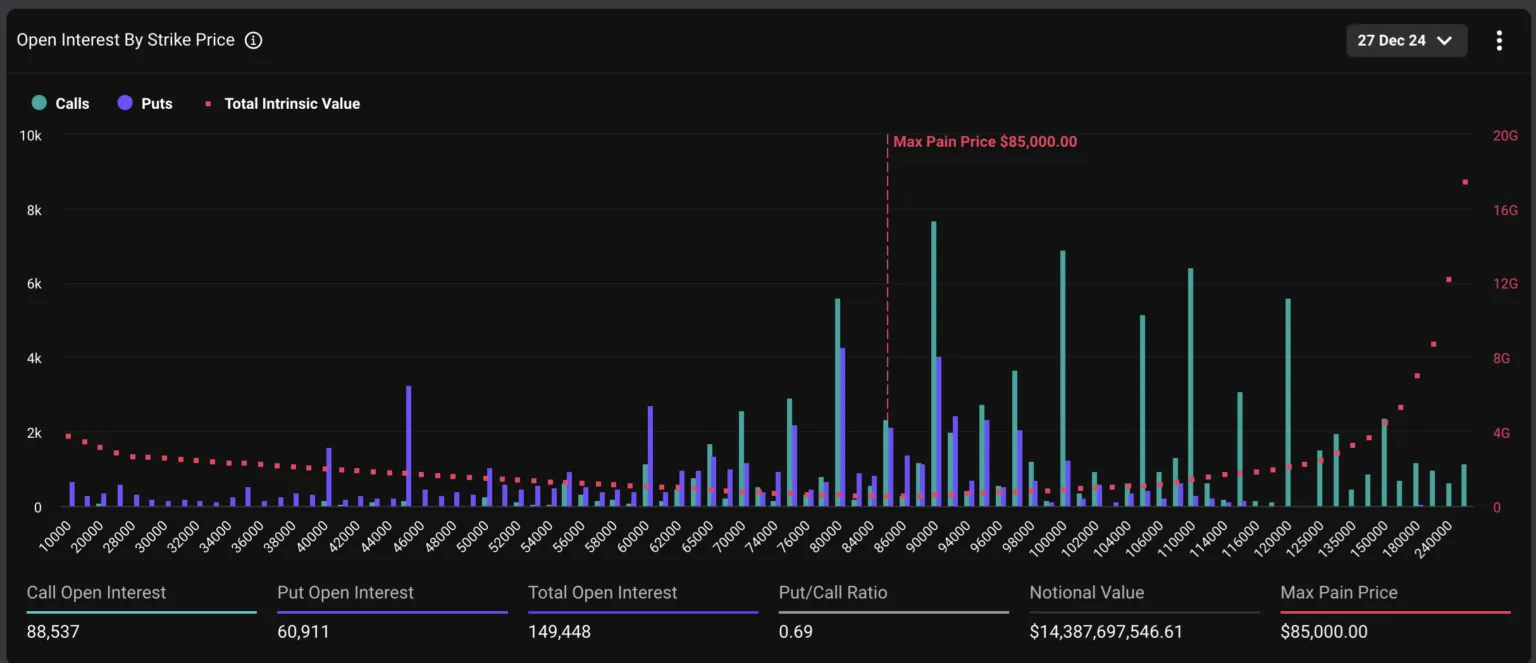

Today, Deribit data indicates that a staggering 88,537 Bitcoin options agreements are set to expire, which is approximately four times the volume recorded just last week. The combined worth of these expiring Bitcoin options has reached an unprecedented high of $14.38 billion.

- The expiring Bitcoin options have a maximum pain price of $85,000 and a put-to-call (P/C) ratio of 0.69. Typically, a low P/C ratio below 1 suggests positive sentiment, with more call options (bets on price rises) being purchased, indicating bullish market expectations. However, historical trends show that the put-call ratio rises steadily during the final quarter of the year, and traders might opt for hedging strategies as well. David Lawant, Head of Research at FalconX, commented:

Over the past few weeks, there’s been a growing need for safeguards against potential losses. This surge might be influenced by investors aiming to secure their annual performance targets for 2024. Notably, the ratio of put options (offering downside protection) to call options (providing upside potential) in December 27th options has nearly doubled, increasing from 0.35 in October to approximately 0.70 now.

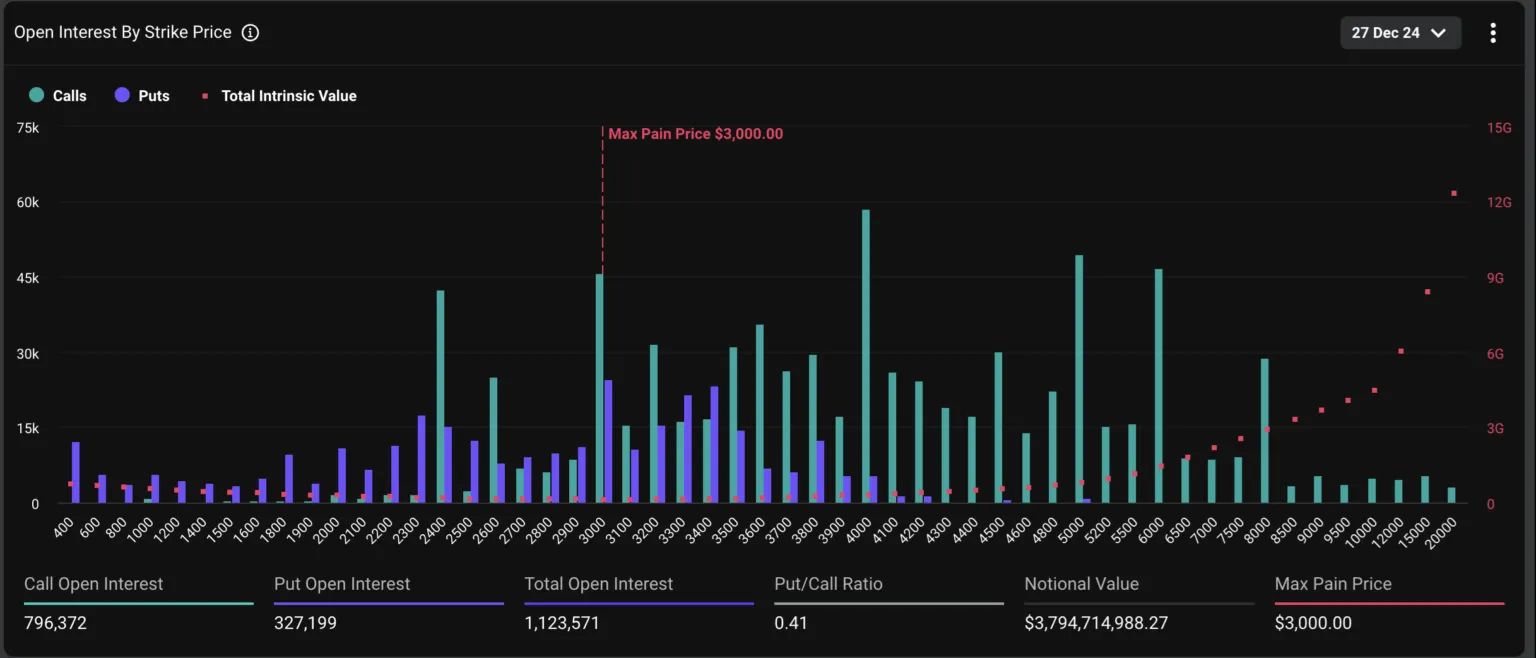

$3.7 Billion in Ethereum Options Expiring Today

Today marks the expiration of approximately $3.7 billion worth of Ethereum options, with the highest potential payout at around $3,000 per option. The ratio of put (selling) options to call (buying) options stands at 0.41, which is significantly lower than the 0.97 ratio observed in October. This shift has occurred due to a rise in Ethereum’s price following Donald Trump’s election victory in November, leading to a decrease in the number of bets placed on a potential price drop.

- Over the last week, both Bitcoin

BTC

$96 631

24h volatility:

1.1%

Market cap:

$1.91 T

Vol. 24h:

$48.51 B

and Ethereum

ETH

$3 410

24h volatility:

1.4%

Market cap:

$410.84 B

Vol. 24h:

$24.44 B

have gone through strong turbulence. From its all-time high, the Bitcoin price has crashed more than 11% and is currently finding strong support at $95,000. Market analysts predict that if BTC loses this support, it can further crash all the way to $70,000 by Donald Trump’s inauguration ceremony next month on January 20.

With January approaching, Donald Trump is poised to make history as America’s president with the most supportive stance towards cryptocurrencies. Meanwhile, Elon Musk’s ongoing promotion of virtual currencies could potentially boost the market even more.

Conversely, the cost of ETH is experiencing a decline due to increased selling, dropping by over 17% following a rejection at $4,000. Analysts predict a fall towards $3,000 before Ethereum starts climbing again.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Gold Rate Forecast

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-12-27 15:24