As a seasoned researcher with extensive experience in the cryptocurrency market, I have closely followed the Bitcoin halving cycles and their impact on the price action. Based on my analysis of historical data from the three previous halvings in 2012, 2016, and 2020, I strongly believe that we are on the cusp of a significant rally for Bitcoin.

As a Bitcoin analyst, I’d like to point out that we’ve reached an significant mark today, July 29: exactly 100 days have passed since the beginning of this year’s Bitcoin halving event on the network. During these past 100 days, the price of Bitcoin has experienced considerable volatility. Additionally, there have been substantial inflows into the newly launched spot Bitcoin Exchange-Traded Funds (ETFs).

As a researcher studying the Bitcoin market, I’ve observed that the quarter following a Bitcoin halving event often sees significant miner capitulation. During this time, miners sell off their Bitcoin holdings to cover operational costs. However, in recent weeks, the pace of miner capitulation has noticeably decreased, thereby reducing selling pressure on the asset.

Instead of “On the other hand,” you could use “Additionally”: Bitcoin’s price surge can be attributed to the ongoing Bitcoin Conference and the upcoming US elections serving as significant catalysts. In a recent statement on X platform, Andre Dragosch, ETC Group’s head of research, explained:

Today is the 100th day since the Bitcoin Halving occurred on April 20th. Despite the market’s tendency to forget past events, the supply reduction initiated by the halving is now set to take place.

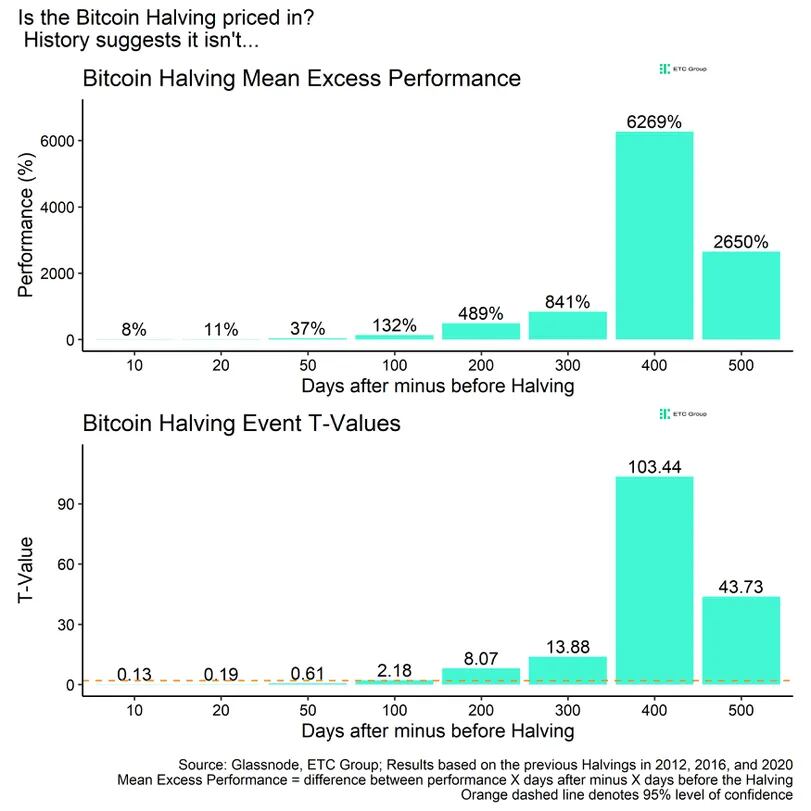

After examining the data from the three prior bitcoin halvings in 2012, 2016, and 2020, Dragosch discovered a trend. Specifically, the study found that the average difference in performance between the specified time periods, referred to as mean excess performance, markedly grew 100 days following each halving and attained statistical significance, with T-values surpassing the 2% threshold.

Based on my extensive experience in data analysis and blockchain technology, I can confidently assert that the statement “The key takeaway is that 100 days after the Halving, the performance difference between two groups becomes statistically significant (T-value > 2) and then becomes increasingly significant until around 400 days after the Halving” holds true.

Photo: Glassnode

Bitcoin Price Action Ahead

Starting from a low of $53,900 in early July, Bitcoin’s price has made a remarkable comeback and reached approximately $70,000 during the Bitcoin conference. As the US elections draw near, experts anticipate heightened volatility for Bitcoin.

As a crypto investor, I closely follow the insights provided by AI modules like Spot on Chain. Based on their analysis, there’s a high probability (63%) that Bitcoin’s price will surge to $100,000 during the second half of 2024. However, our attention is now focused on the upcoming FOMC meeting scheduled for July 31st.

The CME data indicates a high likelihood, at 96%, that the Federal Reserve will not adjust interest rates for August. In contrast, experts forecast a 85% chance of reducing rates by 0.25 percentage points in September.

In the upcoming first half of 2025, there’s a strong possibility that Bitcoin’s price will rise above $150,000, according to Spot on Chain’s analysis. This optimistic forecast is backed by a probability of 42%. Furthermore, when considering the entire year of 2025, the likelihood of Bitcoin reaching this price point rises to 70%.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

2024-07-29 14:28