Oh, dear! The American Bitcoin Spot ETFs have been rather unfashionably deserted, haven’t they? Another week, another $900 million down the crypto drain—fifth week in a row, darling! It’s rather like watching a high society party where everyone’s leaving before the cake is cut.😂

Bitcoin’s Institutional Chums Are Skipping Town—Again!

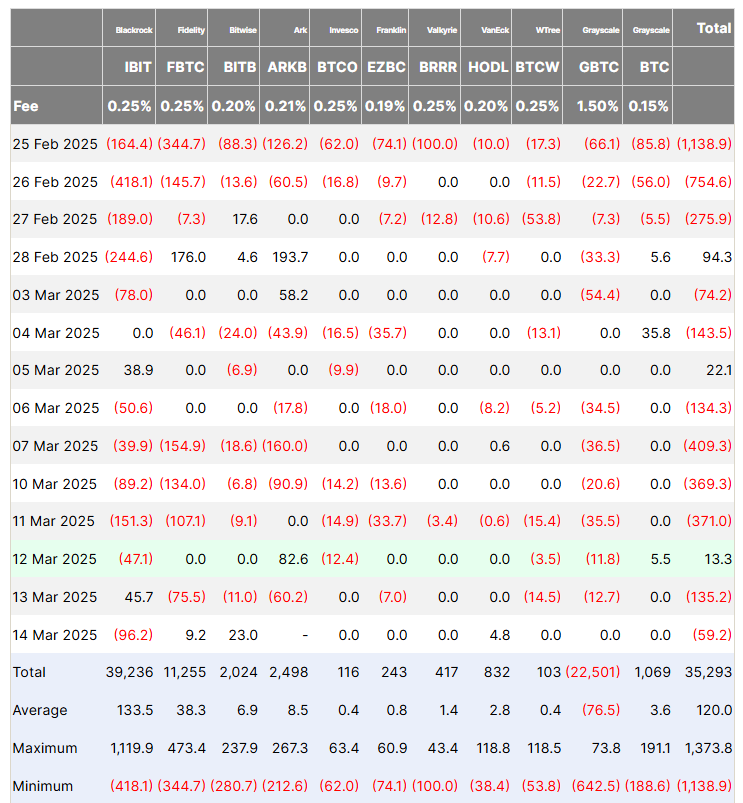

It all started so brilliantly with a jolly good show of $5 billion in investments at the year’s beginning. But now, institutional investors are acting like a nervous bride at the altar—cold feet and a quick exit! Farside Investors report that the grand total of outflows has reached a whopping $5.4 billion in just five weeks. My, my!

Last week’s grand exodus was led by BlackRock’s IBIT, which saw a rather dramatic $338.1 million bid farewell. Fidelity’s FBTC wasn’t far behind, with a hilarious $307.4 million vanishing act. The rest of the Bitcoin ETFs seem to be in a race to see who can lose the most, but Grayscale’s GBTC is the exception—only losing a modest sum. How dull!

Bitwise’s BITB, Valkyrie’s BRRR, and VanEck’s HODL all had a rather pedestrian showing with minor outflows, not even hitting $4 million. But look at Grayscale’s BTC, the paragon of the group, with a thrilling $5.5 million inflow. How positively scandalous!

It seems the old Bitcoin ETFs are as stable as a house of cards in a wind tunnel. The cryptocurrency market has had a bit of a tantrum, hasn’t it? Prices have dropped faster than a socialite’s hemline, and institutional investors are more cautious than a cat at a dog show. Total net assets have plummeted by 21.70% to a mere $89.89 billion. Quelle horreur!

Ethereum ETFs Are Having a Bit of a Drip Too

While Bitcoin’s ETFs are having a spot of bother, Ethereum’s Spot ETFs are also in a bit of a pickle. Investors have yanked out $189.9 million last week—third week in a row! The cumulative outflow is now a paltry $645.08 million. Such a bore!

BlackRock’s ETHA was the talk of the town with the largest withdrawals—$63.3 million, no less. Ethereum itself seems to be holding up better than its cousin, trading at $1,924 with a modest 0.73% gain. Bitcoin, on the other hand, is just sitting there at $84,009, as still as a statue. How enigmatic!

Read More

- Connections Help, Hints & Clues for Today, March 1

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- The games you need to play to prepare for Elden Ring: Nightreign

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

- The Babadook Theatrical Rerelease Date Set in New Trailer

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

2025-03-16 23:48