Behold, the soaring flight of Ethereum, an ether that graces the nascent realms of DeFi and NFTs, causing oracles and analysts alike to augur a triumphant resurrection in price.

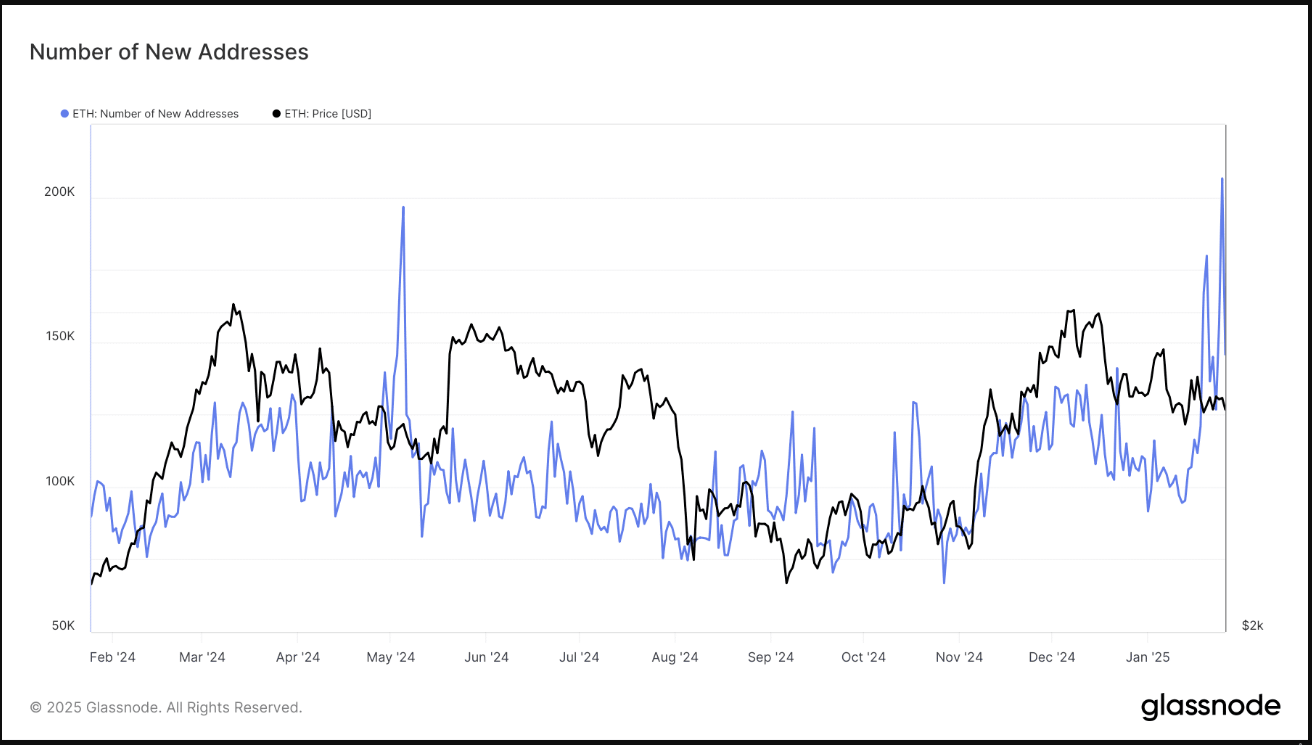

On the hallowed eves of January 24th and 25th, Ethereum experienced a prodigious surge in daily active addresses, surpassing a magisterial 200,000—a celestial figure unseen since the bygone days of October 2022. What arcane forces are at play behind such a phenomenon? Data-gazing seers from Glassnode reveal this meteoric ascent heralds the paramountcy of Ethereum within the baroque world of decentralized finance and iridescent tokens of non-fungibility.

A Dance of Addresses and DApps

Numbers, dear reader, seldom lie. The burgeoning array of daily active addresses is a telling metric of Ethereum’s allure, a veritable vortex pulling in more and more users who find their salvation in the labyrinthian pleasures of dApps and DeFi transactions.

This newfound wealth of addresses hints at the fragrant allure that price fluxes waft into the market’s nostrils, summoning neophytes and old hands alike, even in times of falling prices. Such patterns echo the past, where tremors in the market bedrock engendered frenetic activity upon the Ethereum mantle.

Notably, addresses brimming with non-zero balances have swelled steadily, reaching beyond the pinnacle of 136 million by January 2025. This unwavering growth in the face of plummeting prices is a testament to Ethereum’s indomitable spirit, transcending mere speculative trifles to hint at demand both robust and eternal.

Price Recovery: A Sisyphean Struggle

Ah, but will this crescendo of activity summon forth an echoing rise in price? The periwinkle enigma persists, ensconcing Ethereum’s price below the firmament touched in January 2025, trapped beneath daunting resistances despite a burgeoning user base.

Even as the ether swells with life, its price languishes; $3,203, down by 4.0% daily and 1.0% weekly at the time of this literary tribute. The cosmic ballet between adoption and valuation remains fraught with tension.

Yet, the almighty analysts, those seers with a keen eye, prophesize that institutional titans and individual hunters of profit may yet glance favorably upon the rising star of ETH-powered ventures, bidding its value to ascend once more.

Macroeconomic machinations and the mercurial dance of Bitcoin also cast their spectral influence upon Ethereum’s price—a rollercoaster ride of sudden ebbs and surges keeps trader hearts a-flutter.

Should Ethereum sustain this upward spiral in user activity and extend the tendrils of its network, the coveted ascent in price might finally glean the momentum it so desperately seeks.

What, then, stirred this January tide? The answer lies in the capricious currents of market volatility—the siren call that lured fresh souls into Ethereum’s embrace. Detailed dissection reveals a crescendo of interest in DeFi and NFTs, painting a future wherein speculative trade cavorts with genuine utility amidst a landscape where user engagement blooms despite the fickle dance of prices.

Read More

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Connections Help, Hints & Clues for Today, March 1

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- The games you need to play to prepare for Elden Ring: Nightreign

- What Does Mickey 17’s Nightmare Mean? Dream Explained

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- The Babadook Theatrical Rerelease Date Set in New Trailer

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- Sitara Ghattamaneni: The 12-Year-Old Fashionista Taking the Spotlight by Storm!

2025-01-28 14:12