On the digital shores of cryptocurrency, where the leviathans of Bitcoin (BTC) – those colossal wallets bloated with crypto treasures – have awakened from their slumber, a narrative of accumulation unfurls with the elegance of a Nabokovian twist.

Whales Engage in a Ballet of Accumulation

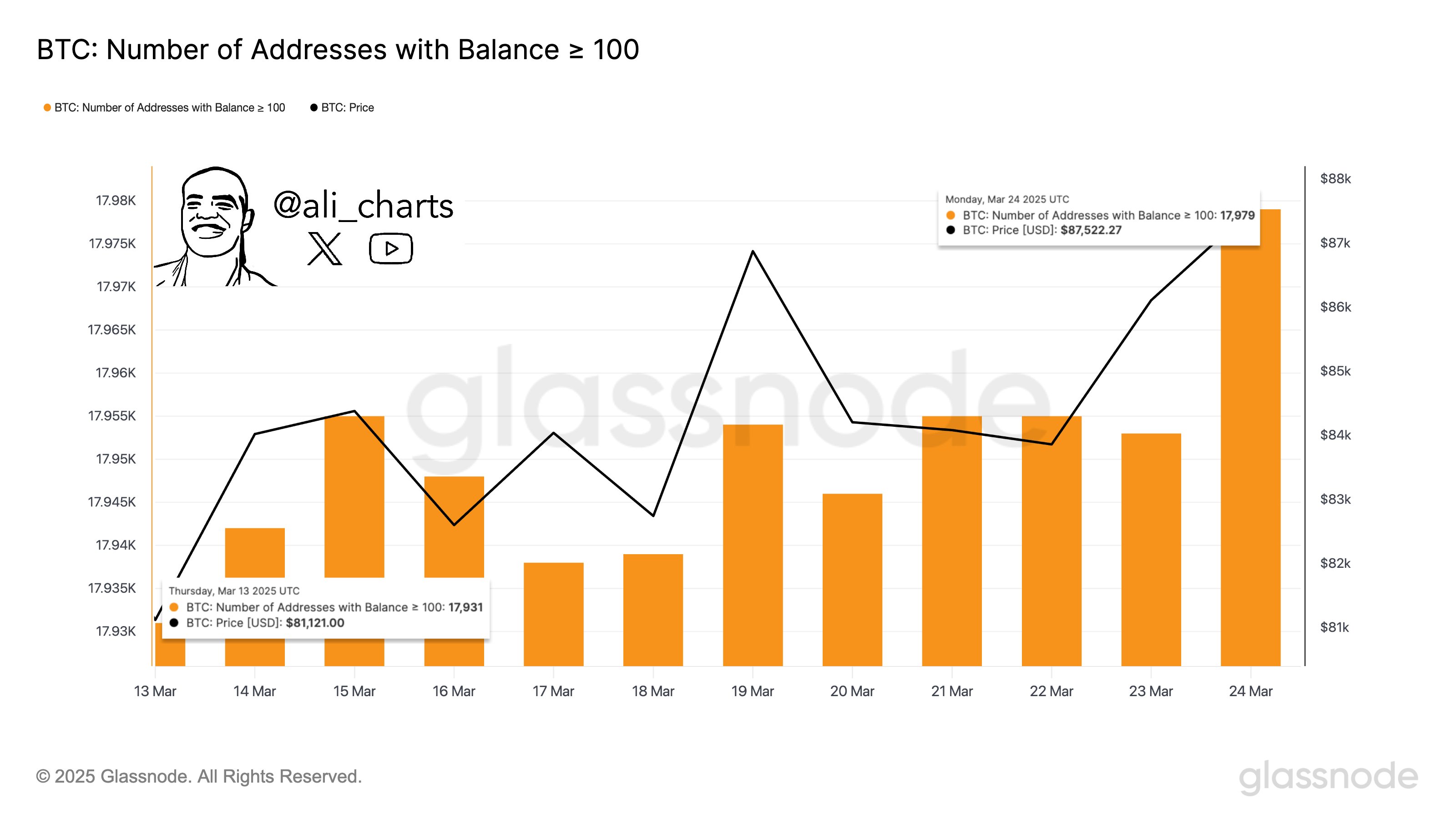

Our tale begins with an X post, a missive from the seasoned crypto analyst Ali Martinez, who, with the flair of a seasoned storyteller, unveils a chart that sings of48 new wallets swelling with100 or more BTC. Behold, a visual sonnet:

This surge, dear reader, is no mere fluke; it is a symphony of confidence in Bitcoin’s enduring allure. The digital gold has ascended over15% from its March nadir, now pirouetting in the high $80,000s.

The optimism, like a playful sprite, dances upon the stage of macroeconomic developments: cooler-than-expected CPI inflation tales and whispers of a softer stance from President Trump on tariffs – a veritable comedy of fiscal errors.

Arkham, our on-chain intelligence maestro, reports the awakening of long-dormant BTC whales. A wallet, once cradling $3 million in2017, now stirs after8 years, its holdings blossoming to a near $250 million – a transformation as dramatic as any metamorphosis in literature.

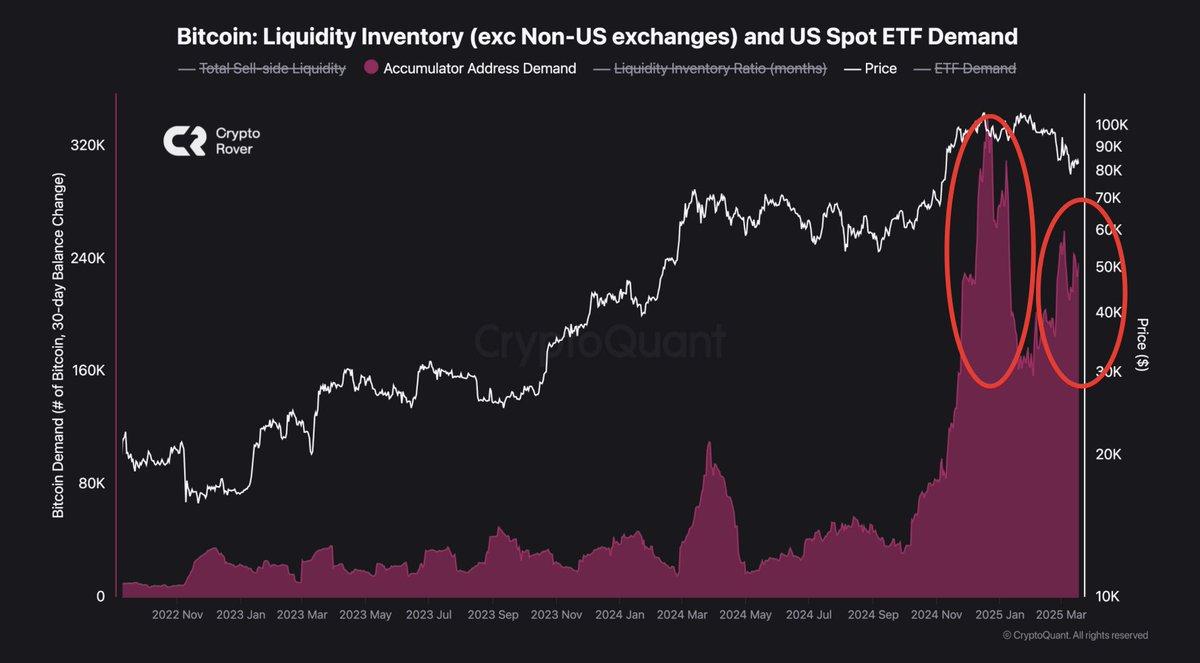

Crypto Rover, another bard of the blockchain, shares a chart that illustrates the crescendo of whale accumulation since the twilight of2024. Excluded from this opus are the wallets of non-US exchanges and US Spot Bitcoin ETFs, a narrative choice as deliberate as any in a Nabokov novel.

A New Peak on Bitcoin’s Horizon?

Speculation, that mischievous sprite, whispers among analysts: might BTC have touched its nadir for this cycle, embarking on a journey towards a fresh all-time high (ATH)?

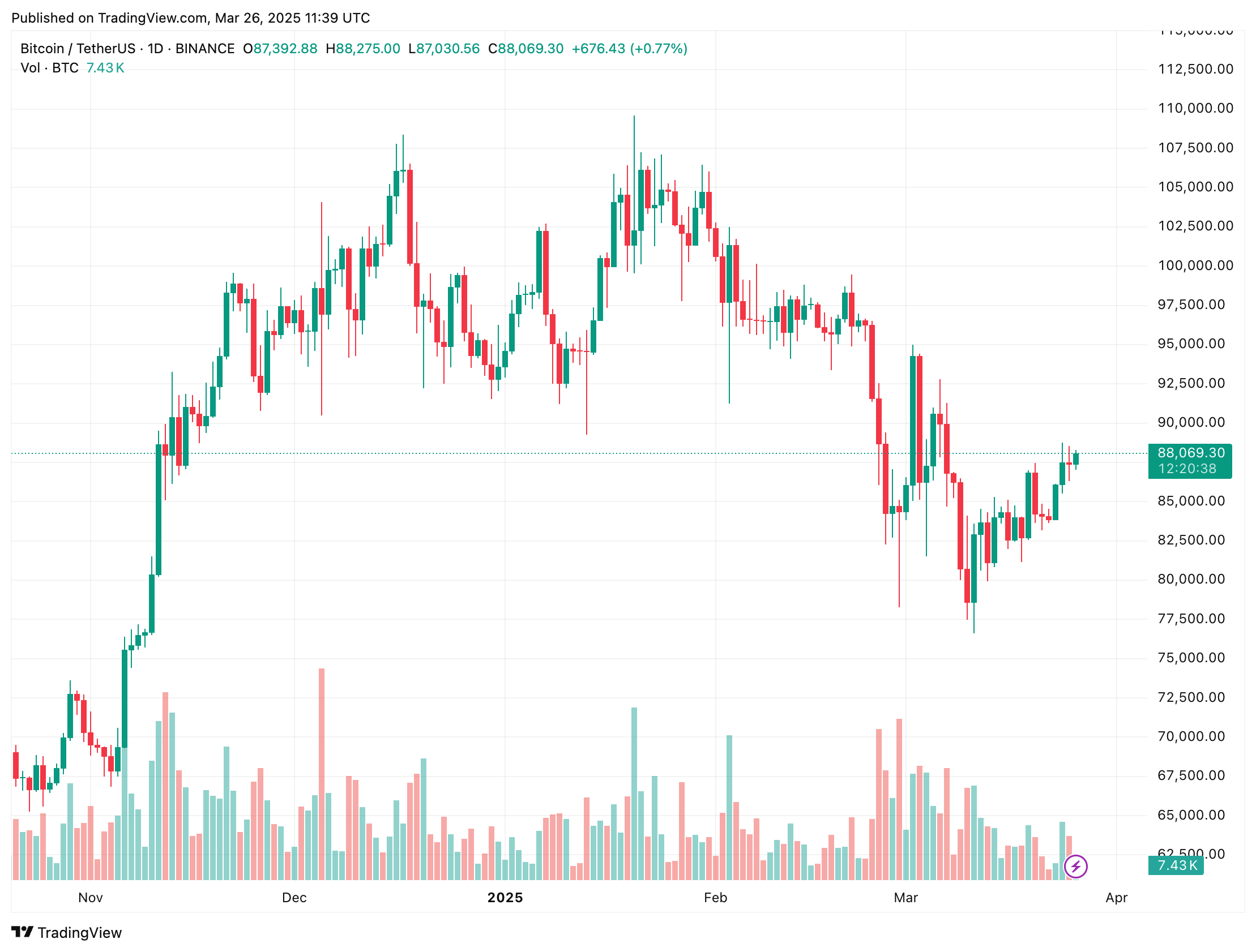

Arthur Hayes, the former BitMEX CEO and crypto entrepreneur, muses that BTC ‘probably’ kissed its bottom on March10 at $76,600. Stocks, he hints with a wry smile, may yet face their own descent.

Momentum indicators, like the Relative Strength Index (RSI), perform a bullish pas de deux. Bitcoin’s daily RSI breaks free from a downtrend, a ballet of upward momentum.

Martinez, with the precision of a chess player, projects BTC could soar to $112,000 if it conquers the $94,000 resistance. Yet, a fall below $76,000 might herald a descent to $58,000 – a plot twist worthy of Nabokov’s pen.

Bitwise, in their latest investor memo, hints with a wink and a nod that now might be the moment, on a risk-adjusted basis, to embrace BTC. As I write, BTC flirts at $88,069, a modest rise of1% in the last24 hours.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

2025-03-27 05:49